Know When to Hold ’em – Know When to Fold ’em

One of the most challenging decisions that Forex traders are faced with on a day to day basis is…knowing when to hold on to a trade and when to close it.

This decision is usually the one that gives traders the most difficulty and frustration, and it is something that you must learn to effectively deal with if you want to make consistent money in the forex market. Trade management is often the area that gives forex traders the most trouble; it is relatively easy to get into a profitable trade but it is much harder to manage that profitable trade in such a way that it produces an outcome you are satisfied with.

This decision is usually the one that gives traders the most difficulty and frustration, and it is something that you must learn to effectively deal with if you want to make consistent money in the forex market. Trade management is often the area that gives forex traders the most trouble; it is relatively easy to get into a profitable trade but it is much harder to manage that profitable trade in such a way that it produces an outcome you are satisfied with.

This article will only focus on one area of the process of trade management; knowing when to hold on to a winning trade in order to let your profits run, and knowing when to close a winning trade and take your money. Pardon the cliché, but as the Kenny Rogers song goes, “You’ve got to know when to hold em’, and know when to fold em”…(If you never heard the song click here: Kenny Rogers)

How to manage a trade with a big open profit…

While there are certainly worse problems to have in the world, trying to figure out what you should do with a trade that is deep in profit can actually be quite puzzling for many forex traders. The problem that traders in this situation face is whether they should hold their trade for an even larger gain that may or may not materialize, or close the trade out and walk away with a very nice profit.

What this decision really comes down to is one of logic vs. emotion. Take a look at the technical picture of the chart that you are trading while completely disregarding how much money you are up or how you feel. When you look at the chart from this perspective think about how big the recent move has been that you have traded, how much has price moved compared to the ATR (average true range)? Do you really believe there is a logical technical reason that such a large move will continue on in your direction before reversing, or are you just being greedy? Remember that just because a trade is heavily in your favor does not mean you should necessarily keep it open. If you are in a trade that is up more than 3 or 4 times your risk, you should really stop to ask yourself, “Do I really believe this trade will keep going up or down in a straight line or is it more likely to experience a correction?” It usually makes more sense to lock in most of your profit or close a trade out that is deep in profit, because if there is one thing we can all agree on about the forex market it’s that it ebbs and flows and doesn’t travel in a straight line for very long except on rare times of economic volatility.

Here is an example of the point above illustrated in the daily GBPJPY daily chart from mid – 2010…

Another example….

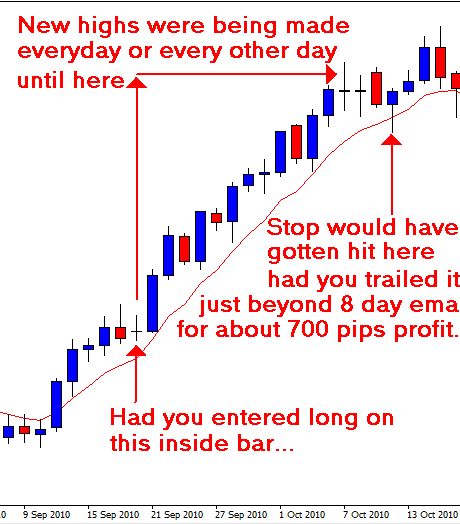

How to manage a winning trade in trending markets…

Trending markets can increase the odds of a trade moving in your favor and as a result the chances of being able to let your profits run into bigger gains. One good way to tell whether or not you should try and let your profits run when a market is trending is whether or not new highs (in an uptrend) or new lows (in a downtrend) are being made on near daily basis. If this is happening you can simply trail your stop loss along the 8 day ema or slightly above / below the previous day’s high or low and let the trade run in your favor until it reverses and hits your stop.

Here is an example of the above point illustrated in the recent EURUSD bullish move on the daily chart…

Another example…

How to manage a winning trade in the midst of opposing price action or support / resistance level…

Another factor you want to look for when trying to decide if you should hold your winning trade or fold it is whether or not there is an opposing price action signal or a nearby support or resistance level. A nearby opposing price action reversal signal or strong support or resistance level can be a good reason to close out a winning trade. Also, if there is a previous support or resistance level that has held strong in the past, you might want to use this level for a profit target, usually putting your target just in front of the level works better than trying to squeeze every last pip out by putting your target right at the level or slightly beyond it.

