The Forex Trader Vs The Forex Gambler

Today’s lesson is going to open your eyes and help you decide if you are trading or gambling, so I want you to read the whole thing very closely, three times over if you have to. You should read today’s lesson even if you don’t think you have a problem with gambling in the markets, because you will surely pick up some useful advice that will work to improve your overall trading results.

Today’s lesson is going to open your eyes and help you decide if you are trading or gambling, so I want you to read the whole thing very closely, three times over if you have to. You should read today’s lesson even if you don’t think you have a problem with gambling in the markets, because you will surely pick up some useful advice that will work to improve your overall trading results.

Gamblers fund $500 accounts, blow them up and fund them again with another $500, they repeat this process over and over again without changing their routine, mindset or their strategy; they do the same thing week in and week out expecting to actually make money. I believe it was Einstein who said “doing the same thing over and over again and expecting different results is the definition of insanity”… so we could even go so far as to say that continuously gambling with your Forex trading account is not only financially problematic, but it’s insane.

Any business like trading where you are your own boss and there are basically no rules except the ones you make can be addictive and induce gambling qualities. Now, I am not here to tell you have a gambling problem; I am here today to help you recognize that you may be trading like a gambler and you need to make a change and start trading like a professional. This lesson will help you transition your mindset and your daily routine into that of a professional trader’s, so that you can avoid throwing anymore of your time and hard-earned money down the drain.

The difference between pro trading and gambling…

In trading, we have the possibility to do almost unlimited financial damage to ourselves. There are basically no rules in the trading arena, it’s just you versus you, and the winner or loser will be you. Sure, you can think you’re trading against other market participants, but in reality you are trading against yourself. You are the one who determines whether you make or lose money in the markets. My point is that when you put a human being in this unbounded trading environment, they have nearly unlimited temptation to gamble with their money, so we have to devise a plan to combat this temptation. Many traders think they are ‘trading’ when in reality they are behaving exactly like someone with a gambling problem.

Since it’s so easy to fall into a cycle of gambling as a Forex trader without even really being aware of it, it’s important that we go over some of the basic traits of both a gambler and a pro trader so that you can determine which best defines you:

Basic traits of a gambling Forex trader:

• Has no trading edge or effective trading strategy

• Doesn’t have or use a trading plan

• Doesn’t have or use a trading journal

• Pays little to no attention to risk management

• Spends most of their time focused on profits and rewards

• Often feels intense emotional ups and downs while trading

• Often holds trades in blind hope of unrealistic profit targets

• Trades far more often than they should

Basic traits of a professional Forex trader:

• Mastered an effective trading strategy like price action

• Has a Forex trading plan and uses it

• Has a Forex trading journal and uses it

• Focuses on risk management and on controlling risk on every trade

• Not overly-focused on profits and rewards

• Trades only when their trading edge is present.

• Does not become emotional over a win or a loss

• Treats their trading like a business

As we can see from the traits of a gambling Forex trader listed above, we are mainly dealing with psychological ‘traps’ and pitfalls that we create for ourselves as we interact with the market. I would say that if two or more of the traits of gambling Forex traders we listed above apply to you, then you need to take some action.

Unlike normal gambling addictions, a trader can break a cycle of gambling-like behavior if they will accept that they need to change their habits and then follow a predefined plan of action to start thinking and trading like a pro.

Solutions for the gambling Forex trader…

If you find that two or more of the above traits of Forex gamblers describe you, it’s time to do something to change them. There’s nothing wrong with admitting that you are gambling in the markets, it happens to all of us, I have even been guilty of it in the past. What you should focus on is changing this behavior and on constantly trying to improve yourself both as a trader and as a person. Let’s have a look at some of the most important things you can start doing today to transition yourself from a gambling trader to a professional trader.

If you find that two or more of the above traits of Forex gamblers describe you, it’s time to do something to change them. There’s nothing wrong with admitting that you are gambling in the markets, it happens to all of us, I have even been guilty of it in the past. What you should focus on is changing this behavior and on constantly trying to improve yourself both as a trader and as a person. Let’s have a look at some of the most important things you can start doing today to transition yourself from a gambling trader to a professional trader.

