Why I ‘Seriously’ Hate Day Trading

I have really wanted to write an article on why I hate day-trading for some time now…because I actually do HATE it…Day-trading is something that everyone knows about; you could walk up to any stranger and say “what do you think about day-trading?”, and they would probably say something like “risky, but it can make you rich really fast”. Day-trading is one of the main ideas that lures people into the trading world; they think they will make some fast money and live the “dream” if they just learn how to “day-trade”. However, once they try it, most people quickly realize that it’s time intensive, stressful, and extremely difficult to make consistent money at.

I have really wanted to write an article on why I hate day-trading for some time now…because I actually do HATE it…Day-trading is something that everyone knows about; you could walk up to any stranger and say “what do you think about day-trading?”, and they would probably say something like “risky, but it can make you rich really fast”. Day-trading is one of the main ideas that lures people into the trading world; they think they will make some fast money and live the “dream” if they just learn how to “day-trade”. However, once they try it, most people quickly realize that it’s time intensive, stressful, and extremely difficult to make consistent money at.

If you get hooked on day-trading you are going to enter into a game of ‘quantity over quality’ of trades, and that is not what we believe in here at Learn To Trade The Market. Our goal is to help traders ‘preserve capital’ and wait patiently for only the ‘high probability trades’. Hopefully this article gives you some insight into why day trading is typically a highway to disaster for most traders.

I hate the façade of the stereotypical “day-trader”…

There seems to be an impression among the general public that if you’re a financial market speculator of any type you’re a “day-trader” sitting at home in front of multiple monitors making tons of frantic keystrokes and phone calls all day. Indeed, it seems more prestigious for us to tell our friends and acquaintances that we are “day-traders” during a lunch or dinner conversation…because when you tell someone you’re a day-trader they immediately get a certain image in their head. If you say “I’m a daily chart swing-trader and I trade 4 to 10 times per month”….well that just sounds a lot less glamorous doesn’t it?

This Illusion of the “day-trader” is something that appeals to many people simply because they want to say they are “day-traders”…there’s a certain perception of being some young and rich “day-trader” making millions and having a Ferrari…it ain’t reality though…

The reality of a day-trader is a guy who got 2 hours of sleep last night because he was trying to trade the overnight session, now he’s up at 6am trying to day-trade the next session. Many traders get sucked into trying to become a rich day-trader largely because that’s what they think is socially acceptable or “cool”, and it turns into them being glued to the charts every chance they get and probably not making much money (if any). This is not a healthy way to trade and it’s definitely not a healthy way to learn how to trade.

Top down approach

As a trading educator, it makes me HATE day-trading even more when I think about all the trading websites out there promoting it and how a lot of them are geared towards beginner traders, not to mention how heavily day-trading and scalping are discussed in almost every public trading discussion forum on the internet. Day-trading is something that should only be attempted by a very experienced trader, and probably should just not be attempted at all.

You need to think of trading like building a house; first you need a foundation to build the house on, then as the house progresses you get down to finer and finer details until finally you are discussing how to decorate the interior and what type of TV to buy. As a trader, you NEED to understand how the higher time frame charts work and higher time frame price dynamics before you attempt trading the lower time frames. Trading should ALWAYS be taught and learned in a top-down technical approach, so that you understand what the higher time frames are doing before you try lower time frame trading or day-trading. This is how I teach my students in my trading courses and it’s how I have personally traded for over a decade..

Most Brokers CA$H in on day-traders (not all, but most)

Another reason why I hate day-trading is that there’s definitely a financial incentive for brokers to get people to trade more frequently. It’s very simple, more trades equals more money from spreads or commissions and that equals more money for the broker. So, there’s an underlying bias by many brokers and the greater Forex industry to get traders hooked on trading as frequently as possible. Brokers who have wider spreads make more money off you every time you trade, so they want you to trade. Thus…day-traders make a lot of money for many brokers; this is why you aren’t going to see any information about the perils of day-trading on most brokers’ websites.

It’s worth noting that not all brokers do this; some brokers have very tight spreads and don’t emphasize day-trading, and this is fairer on the trader, but most simply don’t. A Forex broker is in a position of “authority” to the unsuspecting newbie retail trader who assumes the broker well always do what’s in the best interest of their client. The point is this; be sure you choose your broker wisely.

I’ve been trading for over 10 years and I still do not “day-trade”…that should tell you something right there. Again…it comes back to preserving your own capital…when you trade more frequently you give more money to your broker in spreads or commissions, leaving you with less money to trade with when you get high-probability signals in the market.

Stop-hunters love day-traders

Day traders naturally have stop losses closer to the market price since they are typically trading intra-day charts and trying to get quick gains with tight stops. The “big boys” and institutional traders love the average retail day-trader because they give them plenty of stops to “hunt”. Being a day trader and entering a lot of trades each week means it’s a lot harder to have a high winning percentage, largely because you get stopped out so much. Institutional traders have access to information on order flow and where stops are placed; it’s not only brokers who go “stop hunting” but the bigger institutional traders who can “sniff out” where the smaller intra-day traders are placing their stops. Have you ever noticed how if you try to trade intra-day the market tends to hit your stop and then reverse back in the direction of your initial position? The more day-trades you enter the greater risk you run of getting “stop-hunted” by the big boys.

Example Of Stop Hunting In Action

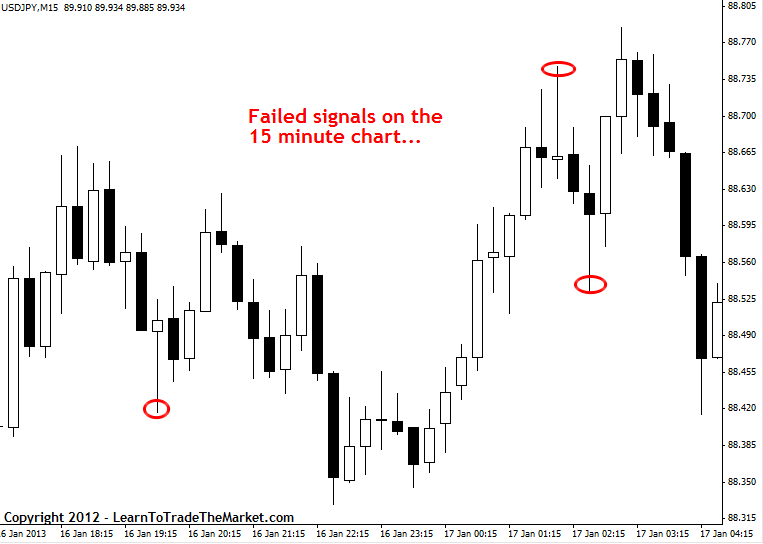

In the chart example below, we are looking at a 15minute USDJPY chart from earlier this week. Now, had you been trying to day-trade this 15 minute chart you probably would have talked yourself into trading all three of the pin bar setups below…

