Trading Is a Game of Anticipation, Not Reaction

Everyone wants to get the most possible money for their time spent at work, and trading is no different; we want to make the most money possible given the finite amount of time we have to interact with the market each day. Sadly, most traders lose money because they don’t understand how to properly use their time in the market. How can you get the most out of your time analyzing and trading the market?

Everyone wants to get the most possible money for their time spent at work, and trading is no different; we want to make the most money possible given the finite amount of time we have to interact with the market each day. Sadly, most traders lose money because they don’t understand how to properly use their time in the market. How can you get the most out of your time analyzing and trading the market?

For many traders, it seems natural to assume that being in the market as often as possible is what gives them the best chance of making money. However, today I am going to challenge this widespread belief and I’m going to show you that you don’t need to react to every little bar or pattern that “might” be an entry signal. Instead, you need to get “in-tune” with the overall market structure and dynamics and learn to anticipate high-probability trading scenarios…this is how you get the most money out of your time in the market.

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.”

― Abraham Lincoln

I recently wrote an article on developing a daily trading routine which discussed the importance of performing weekly and daily market analysis in a structured and methodical manner. Many traders just wake up each day and go looking for an entry signal in a very random and haphazard manner. Instead, when you sit down at your computer to analyze the market, you should already have a good idea of where you are looking for signals and what markets are “hot” right now…you should be anticipating signals in confluent areas and levels in the market based on previous analysis you’ve already done.

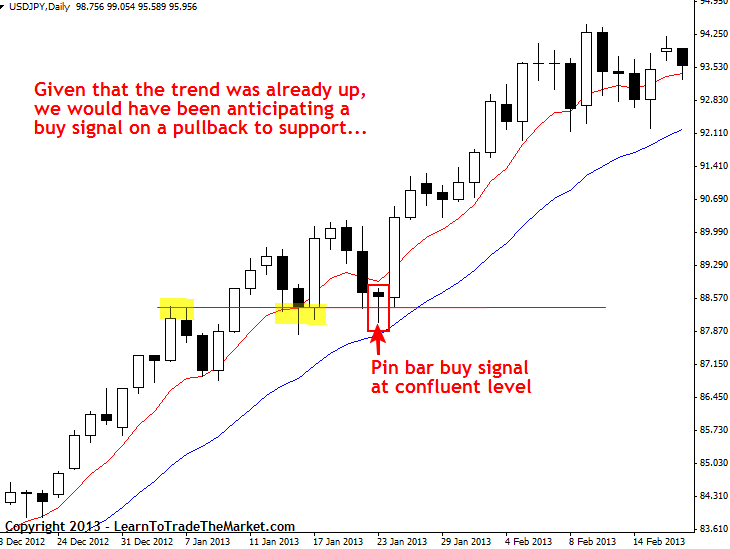

For example, in the chart below, we have analyzed the market and found the most confluent area to look for a signal, now we just need to wait in ambush; patiently waiting for a signal to form in the area or level we are watching. We have anticipated a trade scenario by analyzing the chart dynamics, determining market bias and finding the key areas in the market, as well as recent price action events….

In this USDJPY chart below, we would have been anticipating a price action buy signal to form after a pullback to support given that the trend was up. Note that we may have had to wait for one or two weeks for this signal, but it led to a large move higher and a continuation of the trend, so it was well worth the wait. Many traders were probably getting chopped up on the low time frame charts instead of waiting for this signal to form, and lost money as a result, instead they could have just been preserving risk capital and observing the market each day, patiently waiting for a buy signal from support…

It’s critical to understand the roles that anticipation and reaction play in trading the market. Anticipation can generally be thought of as a higher-level brain function, for it’s the ability to anticipate future events that truly does separate us from other species. Reactions are much more primitive and common amongst all animals; a monkey will react to its environment, but most of us know that it doesn’t really anticipate some event one week out into the future.

In my experience, most struggling traders are too busy reacting to the market to have enough time to catch their breath and make a plan to anticipate what it might do next. It may sound harsh or cruel, but being the frank person that I am, I am going to give it to you straight; traders who only react to the market are behaving more animalistic, and hence they lose money. Professional traders anticipate, they control themselves rather than allowing the market to control them.