A checklist for the gambling Forex trader:

• First thing is to stop trading with real money. You’re going to have to take a break from trading real money to cut out the emotion and regroup effectively.

• Second, make sure you: A) Have a trading strategy that you know can be a high-probability trading edge, like price action trading strategies, and B) Fully understand how to use this strategy and you’ve demo traded it long enough to feel you have ‘mastered it’.

• Create a daily checklist or Forex trading plan. This should essentially be your daily trading routine…write down your daily trading routine so that you have a guide to follow each day, this way you’ll be far less likely to enter random trades or ‘wing it’. This will help you view your trading more as a business and less as a trip to the casino.

• Have a risk management plan, and make sure you actually adhere to it by being aware that you never know when a losing trade will come up. In other words, your trading edge is randomly distributed across a series of trades, so don’t ever assume any one trade will be a winner and risk more than you are comfortable with.

• Start tracking all your trades in a journal…don’t deviate, if you don’t have a trading journal you can get one here.

• Limit your time in the market by setting a maximum of 3 trades per week until you feel you are not gambling anymore. This will give you a strict rule to follow and help instill some discipline into your trading routine.

• Be confident in your trading strategy and rely on the long-term edge to recover any short-term losses, rather than trying to get ‘revenge’ on the market and jump right back in after a loser.

• Constantly be aware of your mindset and try to control your emotions in the market by doing the things discussed above. If you feel yourself getting an urge to trade for no reason or to risk more than you should, simply remove yourself from the markets. Also, work in a section on maintaining the proper forex trading mindset into your trading plan and read it every day.

Professional Forex trading is all about habits, and the first step to changing your habits from a gambling trader to those of a pro trader is by determining whether or not you have a problem. If you are bold enough to be honest with yourself about this and find that you do have a problem, please try to follow the above points at least for one month and see if your trading, mindset, and general physical state of well-being don’t improve.

The gambling traps that snare amateurs and that pros avoid…

A few winning trades often misleads amateur traders into thinking they are ‘onto something’. But what usually happens is they hit a big winner and then they give it all right back, and usually more. This cycle of winning here and there and then giving all your gains back, works to keep traders in a cycle of gambling in blind hope, and it slowly depletes their accounts until their gone. Humans are wired to fall prey to this trap of randomly distributed rewards. What happens is once we hit a few winners via luck, we sort of view that as some ‘special trading ability’ and then we just end up gambling our money away in a futile attempt to keep winning. There are scientific studies that show that we condition ourselves to repeat self-destructive behavior like this for the allure of a large randomly distributed reward…playing the lottery comes to mind here…or going to the casino and hitting one nice sized jackpot and then spending countless hours and dollars trying to hit another.

A few winning trades often misleads amateur traders into thinking they are ‘onto something’. But what usually happens is they hit a big winner and then they give it all right back, and usually more. This cycle of winning here and there and then giving all your gains back, works to keep traders in a cycle of gambling in blind hope, and it slowly depletes their accounts until their gone. Humans are wired to fall prey to this trap of randomly distributed rewards. What happens is once we hit a few winners via luck, we sort of view that as some ‘special trading ability’ and then we just end up gambling our money away in a futile attempt to keep winning. There are scientific studies that show that we condition ourselves to repeat self-destructive behavior like this for the allure of a large randomly distributed reward…playing the lottery comes to mind here…or going to the casino and hitting one nice sized jackpot and then spending countless hours and dollars trying to hit another.

You have to recognize this gambling behavior and try to break through it, because it really is a part of our wiring to trade like a gambler. Luckily, we have large brains with highly-developed pre-frontal cortexes that can plan and think long-term amongst other things. This is our primary tool to use in defending against our more primitive brain areas that tend to naturally dominate most of our actions in the markets and cause us to gamble.