Example of How To Avoid Stop-Hunting

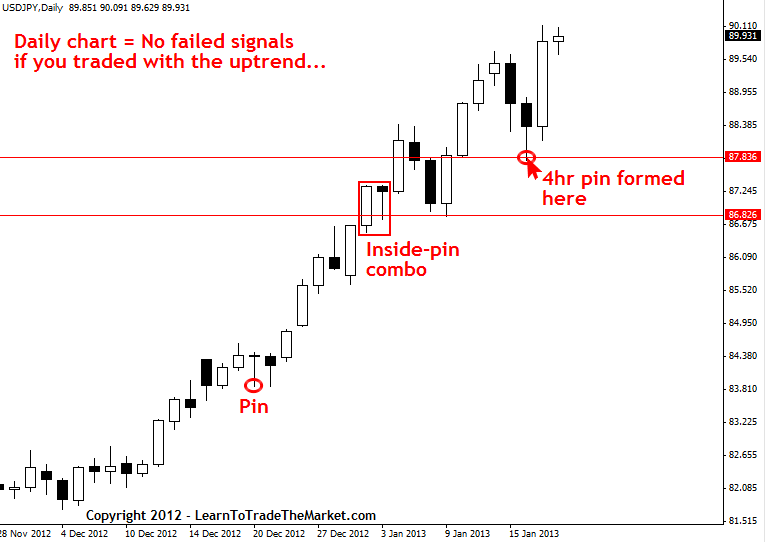

Now take a look at the daily USDJPY chart below…none of those 15 minute failed pin bar setups are even visible…by focusing on the daily chart you give the “stop-hunters” less prey, and you save yourself money, time and stress:

Market Noise: High-frequency and quant algorithm traders hurt retail day-traders

With the advent of high-frequency and quantitative algorithmic trading, we have intra-day charts that are full of false-signals and what I like to call “market noise”. A retail day-trader in today’s markets has a much tougher time trying to turn a profit than they did even about 10 years ago before all this high-frequency computer trading was so prevalent. These high-frequency traders have what is essentially an “unfair” edge because they see the data that we see but a lot sooner. (you can read an article later about high frequency trading here). This type of trading has really changed the “nature” of intra-day charts from what they used to be, making them more erratic and less predictable, which obviously makes it a lot harder for the average retail day-trader to read the chart…

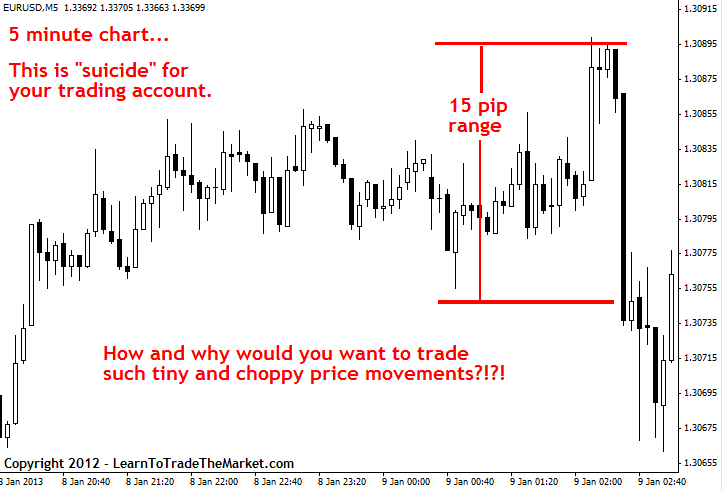

Note all the “noise” on this chart…it’s a 5 minute chart and is only showing about a 15 pip range…this is a very messy and difficult chart to try and trade…notice all the failed signals and “shake outs” that occurred…this type of trading will chop your account to pieces very fast

This is another reason I really hate day-trading; who wants to try to sift through a sea of false-signals and market noise when you can so easily “smooth” it all out by looking at the higher time frame charts? As some of you know, I only teach and trade on time frames above the 1 hour, and even the 1 hour is not a time frame I personally trade very often. The 4 hour and daily time frames are my favorite, and I really consider anything below the 1 hour to be trading account “suicide”.

Filter out the “B.S.”

Day-trading ingrains and reinforces the “more is better” mindset which is basically gambling, instead of the “less is more” approach of swing trading the higher time frames. As we have seen, today’s retail day-trader is up against some pretty stiff competition in the form of super computers and algorithms that are programmed by math “wizards”. Why waste your time and fry your nerves trying to compete against such players with this type of unfair advantage when there is a much easier and more lucrative way to trade?

This is why I trade the 4 hour and daily charts; they filter out all the “B.S.” that happens on the small time frames as a result of all these super-computer-math-wiz-algorithms. I guess if I really had to explain the difference between day-trading and higher time frame swing trading it would be this; work smarter, not harder. Trading on the higher time frames and ignoring all the chop and “B.S” that day-traders try to deal with is really how you trade smarter. If you want more training and instruction on how to trade “smarter” on the higher time frames, checkout my Forex trading course and members community for more info.

Good trading, Nial Fuller

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW :)

Any questions or feedback? Contact me here.

Amen!

Niall, you are not only a breath of fresh air in the Forex World, but also a great trading educator who makes trading the markets not only easier, but also a lot more relaxing and enjoyable!

I highly reccomend your course, which is insanely great value for money!

Cheers

Stefano

England

Nial you are always on point with your amazing top notch articles that have totally transformed my trading. Thank you very much. God bless you.

But how will I get trading experience if I take only 1-2 trades a month and spending max 1 hour a day for analyzing according your method. For example, sportmen train every day for several hours to reach the result. I think intraday helps to get trading experience faster and you can become the master of your stretgy faster.

You missed the point of the lesson, re read it again. Shorter time frames are not as reliable as longer time frames, it’s not about trade frequency at all.

only having very expert person as you in my trading path could force me to think what i was doing, trading 5 times a day and losing and losing without apparent reason in my technical analysis … i highly believe in market noise and stop hunting because i’ve been in them tens of times … there’s nothing valuable in time frames lower than 1 hour

Hi Prof. Nail Fuller,Thank you for your professional teachings , insight and advise to us as new traders.

I’m amazed, I have to admit. Seldom do I come across a blog that’s both educative and engaging, and without a doubt, you have hit the nail on the head. The problem is something which not enough men and women are speaking intelligently about. Now i’m very happy that I found this in my hunt for something concerning this.

hi there thanks for the information

It a great article and I’m new in trading and I haven’t started trading yet,I would like to know how much I have to deposit in my account for trading.

Hi Nial, Until I found ur course I did every style of day trading, mostly no higher than the 1hr chart, and more often 15min and below, trying to find what I was comfortable with. There were too many hours in front of a computer, trying to make some decent pips, but as u said there was a sea of false signals and market noise, which would give in one hand and take the next. Since I have started with ur course I am much more relaxed with my trading. Still putting in the pre trade time, looking for the opportunities and setups, but finding that I have so much more time to make better judgements. Still early days for me but have noticed the difference and looking forward to what u have available in the course.

Thanks alot fuller

it is on point. there is nothing misleading other than the lower time frames .

thanks for the insight.

This article spoke directly to me. I can’t afford 50-100 pip stop-losses so 5-15 minute charts were all I traded. While others posted 500-1000 pip days, I consistently lost 20-30 (my stops). Of course I used higher time frames, FIB’s etc. to determine direction I would still get stopped out 90% of the time using smaller time frames – usually within minutes like someone was watching. Anyway -never again! lol

good article Mr. Nial! I learn to trade on closing of day, has already become a habit, I dont see a day frame below. Thanks for your works!

Hi Nial you make your articles very interesting and easy to understand even for a newbie like me.

Thank you so so much.

This article is really amazing and educative, as I find all your articles. Even though I know how dependable swing trading is before, but this article has opened my eyes to see how dangerous day-tradimg is. Thank you so much

All your articles are really very interesting. I have read many trading materials but never found a useful and clear information like the one I find on your articles.

Thank you

This is what I’ve been looking for, and everything you said is true. Thanks alot#happy

i have read your article on day trading and price action, i must say it makes alot of sense. Once put into action the results are amazing.