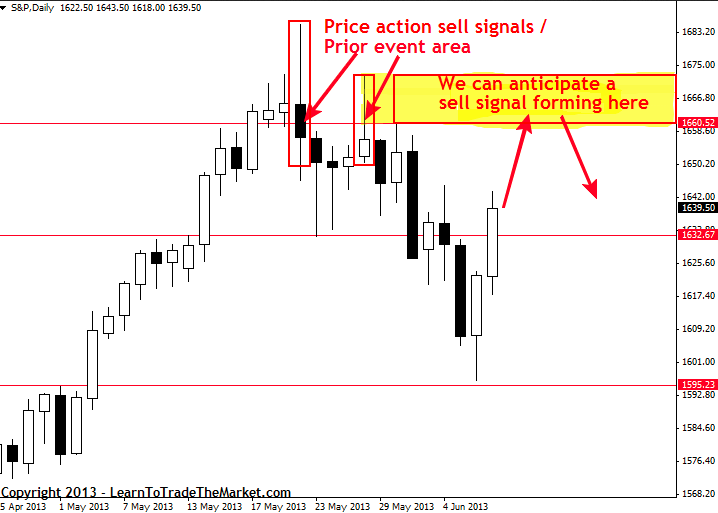

Recent examples of how to anticipate trades

For a more recent example of how to anticipate trade signals, we can look at the daily S&P 500 (USA) Index chart. As we discussed in our recent commentary on the S&P 500, the 1660 – 1670 resistance area was clearly a high-probability resistance area to watch for price action sell signals. We can draw this conclusion based on the fact that two recent price action events have occurred at that level and led to large moves lower. Therefore, we know there’s a lot of selling interest up at that resistance and if the market retraces back up to it and forms an obvious price action sell signal, it would clearly be a very high-probability trade…

Note on anticipating trades: The market will not ALWAYS do what you want it to or what you anticipate it might do. It won’t always move into the high-probability / confluent zones that you highlight on your charts…but sometimes it will, and when it does you’ll be ready and confident, and that is the point. The point of anticipating trades is that you have a plan of action for how you will react if XYZ happens…this is a much more professional way to conduct yourself in the market than simply “running and gunning” with no logic or method behind your trades.

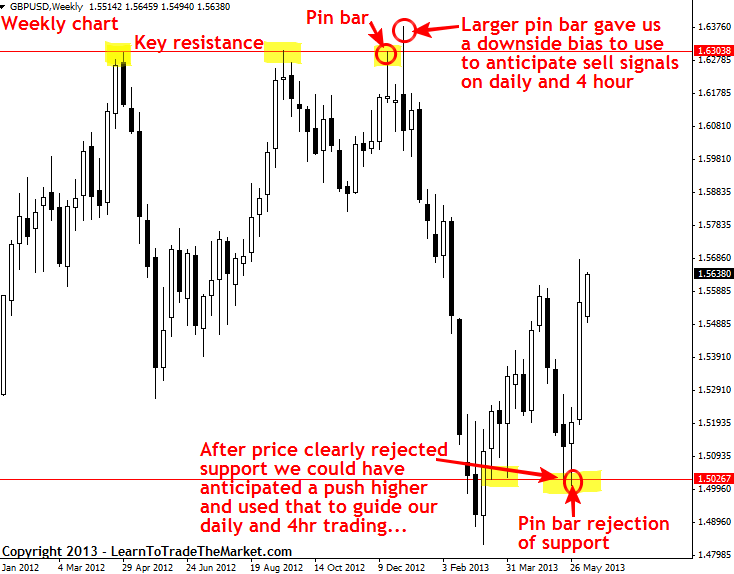

In the next example, we are looking at the current view of the GBPUSD weekly chart. By analyzing the weekly time frame and keeping in-tune with what it’s doing, we can use it as a guide to anticipate trades on the daily, 4 hour or 1 hour chart. In the chart below, we can see that the huge down move which occurred the first three months of this year was preceded by two bearish pin bars rejecting a key level of resistance. Traders who were following this market and analyzing its price action would have been aware that the longer-term weekly bias was changing from bullish to bearish and could have begun anticipating sell signals on the daily, 4 hour or 1 hour time frame as a result. After the down move occurred, we can see that bullish price action on the weekly chart gave us the ability to anticipate the current move higher that this market is experiencing.

Here’s an example of determining the weekly chart bias and using it to anticipate trade signals on the daily, 4 hour or 1 hour charts:

Another example of anticipating trade signals is when an obvious pin bar reversal signal forms and we anticipate a 50% retrace entry. This pin bar entry technique is something I teach in more in-depth in my courses, but for the purposes of this lesson, we can see that’s an anticipatory entry technique. Knowing when to anticipate a 50% entry on a pin bar signal is something that takes some “gut feel” to get good at it, but you will get better at it through training and practice.