A professional forex trader is constantly managing their risk and thinking about it. They are disciplined and they follow a strict routine, they know they are in the business of trading and they treat it as a business. A pro trader is not fazed by a winning trade or even a series of winning trades; they are emotionally neutral on a loser or a winner. Professional traders are more emotionally excited about their ability to stay true to their trading plans and capital preservation plans than they are about the outcome of any one trade…because pro traders know if they can manage their bankroll properly they will end up out front. If you want to learn professional Forex trading strategies and concepts that will help you transition from a gambler to a successful trader, checkout my Forex trading course and members’ community.

Talk soon, Nial Fuller

If you win you are trader, if loss you are gambler

thanks Nial, very useful article.

Many trader are gamblers and lose much money

Like you said, we can make money gambling, but trading is always the wiser choice, gambling will lose it all sooner or later.

Thanks Nial, the only thing I know about trading is, you are either a trader or you are not, this is not a hobby or casual thing. When the light bulb goes off and you face all your weaknesses, all your misunderstandings, and am willing to grow up, really get mature and stop b.s yourself, then you will be in incredible appreciation that life has given you an incredible opportunity to experience your truth, your greatness. Only then will you know what it takes to be a successful person. Its a bit scary, no doubt, but is it worth the possibility of devastation, of failure, yes. I have failed time and time again, but life is just waiting for me to get in sync with it. Stop fighting, stop wishing it was my way,stop banging my head on the wall, it starts to hurt! Let go, have faith in Truth, focus on my highest desire without fear of losing/devastation, for when we do this, we are automatically successful, reguardless of the external world. This is all I know about trading/life.

good article to read even if you feel you aleady know the topic well.

funny how I want to share this info with my family and friends… sigh (non of them trade).

Profound! Thanks! … It is me described in no umcertain terms

This is a good article to read because many traders are gamblers .

Thank you .

EmmNUEL

wow this is more than an article, its a lot of great information, great advice and is its worth to learn from it regarding the difference of gambling and serious trading… thanks Nial

thanks nial.u’re the best………u teach me a lot..

thk nial..good for me…

Excellent Nial!!

Ive been trading like a gambler since i started and loss money. Is good have a mentor like you!!

Hello Nial,

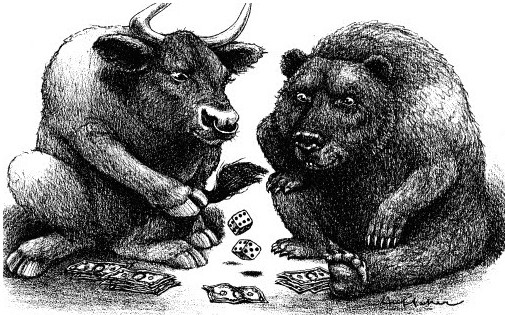

really good article ( and also I like the bull&bear-pic:)))and thank you so much for your work!!!

Brilliant help specially for new traders…

Have a nice day, Sabine

Hi Nial

Well said. Wonderful article.Thank you.

yes thats the hard cold facts…been there and you want to play catchup when you lose a trade..addictive behaviour that can distruct a traders mind.

I now look at my chart no more than three times per day and unless I see an obvious trade I turn it off. problem solved.

Thanks Nial,

Once again a very valuable article

Luca

Another excellent article.

Before coming to this site, I was making 10~12 gambling/revenge trades in a month. Last month it reduced to 2 trades. In Sep ’12, I am targetting zero gambling trades.

I am repeatedly reading the articles one by one. Thank you Nial for your education.

nice article , everyone should read it carefully and follow that rule, hope all will be sucessful in their journey

Thanks NIAL for hitting the core aspect of TRADING between “a well trained-disciplined SNIPERS/PROFESSIONALS like YOU, Versus Whimsical gamblers”. Let us seriously follow our true “Mentor,our Savior” Mr.NIAL FULLER. There lies OUR SUCCESS. WITH REGARDS, AMIN MALIK from PAKISTAN

10/10!