Thank you very much Sir I have tried your method and it is working for me very well

I love this article. Pls, what is the minimum account I need to operate on daily chart? How do I take care of drawbacks with a small account?

Thanks.

Thanks for enlightenment sir.

It’s easier said then done.

How can you not make that trade a day?

One must be very patient or well trained to limit your mind to not to trade.

May I ask how Nail was able to avoid trading?

How did you train your mind in order not to trade every day?

You are the best, my inspiration

This is just fantastic coach. i love the expression “…and you save yourself money, time and stress’. Intra day trading of small time frames is now as dead as a nail hammered to a wall as far as my trading is concerned. kudos

GREAT to hear from you always Nial. in fact when I read this article I started trading H4 on my demo accounts and as I did it a day time I made about 9000 and refuse to take profit, then later on all of them runed back to heavy negatives and finally the trades were taken away automatically by the broker and I think margin level was reached each trade was about 8 in value and I intentionally do not put stop losses. all I need is to study exactly when to take profit or trades are expected to reach their maximum profit achievement. but this article is very good for me. I have reduced wieght becos of sleepless night. 60 kg -58.5kg. too bad

Yes mate, i’m now knowing you’re completely right. How do i know ? My account has just been “Hunted” few days ago. Why i didn’t follow your advises ? well, first i didn’t see this article before this day. Second, due not to arrogance, but over-confidence leads me to this, after some successful trades that gives me profit of 400% in tow weeks, and those successful trades was definitely thanks to your courses i found on your website. Once i was getting out of you’re discipline, i got losing trades. So, you can punch me on the face…

Thank you for make me sure that this is the way, even so late for me ;)

Hi Nial

I have been there (day trading) and you are absolutely correct. How many times have I seen my stop losses wiped out by only a few pips, only to return in the direction of my profit level and hitting it there after. This article explains all my mistakes in a a nut shell. Thank you so much – you brought me back to being a profitable trader (using higher time frames) with so much less stress, enjoying Forex trading again.

Johnny

Hi Nial

Such a pity I did not discover your blog a few weeks earlier…my account would still be alive if I did..

I will be following you closely from here on forward.

Thank you

Daniel

Hi Nial,

Your observations about the downside of day trading is true, I have been trading in both 1HR and 4H time frames for quite a while. I can confirm that there is better clarity in the higher time frames.

Your articles are very educative. Congrats in winning the trading champion. It shows you are walking the talk.

Essiential.

Makes sense, but surely wouldnt the countless traders using the smaller timeframes, and stop loss hunters, impact on the the higher time frames and have a knock on affect by producing random movements?

thank you for this great article! i will just trade above H4 time frame!

thank you again.

Dear Nial

Unfortunately, from my Recent Experience, I have to agree with you 100% .

Hi i note this one from the article “Day-trading is something that should only be attempted by a very experienced trader” meaning it’s ok if you are skillful enough.

I think theoritically and mechanically price action signals should work the same in all time frames, lower and upper. But why in fact they are different and produce a tons of fail signals in lower time frames. So I think market operating and moving inline with normal human business behaviour and controlable time frame. Only my opinion..

From this article I get that higher time frame charts gives one the better perspective. Lower time frame charts gives you a perspective of driving a Land Rover in the bush while higher time frame charts gives you a perspective of an helicopter in the air so you can see the next turn earlier or at a distance.

Really enjoyed reading that . As a newcomer to trading I believe it’s critical to my success, how I align myself . Which essentially means I need to discriminate out of the noise what Information and education I take on board. That article felt like it had integrity, clarity and just made good sense.

Great Article Nial,you are always on point.

I agree with this 100%, well almost. I finally started to trade futures using higher timeframes (monthly) and watching it with (50 min) charts. I only trade (right now) a few contracts and watch sectors (Indexes, Metals, FX,, all of them mostly FX) based on monthly historical trends (buy and hold still works contrary to the lie that is doesn’t). It is working so far. I rather make a few thousand over a month than try to make $$$ daily because that is what the brokers want you to do. The manipulation is actually greater than presented in this article. And this statement is the absolute truth: Have you ever noticed how if you try to trade intra-day the market tends to hit your stop and then reverse back in the direction of your initial position?. That sums up all of day-trading.

Yet, another great article.

back on the forum this week. thanks mate.

Hello Nial, this is very necessary article, thank you very much!

Regards

You are bang on warren buffet didnt day trade ..thats why he may be super rich…..truly in trading more less is more …less u trade ( big time frame) more money u make

Right Boy.

I have suffered huge loss in Day trading.

Higher time frame is helpful in keeping control on over trading and therefore preserve capital.

Thanks Nial,

This article is very insightful for newbies like me who want to learn how to trade.

Prior to reading this article, I was thinking along the line of day trading.

I hope to read more of your articles.

You can make huge money very quickly day trading, yes. I made $42k in my 3 weeks. BUT the stress and the all nighters and long hours totally consumed me and nearly killed me.

PLUS I then lost about $30k of my profit the next week and believe me, when that happens, your mind is NOT in a good place.

It is addictive and enjoyable to an extent, but I am not sure it is worth the stress and pressure and your health/eyesight being affected in only 3 weeks.

There must be a better way to trade that allows you to have a life and be happy instead of wanting to commit suidpcide when you torture yourself so badly for not preventing something that you should have.

Think carefully. Good luck.

Great article but this does not apply to everyone out there. Lets start by asking what type of product are you going to trade, how much capital do you have, what is your risk allocation and what suits you the best. Now let me elaborate on this, lets say you are a futures trader with a 10k account. Well swing trading wont benefit you at all because every point that moves is $50 and if your risking 4%($400) (this is alot of risk by the way) than you will be wiped out quick since the range in futures is very wide. Now you can catch 1 or 2 great trades and be done for the day. Thats day trading but in a very conservative way. Not to mention that its a very bad idea to hold a futures contracts over night as well. Now if you are day trading stocks or currency than that is a different game. I would say stocks, forex and options are not meant for day trading.

Paulo, your point that there is no point swing trading or position trading futures if your account is small… is simply not valid. There are ways to trade these products at lower $ cost per tick/pip, most brokers offer mirror CFD products that allow this.

Hi Nial, thanks for your comment but I think he has a point there especially with swing trading. To the best of knowledge, I’d say that if you have anything less than $5000 as capital, it is best to avoid swing trading.

Because holding positions for a long time like weeks or months would yield very little ROI and you’ll learn at much slower pace.

I think everything boils down to capital. If you have a huge capital, then swing trading is for you. If you don’t, you may have to wait until you can or do conservative day trading – placing 1 single trade a day.

In the long run, you’ll grow your account at a much faster pace and and if you good risk management skills and proper compounding techniques, the result will be astronomical.

It’s all about position sizing, not the size of account.

“In the long run, you’ll grow your account at a much faster pace and and if you good risk management skills and proper compounding techniques, the result will be astronomical”

The point you made here is profound. You can also deplete your account just as fast or at a faster pace. Many retail traders have tried day trading and have lost fortunes. Day trading is just so hard for a retail trader, my broker used to bug me for months about trying to trade the ,M30 or M15 timeframe and how i can make fast money…..as soon as i am making money on the higher timeframes, all the emails have dried up. They don’t bother me anymore.

” I’d say that if you have anything less than $5000 as capital, it is best to avoid swing trading”.