Here’s an example of how we can anticipate a sell entry at the 50% retrace level of a bearish pin bar sell signal. This is a good example of using anticipation and patience to enter the market, instead of just “reacting” to the initial signal:

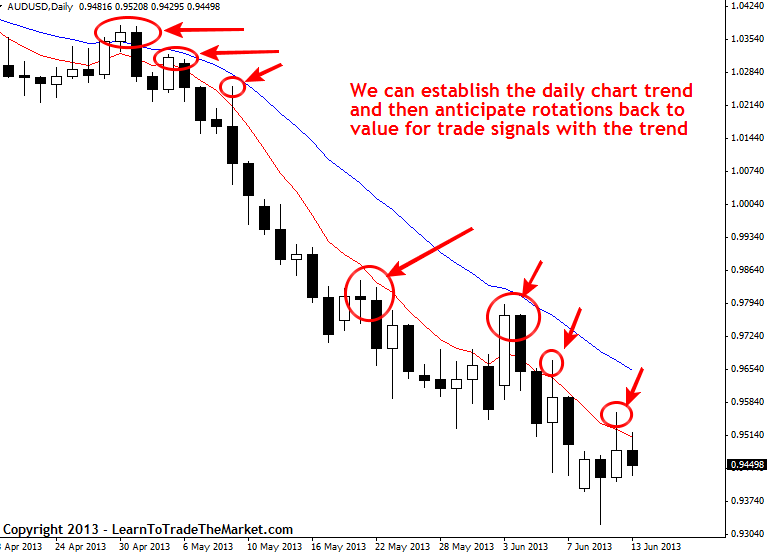

Identifying the near-term daily chart trend and then looking for price action signals as price rotates back to “value” (support or resistance) within that trend, is one of the most powerful uses for patience and anticipation.

In the chart below, we can see an example of first establishing that the daily chart trend was down in the AUDUSD (note the 8 and 21 day EMAs were falling) and then as price retraced back up to the 8 / 21 day EMA resistance layer (value) we could anticipate price action sell signals on the 1 hour, 4 hour or daily chart time frame to trade back in-line with the downtrend:

WHY you NEED to learn to anticipate trades

Think about your iPhone or iPad for a minute. It’s common knowledge that Apple has become the most valuable company in the United States, but what you might not know is that Apple’s founder, Steve Jobs, was a very anticipatory person. Mr. Jobs anticipated what people would want and like, and the Apple electronics that so many of us love and now seem to “need”, are the result of this anticipation. In reality, all good ideas are not just “instant”…ideas require time, planning, thinking and anticipation. As traders, we can take the fact that anticipation is a key ingredient in almost every big business or personal success story and apply it to our trading. To put it simply, we need to plan, anticipate and then pull the trigger once market conditions meet our anticipated criteria. To learn more about how to anticipate high-probability trade signals, checkout my trading course and members area for more.

Thank you Nial, you are excellent teacher.

Y’re simply cool man. I’ll trade using your lessons as possible.

Thans a lot.

Fuller,you are great with your price action strategy i have deleted all my nonsence indicators.

Good for you. I was afraid to get rid of my indicators. after a few weeks, looking at price is so much clearer!

thank you Nial. I will look forward to putting this into practice sunday night when the market reopens

This is one of the best article you’ve ever written, Nial. It’s really vital to plan our trades throughly by analyzing the important key levels on charts and wait for the price to reach the levels that we’ve highlighted.

I’m looking forward to join your members’ community after I read your wonderful and educational articles.

This is one of my favourite article. I love to read this many times again and again.

A breath taking article Mr Fuller,gives me different view of trading.

Thanks Nial for this lesson!

Very important .. As usual!!

This is great Niel,your articles make me understand forex as a business and appreciate price action,am working towards subscribing as a full member cos am becoming a better and disciplined trader through you,hope i become pro one day.thanks

Brilliant Nial. Great lesson Thank you.

Thank you for the very inspiring article!

Thanks Nial. You gave what a trader wants at the right time and very precise.

Thank you Nial for these great articles!

Another very motivational article, clear, concise, easy to read, should be a part of every aspiring traders must read library.

Thank you, Nial!

Always learn something to fine tune my trading or give me a greater insight into the market & how be a better trader.

Thanks again sir! I am now looking around my house to see what I can sell to raise the cash for your course. I hopefully will be able to join soon.

Including charts to illustrate the ideas covered is pretty awesome and makes the whole learning process not only fun but also easier to understand.Many thanks Nial.

Thanks Nial, great lesson, with implementing weekly charts is everything much clear and combination weekly,daily and 4H is extremly powerfull.