Nial, I wish I knew you when i had a lot of funds under management and also personal funds to trade, the gamblers that depleted it would not have had any access to it. I also joined the group of gamblers trying to recover lost funds and lost more. I have stopped trading and looking for a J.O.B instead but I want to come back big time. Your articles have been very helpful and in due course I intend to enroll in your training program

Thanks Nial. Another great article.

Good day Mr. Fuller, I know that I have been a gambling trader in my demo. I make money and when I place another trade, I loose what I have made in the previous trade. Now with this and your other lessions, I know better. Thanks again for your help. Jude Erameh from Nigeria

Very well written and helpful. Could wait to tweet. Trading is more about handing out control to your pre-frontal cortex which is comparatively aware and is able to carry on critical thinking and planning as per situation than just to act reflexively

simply POWERFUL………

Thank you for a priceless lesson. I have never thought that I have such mentality, now I know.

Thanks for giving me the key to break this mindset and behavior. I guess that is why it has taken me ages to get on top of this game!

Thank alot!!

This is a very usefull article. I hope I have learned something.

Hi Nial

You are doing GREAT JOB.

Mike

Nial:

This was an excellent article and as I skimmed my way through it, reviewing my past 3-4 years of trading I saw a migration and a morphing of myself from the gambler to the trader. Now, I don’t have the money I used to have (because of being in the wrong camp with the wrong mindset) but I am certainly in the camp of the trader now instead of the gambler. My wins are increasing, my patience has went off the scale in looking and waiting for my PA setups and I feel really a lot more comfortable with where I am with my trading style. I don’t focus on the big buck but I focus on the key ingredients you have defined so very well in this article.

Every trader sooner or later has to develop their own style and confidence levels as they will never trade like you, but, through the constant teachings of your wonderful course and your website blogs and support if anyone wants to grow (and that’s what it will take) they have the option through your course.

Thanks for all that you do to help all that want to grow in this business.

Gordy

Thank you Nial for your great article. It will surely help me to change some of my bad habits.

Regards

Adam

Hi Nial Hit it right on the head, probably the best piece of imformation you could give to aspiring traders.

This is the best article you have written in a long time.

Thanks for the great content.

P.S EVERYONE should do his course it is the best in the market.His material will make you a winning trader.

Thanks Nial. Another great article as always!

Well articulated piece of advice that got me thinking all through. Lots of points to keep when moving on.

Nial, this is a great article! It definitely helps identify this serious problem, and provides solutions which we all can apply towards a permanent resolution. Funny as it seems, the new novice traders become vicitms of this dangerous behavior without realizing how quickly it’ll drain one’s trading account, and how often this will be repeated.

Thanks a bunch for such a great article!

Regards

short but right to the point . we are all gamblers more or a less we just need to control are risks better.

Prof. Nail,this is wonderful.It’s human and traders’ diagnostic article.More blessing on your efforts.I believe putting all the points to practice could make a professional of ones trading career.Regards

What another great lesson our Professor has posted again. These points look simple on the surface but very hard on the practice. Every forex trader has been a victim of gambling at a point in his trading life.However the good news is that we can change, especially using and applying the truths of these numerous lessons from Nial the Professor.

Hi,thanks for your insight.To be honest,i have been a gambler but on the demo account.For instance today morning i entered 4 trades and all went in the right direction and made about$120.However, i thought that the reverse was true only to lose the profits i had made.once again i have been a gambler and thanks for changing my way of doing trading. Could you talk about the use of EAs and which would you recommend.

Thanks n Cheers

Thank you for sharing this. It is very important to have a plan in place and being disciplined to follow your plan with sound money management principles.

‘Professional traders are more emotionally excited about their ability to stay true to their trading plans and capital preservation plans than they are about the outcome of any one trade…because pro traders know if they can manage their bankroll properly they will end up out front.’ – NIAL FULLER, I LOVED THIS QUOTE…..VERY DEEP….GOT ME PONDERING ABOUT MY TRADING APPROACH…..THANKS NIAL

Dear Nial,

It’a good article & appreciate your article.

Regards,

Nadeem