Not true, many people including myself swing trade on the weekly, daily and 4 hourly on a account in the hundreds, its all about position sizing and the nature of the trader.

great to hear this from you too. higher time frames needs big accounts. even the volumes/value of your trades also counts because your initial trades can run into heavy negatives but later reverse to higher profits. so if your accounts is small, at the time of big negatives if you have no stoplosses the trades will be taken off automatically because margin limit reached.

Thanks for pointing me to this article. I need to be reminded from time to time. What most wanna be forex scalpers and day traders don’t realize is that the spreads will kill any profit you try to make. There just isn’t room in those tiny market movements to make any profit.

really, i was read this article i think 4 time. this is very valuable lesson for me. because, I’ve been trading with 1H time frame since long time. but not be success. but after reading this lesson I’m trading on day time frame. actually i feel very big thing for my trading life for this. ya. day time frame is more suitable time frame to trade.

thanx for lot dear.

stronge day trend and if not hi imfect news than if you find a pin bar in trend( day bar close),you will be win, day chart very good.

Here i am reading it in 2016. I am struggling to handle my mental physically and emotionally. After reading your valuable post, i swear to follow your advise to trade on higher time frame! Wish me luck. Lot of love! :))

Very very thank you sir

You are the first person who tells the truth of market

I’m glad I came across this article, as I was going to sign up at a day-trading company. Trading is something I aspire to do – could you tell me what the difference is between day trading & what exactly it is that YOU do? I’m so overwhelmed with all of the information my brain is taking in with regards to trading, it’s about to explode! Lol.

If I want to trade the way you do, are there any firms available to help me out with funding? I’m an MBA student & not working at the moment. I’m aware that commission is involved, obviously.

Your advice & guidance would be most appreciated. :-)

No words to Thank you , your course is really helping me. I repeat thank you once more.

I tarted reading Mr. Fullers articles 3 weeks ago and to be honest I adopted his trading trading style. In two weeks consecutively, I have been in profit something that has not happened since my 8 years of being a day trader.

Very good article … as a newbie I have learnt that most if the money I made was from the daily chart … but have fallen prey to doing multiple trades a day and lost all of the gains. Thanks to LTTTM this has all changed and I am a converted swing trader now. Great stuff Nial

You are spot on Nial

That’s my goal to run million miles away from those pathetic low time frames, I used to make lots of bucks on them and losing it all if not more! Extremely stressful.

Thank you for making it a BIG point and keep up the good work and being honest.

Helen

Thanks Nail for the timely advice. I use the higher time frames, the major

problem I have is on the entries.

True, very true Nial. I knew that the ones who benefit from day traders will disagree with this truth.

“The reality of a day-trader is a guy who got 2 hours of sleep last night because he was trying to trade the overnight session, now he’s up at 6am trying to day-trade the next session”.

Nial, you live “Down Under” and it can look like this from your perspective. Maybe you could see it in an other way if you would live in Europe like me. Just imagine: London Open = 10.00 AM. NY Open = 4.00 PM. You can day-trade in a usuall business hours.

I even don’t know exactly when NY closes: maybe at 11 PM, maybe at 12 PM. I always sleep at his time. I can enter a D1 trade only a couple of hours after the new candle started.

Of course, you may be right that trading on a daily chart is better than day-trading. But please remember: 6 + 3 = 9, but so does 5 + 4. Or 2 +7. Don’t hate other people’s way of thinking. Respect it.

I respect peoples opinions, I just don’t have to agree with them. Day trading in the traditional sense has a very high failure rate and leads to account churning.

I want my students and followers to understand the realities and that is what I write about.

Nial is 100% correct. He repects all other opinions & So do i. He & his followers are price action traders, so he is guiding them to trade on H4 & D1. Which are best timeframe for price action trading with his setups, ofcourse there are few traders making money trading lower time frame charts but most of them are using other strategy than price action. Wake up. This website is about price action strategies

and yeah also keep in mind that those strategies are too much complicated. And nial’s price action strategies are very very simple. I am his official student thats why i know. End of day higher time frames trading is far better then day- trading sitting infront of your computer and wasting whole life & time

Day Trading is a mirage for people who don’t have a real job. It’s a perfect place where the money transfers silently from poor people to rich brokers.

Despite even ‘knowing these things’ it’s great you wrote an article like to hammer home the point the benefits of longer time-frames.Again, another a well written, telling article. Thanks again. Just an aside it was also good to have some charts to practice ‘what why I have done’ Alex

Being in the market since 2007 and believe me lower time frames i.e H1 -M1 have wiped my account more than 4 times. keep off.

EMMAH DANIELS

NIGERIA.

Day trading is a farce

i can’t agree with you more. Most of day traders do not make more than 50K a year. Very few people make 100k a year. After paying all trading fees and spreads, people won’t make much. Even if they do. The short term capital gain tax will take big chunk out of it. In my opinion, people do day trade cause they don’t have a real job. I do long term buy and hold and sell covered calls/puts. That gives me very consistent performance with very little work while i can still focus on my profession as an endodontist.

Nial, I can tell you are versed in the fx market and a very good businessman as well. After reading this article and comments I wanted to share my thoughts on a few things you wrote. First and foremost, intraday traders( good ones) do make money on a consistent basis and most do not only trade one time frame. Specializing is also a key to one’s success in this business; being able to spot a probable trade in any time frame is just as innate a quality that makes one profitable in predominantly one – sometimes you can’t teach this.

Volatility or noise, whatever name you use, it is something that is needed and is capitalized on. Here’s the reality of all that noise, it actually makes the trending price action. It’s all transpires into the different time frames and makes the market tradeable.

Ultimately, I don’t disagree that a beginner isn’t going to have a difficult road trading. People should understand this…the 98 percent of traders that don’t make money in the markets, didn’t make money in any of the time frames.

David, all good comments. To be frank with you, most day traders or high frequency traders lose the average of the spread on every trade, that is usually 1.5 to 2 pips per trade round trip. The more you trade the more you lose, all brokers know this and that is what brokers rely on. I have plenty of contacts inside the industry that provide me with the statistics and I can tell you that 99% + of all clients who attempt day trading or high frequency trading lose alot of money. Those that tend to make money are position traders and those who look to hold trades over longer hold periods (multiple days, weeks or months). I agree some traders with skill and experience can make money day trading, but it’s the hardest way to trade and the odds are stacked against you because of the price spread on each transaction.

It always makes me laugh when I meet people who are just getting into trading and they boldly state that you can make lots of money daytrading for just an hour or so per day. Then they give me examples of people who are selling courses stating that they make 1000s of pips per week etc. These newbies dont have any chance and are just getting taken to the cleaners.

Knowing what I know now about higher timeframes I would never ever go onto anything lower than a 4HR chart. In fact on MT5 I have D1/H12/H8/H6/H4 and have removed the rest from sight.

This is all I need to give me a decent % per year and am already up 37% of my account since the start of the year.

Higher Time Frame trading rocks!!!

DAY trading is very very risky specially for newbies ,,, Because they do not know market flow … Market is very un-predictable no body know when market go opposite … So i personally suggest every newbie practice on weekly or 2 3 days trading Chart. Which make you a real and long term trader… Thanks

Good one, it will be more informative for traders…Thank u.

Intraday Trading is basically a High Cost & Effort Trading Activity to make money in Forex Market. And in any period of time the End Result is not always better than Daily Trading. I agree with this Good Article. Very Good NIAL ….

There is no such thing as stop hunting in the market. It is normal market behaviour of seaking liquidity.

It safe to trade with higher timeframe perspective in mind while 15 or 30 min chart is used, where you can spot areas of high liquidity and market reaction.