Dear Nial,

I must confess, this lesson is incomparable, it is a good rule and knowledge for a successful trading.

this is this popular saying that goes this way “TRADE WHAT YOU SEE AND NOT WHAT YOU THINK” can you reconcile it with your lesson above.

thanks for the wonderful lesson!

Great article Nial! Being able to read the market is the main reason why I joined LTTM course. Profit will present itself…

Great article Nial! Being able to read the market is the main reason why I joined LTTM course. Profit will come in soon…

That’s great article. and most valuable to beginners and experts. You are great.

Great article. thanks Nial

Another inspirational lesson from the GURU…

thanks for insights into complexity of forex market.your lucid style of explaining/ teaching is what a novice like me looks for. thanks

What a great lession! I am getting molded by your lessions.

awesome article! looks like the aud/usd is reaching for resistance again. looking for another good sell on a shooting star!

Great lesson teaching me what a good trader should do and behave. This is the enhance material to the trading course.

Great Thanks.

This is so full of insight and nurturing. This is the stuff that I find most valuable in developing my mindset to trading. Thank you Nial; you are the best!

Cheers

Excellent lesson!!! as usual …….

As usual, nial.feeding my trading knowledge with rich info.indeed, you are one of the best.thx a million

It will be very difficult for any serious minded trader not to start regular and consistent profitable trading after following this kind of teaching. I say thanks for the lectures. I appreciate.

This is way the battles are won under the command of intelligent commanders

Another ‘spirit’ of successful and stress-free trading!

Pls keep it coming and may GOD bless you real good.

Best advice EVER.

Thanks for this wonderful and heart-warming article. However, can you please explain better on “THE CONFLUENT LEVEL AREA”

Very insightful lesson Nial. I agree with you 100% in anticipating trades especially the 50% fib entry and price rejection on Horizontal lines. It takes a lot of waiting and patience to do this and I am glad i have learnt how to wait for my trades by learning how to trade like a sniper and a crocodile. Thanks a lot Nial.

THE ONLY THINK I SAID ON THIS ARTICLE, IS THANK YOU. THANK YOU MY FRIEND anticipation? oooh thanks

Thank you sir.for very importance article.

Hi Nial,

Thank you for this article.

The more i read your course the more clearly i can see that going for short trades is more risky and less rewarding. Your article reinforces this fact.

Another very useful post again Nial. Thank you very much.

Hi Nial,

As usual, this information is absolutely spot on!

Just what I needed to be reminded of!

Cheers,

Chris.

Hey Nial,

Great article – as always; one of your best ones I think.

This approach will make difference to traders being successful – along with knowing when to exit (taking profits).

Great stuff.

Good trading,

Patrick

Thanks Nial,this article is going to improve my trading as i am still starting

A very useful way to understand the market.

Thanks Nial.

Great arthicle.

Cheers

Thanks Nial

good article indeed, thank you

Great Article !!!!!

Nile You are such a wonderful, experience & supportive that you reveal lots of these truths every week. Most of them are PINPOINTS.

Thanks a lot for the article

Thanks Prof. for this wonderful article!

a gem of an article. Thank you for this.

Thanks for the article. Totally agree. Waiting for the trade to come to us and forming the right signal at the right place at the right time is truly an anticipatory act. As Sun Tzu, a famous war strategist pointed out. “Victory belongs to those who make the best preparation.” Not the exact quote but close.

What timing Nial! Spot-on! It’s as though you wrote this one for me. Thanks!

Today I made an effort to re visit your course material as there is always more to learn with redefining my” edge” my “gut feel” and “intuition”. Combined with todays lesson to anticipate with what the market is doing and to reload up on your course material has been a double whammy!!! Thanks Nial.

Thanks Nial for another great lesson!

Nial, I must tell you that since last month that I signed up for your news letters things are changing for the better and spending two or three days without reading from you makes me feel something is missing.I look forward to reading from you.

Thanks

Thank you Nial

Thanks nail ! . Its really nice lesson.

Excellent lesson!

Thanks Niall.

thanks Nial.

The above is a nice article. I have few question I will email you please let me know their answers.

Thanks Nial, very good explanation . When I read your these sorts of commentaries I feel I am growing day by day, I refresh my mind with where I should do better today….

Excellent article that fills a gap that has not been covered. The course is clear about signals, pin bars at support, inside bars, fakeys etc, but what this shows is that to get the best probability setups you have to plan ahead and look at points where they will occur and not go blindly in on any signal.

Nial who are thoose MA’s that you use on your charts? Thanks.

Sir, you really motivate us through ur strong words,

Discipline, Patience and from today “ANTICIPATION”

Thanks for the lesson, Sir

Thanks !