Marcin. I am sorry but I strongly disagree with you…. Stop hunting or stop running is a very real concept and happens every day in the markets. I do agree in part that market looks for ‘liquidity’as you have suggested, but I don’t believe this is the same concept as stop hunting. They are 2 unique market phenomena.

definitely stop hunting in equities-i was trading a stock that hadnt moved 10 cents in 30 minutes-short 13.01-stop-13.11-took 34 seconds for my stop to be hit and 1 minute later stock was at 12.91-definitely algo stop hunter got nice short in-equity now at 12.71 2 hrs later with nevra retrace to 13.10

day trading is okay for 15min charts and above. under 15min and you have to keep checking the screen frequently resulting in addiction and emotions in trades

Nice one thumbs up for you.

Great article again and again , thank you for it :)

Excellent lesson Nial !!!!

Very clever and smart concepts what you exhibit

Best regards

Javier

From Argentina

nice article Nial, in fact this is actually how i do my trading is very easy and simple to trade this way yet come out with a huge profit. so why stress yourself with baseless effort to make money quick? patients is the only ingredient that you need to do this…. believe me you can be extremely successful trading this simple way….

pls continue the good work

I don’t see the failed pinbars on the USDJPY – all three gave great 38-50% entries and 2:1 RR or better.

Great article Nial, you can safely rate this as one of your best. I agree with you especially on the point that there are “stop hunters” out there and there is no point competing with them when you can lessen their impact on your account.

Cheers,

Nail, you have nailed it again. The more traders that heed these words the better.

Thanks Nial for your vast knowledge about trading Forex,soon I will be enroling on Foex Trading course.

Yeah I am already find out that I am really tired of day trading, trading daily chart is more less calm and stresles but you also need a time and nerves to play out to your way.

Nial, how would you compare trading (day, swing, momentum,…)with performance of some professional sportsman? They have ages where they are in very good performance and than after some time they can`t compete any more?

Thanks Nial, You are THE MAN.

Great guidance.

Daytrading is crazy. I tried some, didn’t demolish my account (really had good periods making some money) but realized that this is not trading at all! This is time consuming, addictive and mentally exhausting. Even when you make money your broker make even more, and it’s so absorbing that one moment you hate this. Stops are hit so often that you are on emotional rollercoaster.

Absolutely agree with Nial. One can daytrade from time to time for fun, but as a trading method it’s not best idea. Instead I like this idea of minimalistic, “purist” trading, and I hope to become succesful trader eventually. Or better to say “risk manager”. Idea that trading can be peaceful and that “less can be more” really opened my eyes. I feel that mystery of good trading lies in psychology and emotional aspects of human nature. Thanks to Nail for conducting us this way. Hope this is right path.

I would like to analyze this question from the standpoint of time / reward only and get some more concrete parameters. if you are a swing trader you will spend an average of 1 hour per day to analyze 5 times the 4H chart, and may cover some 10 markets as I do. day traders spend at least 8 hours a day glued to the screen, if not 12 or more hours following at most two or three markets. then a day trader will spend at least 8x longer , covering about 1/3 of markets than a swing trader. even if he is a successful day trader, I doubt that the results are proportional to the time he spends and lower quality of life !!!

I,m richly inspired by your honest experiences which you share with us all the times.God will never let you down

For various reasons, the shorter the time frames the lower the signal to noise ratio. This makes setups more difficult to spot and less reliable. Providing there is reasonable liquidity (currency majors even on 5 minute charts normally provide this), you will still get strong and valid set ups on short time frames. The problem is that you may have to wait hours and sometimes even days for them to occur and that is psychologically very difficult to handle. Most short term traders become impatient and finish up overtrading. A few, people with the necessary skill and discipline are able to consistently trade these timeframes but in my experience it is the most difficult as well as the most physically and mentally exhausting form of trading that you can undertake.

An hour or two of scalping, once or twice a week however is terrific practice and may help to keep you sharp and on your trading toes.

Trying to call the next move on a 5 min chart is like in a sporting event trying to predict who will win the first 5 min of the 3rd quarter. You are just guessing. Best to stick with daily charts and only trade reversals and breakouts

I thoroughly agree Nial. I think people day trade to satisfy an emptiness that doesn’t have much to do with making money. As a person with a tendency towards addiction I can see the appeal of day trading and strangely I can see how it could even be oddly comforting to loose money. Your trading paradigm weeds out many of the features that make trading something other than a money trading venture (e.g. it’s not fast, you don’t watch the screen and experience the highs and lows etc). I’ve been a member for about 3 months and I teade pin bars (at significant levels etc) on four of the majors on the day chart on a demo account. I’ll be going live in the coming months.

Well said

thanks a lot nial…trading in high time frame is my chances to change my future…thanks for the best article…

I wish Nial could’ve shown a normal Daily chart instead of a perfect one without fakeouts. If what he said is true he doesn’t need to exaggerate. I do agree that the lower timeframes are a heck of a lot more noisy, but Daily charts also have their false stopouts. Many of the Fakeys and Pin bars on the Daily took someone out before reversing, lets not kid ourselves that Dailies are free from this. Otherwise newbies are being mislead just the same.

Tim

I will add more examples to suggest daily charts experience ‘less stop hunts’ than intraday charts. I agree, no chart or method will remove the chance of ‘stop hunting’ etc.

I love the explanation on stop hunting. Thanks!

this is true

Absolutely. Thank you for this article.

Super article, Nial. I thought I would jump into the mix on this one. I doubled my Scottrade stock account in 2007 trading off the daily charts ( bull market ). I retired from my plastering career and day traded the stock and futures markets in 2008 using 5 minute charts. What an emotional and wild ride that was. By year’s end I literally fought to break even in one of the most unruly bear markets in history( moral victory, but not so great for paying the bills ). I realized that my temperment was not suited for day trading at all. One’s emotional control and discipline has got to become so focused– almost robotic by nature in order to succeed. I will admit, there are professionals who make an excellent living at it, but they are indeed few and far between. Amen to daily charts and trading relatively infrequently and not being glued to the computer monitor . . .

Cheers,

RD

Depends on how you define “day trading”. I do it, but I usually look for 1 trade a day, and don’t necessarily close out by end of day. I use a top-down approach like you stated–Daily chart is key.

At the same time, I wouldn’t write off the possibility of someone who trades many times per day off the 15 min chart or whatever; I still think you need the top-down approach to do so–to more accurately identify the trend.

Great Ideal

Superb revelation .No body else other than One and only one Nial fuller will do it .I was trapped by the magic of day trading.Today onwards I quit day trading once and for ever.

i love trading the 4 hour charts to XD.

Nial, I am a 3 year old trader. I have 3 blown accounts in my past. But this last one, 3 months old now is growing nicely. And the only reason it is grow is that I stopped using a live data feed. I use ninjatrader platform that gives me end of day data only. My trading plan I have adopted from your videos you make available for free on youtube. This article highlights exactly why and how my last 3 accounts got blown, they NEVER GOT IN THE MONEY even. hahaha, day trading its a joke. I will wait till the end of day to see what price did that day. And I am often in trades that last several days , especially lately.

Cheers.

I agree with u 50%! as i started trading 4 years ago i was Day trader for 2 years i was break even most of the time, then i started to trade the bigger time frames, daily charts i make using trading on the daily average. Etween 400 and 1200 pips a month.but there is a problem on the day trading the STOP LOSS is really big number 2 u neex to have big capital to make life from it …… anothere reason if the market is not trending for long time could expand for several months u cant trade well …. Now about trading as day trader in m opinion every one can make money on it under some conditions : 1 – follow the bigger time frames

2- once u hit the first target which is mostof the time not more than 30 pips take ur profit

Day-trading CAN be very profitable if you can stay glued to your charts 24/7. I have done it in the past BUT there’s a price to pay in terms of the stress involved. Also, if you make a mistake it can be a slippery road to a world of pain… If you want a normal life without stress stick to swing trading the H4 or daily charts per Nial’s advice.

Thanks Nial, once again.

Great article.

I loved when you wrote: “Have you ever noticed how if you try to trade intra-day the market tends to hit your stop and then reverse back in the direction of your initial position?”

This happened to me most of the time in day trading.

Trading higher time frame charts and looking for price action is what suits me best.

Thanks for everything you are doing.

Keep the good work.

Regards from Portugal.

personally, i have raised a $10 account to $213 day-trading 15 min time frame for three weeks though it was very very stressful. That was at my early stage of my trading carrier. it was fund. Base on this achievement, i was carried away and after sometime i fail to follow my trading rules and strategy. The moment i started neglecting and disobeying my trading rules, i was no longer profitable trading smaller time frame. i say this because smaller time frame is very profitable if a well thought out strategy/ trading rules is strictly followed. But the disadvantages are that, it is very stressful, high emotion is involve and as a matter of fact once health is at stake. I even know of a professional who trades one minute time frame. Though he is make the money but he is paying with his health – high-blood pressure and deteriorating eye sight.

Nail, i buy your idea. Ever since i started trading 4hrs and daily time frame, i feel relaxed, less stress, i make consistent profit and have time for other things. I am not condemning the lower time frame. Lower time frame works if a well thought out strategy/ trading rules are strictly followed. it all depends on individual who is ready to give what it takes to be successful. so in a null shell, whatever time frame one trades, one should carefully weigh the pros and coin. But for me 4 hrs and Daily is the best.

Thanks for your insightful articles. you are great. keep the good work alive. Have a nice day.

Do you want to be a cool day trader that sits at his pc all day, or a swing trader that can cover 16 instruments in 30 min on the daily chart then spend time with ur kids or play golf? I know what I chose.

Is true “Stop Hunting ” happens all the time. In other articles I have read on the net, some refer to it as “Search and Destroy”. Anyway another great article by the Lord. Have a nice weekend and Allah Ma’ak.

I hv suffered a lot of losses in Day-trading. I lost nt less than $15000 in daily trading, and I can nt repeat that nonsense , I hv learn a great lesson of my life.I cant easily 4get that loss. Since I lost my entire capital, I cant trade again. Even if am to re-start forex trading it can nt be on daily basis trading. I will be trading on monthy or quartely basis. Thanks I appreciate this lesson is a great one.

Hi Nial. Interesting article. Question… are you suggesting that high probability setups do not present intraday? The failed setups you noted on the JPYUSD chart were indeed failures, but there were others that would have yielded a perfectly good intraday result.

Also, if I am not mistaken, the 5m EURUSD chart you chose as an example reflected one of the least active time periods for the pair on any day, thus the narrow range is to be expected. I can tell you from experience there is plenty of tradeable movement in the pair during the hours the UK/European/US cash equity markets are open.

To be clear, I certainly agree beginners should focus on the higher timeframes while learning. But suggesting that trading intraday is inherently bad goes a bit far in my opinion.

Colin

Most people that blow up a trading account are day trading/over trading/gambling on shorter time frames. I wrote this article to warn people of the dangers and realities of intraday trading. Only a very small % of traders will ever become good day traders, I would prefer to teach my students a different trading approach, which is why I teach a patient trading strategy on the 4 hour and daily charts.

If there is one thing i take home from this It’s the Less is More mindset.

As well as being a trading account “suicide” Day trading can be detrimental to once’s health.

Definitely true. 400 of us trade daily timeframes, make a killing every year and take all of 10 minutes a day to do so. But day traders will always be there because, human nature never changes. Cheers!

I AM BLESSED BY EACH OF YOUR POSTS. THANK YOU Prof

Stop Hunting is made by brokers. I have 3 monitors and 3 MT4 on different account and different broker and I can see that.

A broker who wide spreads more than 2 pips before economic news release is not a fair broker. I saw 10 pips spread on EURUSD before NFP on one broker.

My advice is to open live accounts but not fund them only after at least one month of behavior monitoring.

For above article, I can say that to be able to trade on Daily charts we need more money because we need wide stops and can’t risk more than 2-3 % of accounts equity in a trade.

Till then I’ll make my pips on 5 min TF.

Excuse my english.

All the best.

Thanks Nial. Today’s lesson only further confirms the importance of using higher time frames like the daily and the four hour charts. Trading these higher time frames takes out the stress gaining a better result by letting the market do the work.

Niall, thank you very much for sharing your experience with us. I really appreciate your explanations. Would you still decide to trade on ‘Price Action’, ‘Pinbars’, ‘Fakey’, etc set ups, on the Daily charts?

This is a very interesting article. I am playing around with a trading plan that I call the “momentum method”. I was testing it using a very tight stop (usually around 10 PIPs). I then was curious to see if I would make money by applying the same money management principles that I use for the pinbar setup on the daily and the 4 hour. I found it very interesting that I got stopped out about 85 percent of the time. I have since altered my “momentum method” so that there is much more room for price to “wiggle” and have been much more successfull. Stopped hunting definately played a role into why my original plan failed.

To an extent I agree with the general point of the article that trading off the higher time frames would generally be more profitable. I want to point out that Trading h4 is technically day trading… Though I do my analysis top-down, I still find the lower frames especially important for near perfect entries in direction of higher frame trends and traders who manage to discover this unique importance will benefit more especially for most retailers who start off with low funds. Not everyone enjoys the feeling of 100-pips-against-you-then-in-you-favor experiences of entering off the higher time frames that we see sometimes.

At the end of the day, it is all about mindset and what you want the lower time frames to do for you. For me, they serve best for entries.

Stop hunting is real and undeniable. However, it is not exclusive to lower time frames. Liquidity pool is higher on the higher time frames and surely will incur deeper losses should one experience it. What happens in the day trading time frames is that most traders are completely unaware of the actual prevailing longer term trend. It makes them want to catch whatever pseudo high or low is made thereby providing other smarter traders (doesn’t have to be your broker or the big boys) with more cash to prey on.

Traders should be advised to start their analysis from the big time frames and work their entries out on the lower ones.

Over all, nice article but not as controversial as touted.

Hi Nail,

Great text, I was trying to trade in short period of time as 5min and it is to hard to do. Im now try to do this why and thare are more Chance for success. Thank you for comment. Great regards,

Hello Nial,

I find your way very interesting and i agree that higher time frames are more reliable.I would like to ask , how we can enter on trades? after a pin bar on a sup or res we just enter and place a stop above or below the pin bar? or we are looking for change of trend in smaller time frame? this is always tricky for me .

ps . some time the rejection in a bigger time frame is very big and the stop loss is to high so i dont have a proper risk ratio.

Thanks a lot .

Think i like the most about this site its always confirming suspicions i have had about the Forex market trading successfully, things mainstream websites seem to overlook and discrediting many of the o so popular misconceptions about Forex

Ben Ajose

Thanks again for an insighting article Nial.

One of the reasons you strike a cord with your community is that you’ve been there and coach from your experience. I remember day trading too, but since you introduced me to higher time frames (4hr and above) in your members course, my trading account is healthier and stress reduced.

Many thanks.

I agree, day is tedious ,

but the minute you swing trade, then you are swing investing also. charts might be cleaner but the risks can be higher.

Nialllll, guess some brokers will be getting upset with u. U are the real man especially wen one considers the adrenaline pump while day trading. Thanx man

I’m really glad to be part of the LTTTM community, money well spent! Another great article!

I love the challenge of day trading, fast and furious and when you get to the point of understanding what the market makers,brokers, institutions are looking at, you can then scalp some profit out of the market. But, really tough to get to that point and hard on your account, your emotions, your sleep patterns, your free time, your relationships.

So, Nial I must agree overall with your summation. If you want to give up all you value in life just keep day trading. The market will eventually eat you up one way or the other.

Great article, wish I had read it 10 years ago and saved myself a lot of pain.

Hi Niall,

I agree 4 hour and day trading is best but as ive said before

i know people who make a living trading 15 minute charts.They say the main problem is people are greedy and try for too many

pips in one go. why try for a 50 pips at £2 when you can get 10 pips at £10 a pip. As regards the stop hunters which i do think exist, you need a big stop loss but trail it or if your confident of the trend dont have a stop loss. wait for the stop hunters to take their scraps. then when trend continues

take your 10 pip profit. do this 3 or 4 times during the day

and Bob’s your uncle. comments please

Perfect Perfect.

Nial,i love this article.i was also a victim of lower time frames.every thing you said about it is really true.over-trading,over-analysis and so on.i scalp with robot,i buy signals,in fact i felt forex wasnt for people like me.i almost magine call ontill d last trade that was going against me.then,i was reading your article that talked about holy grail-daily time frame and i saw a pin bar.i had to adjust my stoploss to d pinbar bottom and leave the trade for 2 days and that was how i got into Nial Fuller’s Professional Price Action Trading.Thanks for all the quick answer to all my questions.have a wonderful weekend Nial.Cheers mate

thanks for that great article Nial. Agree with you totally i dont know why anyone would want to do that either

Thanks Nial, it is because of your weekly education that I am still doing forex, it took me 8 months of complete failure and 3 months of reading your articles weekly and I posted a profit. Thanks and continue with the same spirit. Though I would request for an article on position placing and leveraging before entering a trade. Thank you once again.

wonderful article Nial

Good one Nial !!

Other than that, nice article.

Nial,

Now that I can agree to. Major levels such as swing high/low do have stops that are hunted. But stop hunts happen on larger time frames as well, in fact even more so since the liquidity pool is generally deeper with a daily chart!

I still can’t agree with FX brokers hunting stops. They stimply don’t have the capital to do so.

Regardless of ‘who does the stop hunting’ it is a very real phenomena that occurs very often, mostly on short term timeframes.

Man, your article and commentary makes a lot of sense, in light of my recent efforts at day trading. When the market followed the trend (downward) I anticipated, it was great. 5 days in a row I made a minimum of $5,700.00 and one day I made almost 9k. I really thought I had something there. Alas, in the last 5 trading sessions, I’ve given back all my gains from that prior week, plus about 10k more. I wasn’t sure if it was my ability to hone in on the price action, or the fact that I was using better risk management. Definitely respecting intraday support and resistance is a big problem day trading. Its all chopped up on a 1 minute chart. I’m going back to swing trading, using moving average crosses. Its simple and works in any trending market using a daily or 4 hour chart.

Thanks for giving me the courage to turn off this day trading casino!

Thanks Nial. I’ve been studying the market and different strategies for several years now and I totaly agree with the daily and 4 hr time frame strategies. It’s alot easier and more productive . Before it was an ”ego” thing with me ”day trading” on smaller time frames . Now I want to make money. I’m sick and tired of going nowhere trading. I need the discipline of not looking at my charts every hr or so or staring for hours trying to find a setup. Nial, you make trading fun again, thanks.

Nice article Nial :) Very true

Add “DAILY” to your trading plan…trade less make more and go get more hobbies.

So true!

I’m baby trader (2 weeks of an experience) and I’m still at demo accounts and stressed out when trading on M5-H1 (85% of the time). Thanks to you Nial, yesterday I decided to try H4 time frame and I was so relaxed (comparing to last 10 days) but at the same time so concentrated on my daily job/tasks. At the end, result was incredible. MY account (demo) increased more then last 10 days of trading, I made a great job on the side AND final one, I had restful sleep! Just to point out for the 3th time: I still practice demo!

Regarding “Stop Hunting”… um no.

First. Stop hunters from the “big boys” could care less about the paltry stops from the very small retail price action traders. You do not provide enough liquidity to justify such a hunt.

Second. Brokers are NOT hunting your stops. If you believe this, I’d glady like to hear which FX broker you think has enough free capital to make such a move.

Sorry, but I disagree “Anonymous’. Stop hunting is very real.

The charts show this evidence. Eg: price will take out an intraday swing high/swing low where herds of traders have placed their stop losses.

The stops are triggered and the weak longs/shorts are shaken out of the market, then the market reverses and goes in the opposite direction.

This is a phenomena that has been happening for decades.

Absolutely agree 100%

Awesome stuff Nial…been trading the 1 hour chart with a lot of effort, sometimes not even sleeping…will definitely consider:-)

As always very good article Nial thank you.

Good one Nial..Right on the money

Brilliant article and all valid points. I began learning trading via day trading tactics and was inconsistent with winning trades on my demo account. Since using Nialls methods, knowing when to and when not to trade and using higher time frames, consistency of winning trades has improved immensely.

I 100% agree with Nial! I used to trade the 5-minute charts and lost 50% of my trading capital a few years ago. Why such traders like George Soros, Peter L. Brandt or William J. O’Neil do only trade off of the daily and weekly charts?! Even on the 4-hour charts, you have 6 times as much false signals as on the daily charts. I also prefer quality over quantity. Since I only trade off of the daily and weekly charts. I make 8 trades on EUR/USD, 16 trades on AUD/USD, 8 trades on USD/JPY, 4 trades on XAU/USD and 16 trades on USD/CAD on average per year.

Thanks for the reminder it’s needed to be said over and over again.

I have tried it and really lost some money.

When you first look at it it looks so easy, but it drags you in and don’t let you out again without paying for it (lost some money).

I’m sorry but I don’t agree with every point. Yes the brokers make more money and you have to be a lot more active. Your first chart usdjpy 15min , all I saw was an aggressive C sell and then stop and reverse for a long all on a simple but effective ABCD pattern. If we both average 50 pips a day I will make more because my stops will be tighter which means a larger position size. I will look at pin bars and structure and fib ratios but they all have to line up at potential reversal zones. I do enjoy most of what you share, Thank you , I appreciate it, but on this subject I wont change my mind.

Based on your teachings to trade like a sniper with price action strategy, i started trading on the daily TF only since last year August and I got 11 consecutive winning trades by December which skyrocketed my account from $3,000 to $8,000+ as at 4th January this yr. The 12th, which is also the current trade is already in profit heading towards my target.

I had already sworn and taken the oath to be a higher time frame addict as long as fxtrade is concern.

Nial, you are blessed.

Hi Nial, u suprised me today.i was choked on how this institutional traders are using math to play fast. look at this phrase from u again “As we have seen, today’s retail day-trader is up against some pretty stiff competition in the form of super computers and algorithms that are programmed by math “wizards”. Why waste your time and fry your nerves trying to compete against such players with this type of unfair advantage when there is a much easier and more lucrative way to trade?” bros, from today henceforth i said bye to 1hr and down tf tradin.

All your research is just wonderful though it doesn’t quantify the difference of position call and the day trade.

It shall be well appreciated if you do an article with winning strategy of day trade.

Because day trade is something you feel that you are in the market.

Many Many thanks for whatever you are doing to the trading community.

Abdul Rasheed Mamusha

Thank you Nial

I agree with you totally only 4 hour or daily chart which ever been profitable trade for me.

Love the article

Nial, thanks for the great article. You mention the “stop hunters”. What benefit do these big/institutional traders get from finding stop loses and stopping out the day trader? I can see it benefiting the broker because of more trades.

Agree totally. Looked at binary options recently and they are short term nightmares. How you can make money forecasting what will happen in the next 1,5,10,15,30minutes is beyond me, but I have an open mind and tried a demo account. You guessed it!!!!! I have made steady money in the last year using Nials course and only daily and 4hr charts. Please listen to him

Prof Nail.,this is an eye opener.I gain tremendously from the write up.keep it up.

You can succeed in day trading if you follow a strategy that is based on achieving 10-15pips per trade times 4. However, the higher you fly , the clearer your vision.

Nial

I know of a Proffessional intra Day trader who does Day Trade Forex. But they did tell me, their intial stop has to be 70 pips – why? Because, as you said Brokers have taken the traders stop out!!! It’s only when they are up 20-30 pips, they are able to bring the stop down considerably to avoid such a big potential stop loss.

Although I agree with you about clarity in trading. Not all day traders lose – some make a fortune. We don’t get to hear about them, because 90% of them lose – Period!! Lets not pretend though Daily time frames are the Holy Grail. For every winner in trading there is a loser. Risk reward is the holy grail period!!! Most Day Traders Overtrade. I believe sucessful trading is based on the pychology of the trader – not the time frame traded. When someone can show me there are no succesful day traders out there at all – Then I stand by that statement!! Cheers

Hi Nial,

You are spot on mate. It’s taken me a lot of dollars to realise the truth about the shorter time frames, i know a few of the bigger traders think along the same lines.It’s the power of the greed factor that drives most people to trade the lower time frames. Keep up the good work Nial. loved the article!

I don’t think Sergii’s post above should be ignored. Some traders do make a consistent return on the smaller time frames

However, Nials message is just ‘why bother’?

You can trade less frequently, with considerably less screen time on the higher time-frames, with much larger stops (and therefore much smaller lots / or ‘stakes’) and end the month with just as much if not more profit in your trading account

Trading is not the same as conventional ‘work’ it does not reward you for the number of hours you put in, but for the quality and consistency of the decisions you make and subsequent actions you take

I personally like to look at the weekly and daily time-frames to find key levels and obvious trends. Then use the lower (4 hour and occasionally 1 hour) ‘price action’ candle formations to provide trade entry and stop levels, with targets being pre-decided from the weekly and daily time-frame.

This often results in entry’s that are consistent with those that would have been utilised, had I just use Nials 50% re-tracement of the daily candle strategy, so I am moving towards doing this and therefore not concerning myself with the necessity to monitor the 4 hour of 1 hour charts.

The longer I spend monitoring the charts, the more I want to be ‘in’ a trade. This does not aid sound decision making!

have a great weekend Nial and every one that follows you. For those in the UK, keep warm & safe

best

Paul

Thats right day trading sucks ,i lost lots of money by day trading but now i only trade with 4h and daily chart and have much more good profitable trades than day trADING.

Nice one…

Dear Nial,

I agree what u said in this article.

Its a very useful article for all new traders.

Good luck and Thanks for your support.

Have a nice day.

Maniam

FANTASTIC Article….as always….

Nial I think that this is very true and more so about todays choppy market. Having said that trading the longer time frames is for me more taxing as in an 8 hr day I get 2 to 3 candles, then if there is a movement in the 12 – 16 hours I am away I miss the trade, and they are few and far between these days. The daily time frames are far more difficult to read and the odds of getting it right for me are not good.

My solution to this is the 1 hour charts with wide SL and TP with very low contracts that can take up to 3 – 4 days sometimes.

Cheers

Euan

Thank you for your Great Article !

Let us (our forum members)take an OATH to adhere to the bigger time frames of 4 hours and above from now onwards !

Ya hit it on the head again Nial. I’ve been following your site since late last fall and have had 3 of my best months (and less stressed) that I have had in my 3 years trading. I can never thank you enough!

Robert card

Appleton WI, USA

Awesome! Thanks!

Couldn’t agree more Nial.

Day trading was what I tried to do at first because I thought it was cool and less risk because of smaller stops however once you learn about position sizing you realise this is not the case.

Even the 4hr has nothing on a daily chart in my opinion. Although it can provide nice entries if used in conjunction with a daily chart.

As you say, day trading is not cool, it’s stressful as hell. I’d much rather browse my charts for 10 minutes at the close of the day and place a set. & forget trade on the daily.

Absolute truth, thanks a million for the extremely precious article.

Hi Nial.

I do agree with what you said about the difficulties of day trading. Indeed, having day traded myself for three months I know it is really tough to make a consistent profit. However, it does not mean day trading should be avoided by anyone. For each person there exists a trading style which fits his/her psychology. One of the goals for starting traders is to find the right approach to trading in which he/she is likely to make considerable improvement to become consistently profitable. There is no harm in trying, there is harm in keeping your mind closed.

Thank you for very much for the great website.

Hi Nial,

Do you see a risk that H4 and D1 timeframes also become harder to trade because of HFT?

Thank you for what you are doing to help people become profitable traders. Cheers.

I only trade the daily chart on the major pairs. I trade 4hours/daily chart on goldusd and silverusd. I really love the pin bars on the daily chart. Daily chart is the best chart for price action. My news trading + pin bar price action= my trading arsenal. Thanks alot. Hows is Australia n the crocs.

You’re telling the truth. I know from personal experience.

Always known / believed it – but haven’t had the cojones to make the change to the bigger T/F’s. I think now is the time as I am noticing their value as time progresses.

Kneath

thanks a lot for your mind blowing suggestion .i am sure i must follow this lesson.

I’m constantly fighting being drawn to the dark side i.e. short time frames. Your timely article reminds me of the perils of short term trading. Thank you.

Thanks Nail. I have argued with my self for a long time to

stop using lower time frames. Just a few days ago I started to do as you teaches. Thanks Nail

Hello Nial,

I find your way very interesting and i agree that higher time frames are more reliable.I would like to ask , how we can enter on trades? after a pin bar on a sup or res we just enter and place a stop above or below the pin bar? or we are looking for change of trend in smaller time frame? this is always tricky for me .

ps . some time the rejection in a bigger time frame is very big and the stop loss is to high so i dont have a proper risk ratio.

Thanks a lot .

Thanks A lot of stuff i knew about but never understood

Very Very helpfull.

I hate day trading as well, much easier and less stressful to trade higher time frames. Even in the higher time frames I would find it difficult to know where to put my stop loss. Refer to AUD/USD on daily chart. Would you opt not to trade this considering it’s choppy every day ? I can sense that the AUD is falling and it makes sense to go short but the daily time frame is so unpredictable. You have a bullish pin bar followed by a strong bearish candle. What is your recommendation on trading these choppy markets in terms of risk? Thanks Nial your emails are such a wealth of knowledge to me.

every traders must read and follow this message… dont forget.. dont trade on low time frame… thank you so much nial… you are great …god bless you

Very Very nice article Nial :)

I will change my plan of execution and save tons of time and efforts, efforts worth much more.

-C

awesome revelation! thanks Nial.