Just as we can use price action signals to enter into high probability trades, we can also use the opposite signal to exit a trade. How many times have you been in a pin bar trade and then after a day or two an opposing pin bar forms? In this case you might want to trail up your stop to just above the high or below the low of the opposing pin bar, depending on which direction you are trading. Opposing price action signals can be used to exit a profitable trade if they occur in the natural course of that trade, however, you should not wait or depend on such an opposing signal to exit a profitable trade, it is just something to be on the lookout for in case you are in a profitable trade.

Here is an example of the above point illustrated on the daily GBPJPY chart:

Another example…

How to manage a winning trade when reaffirming price action occurs…

One of the best signs that a particular trade is a good candidate to be held instead of folded is reaffirming price action. For example, if you are long the market and you get a bullish pin bar or consecutive bullish pin bars that form in the context of the uptrend you are trading you can be reassured by this price action because it “agrees” with the direction you are trading. This is essentially the opposite of the “opposing price action” rule that we discussed in the point above. This reaffirming price action can be a very good indicator that you should hold a winning trade instead of folding it. Learning to “read” a price chart in this discretionary manner is really what distinguishes the pros from the amateurs.

Here is an example of the above point illustrated on the AUDJPY daily chart…

Another example…

How to manage a winning trade in different market conditions…

Another factor to take into consideration when deciding whether to hold or fold your winning trade is the current state of the market. Is the market trending or consolidating, quiet or volatile? In a strong trend you will likely have a better chance to hold a trade for bigger gains, in a consolidating market you are probably better off using support and resistance levels and / or opposing price action signals to exit your trade. It is crucial that you consider what condition the market that you are trading is in before deciding whether or not to exit your trade.

Here are examples of managing a winning trade in a trending market on the daily USDJPY chart and an example of managing a winning trade in a consolidating market on the daily GBPJPY chart:

Don’t count your money when you’re sitting at the table…

When deciding whether to hold or fold your trade it is important that you look at your trade in terms of risk to reward instead of the amount of pips you are up. This is analogous to not counting your money when you’re sitting at the table; don’t count your pips when you are in a trade but instead calculate your risk to reward scenario. Before entering any trade it is very important to figure out how much reward you can reasonably make relative to the amount you are risking. As the trade progresses it is important to remember your pre-defined risk / reward scenario, you really don’t want to take anything less than this pre-defined risk / reward amount unless there is a logical reason to do so like one of the points we discussed above.

If in doubt…

If you find yourself in a profitable forex trade and you are unsure whether or not you should hold or fold it, the first thing you need to make sure you do is NOT let your emotion influence your exit decision as this is one of the most common and detrimental mistakes that forex traders make. If all else fails you can always refer back to this article and the points discussed above, go through them and see if any of them apply to the current trade you are in, you can think of this article as a sort of “check list” for what to do when you are in a winning trade.

The most important and useful thing that you can do when in a profitable trade is to stop and ask yourself, “should I stay in this trade or should I close it?” Have a logical think about it for more than a few minutes and remind yourself that you need to avoid an emotional exit at all costs. Refer back to the points above and ask yourself if any of them apply to you, make yourself a pros and cons list if you need to weigh the advantages of staying in the trade vs. the disadvantages. If after all of this you still cannot control yourself than you might need to seek additional help by reading some of our other forex articles or watch some forex videos. Producing a satisfying outcome for profitable trades is one of the most difficult aspects of successful forex trading, use the information in this article and the logical-thinking part of your brain to decide how to exit your winning forex trades and you will be in a very good position to profit on a consistent basis in the markets. To learn more about price action and simplistic trading check out my forex trading course.

Hmmm,nial you are too much! All these pieces of article has built confidence in me, I feel I should be charged because of the wealth of knowledge truthfully released uncompromisingly.I still must enroll for the course and membership.You deserve regular percentages of my wins for this heaven sent lessons you give God bless you

Very clear , understandable lesson. Thanks sir.

Thanks sir

I thoroughly enjoyed this article, it was very well explained and had key insights into how to manage the trade. I am very glad I am a part of your LTTTM Membership Nial.

Great article Nial. Thanks

Hello, Nial!

Thank you for this great article! Very helpful for consistent profits)

Important article! Thanks

Hi Nial, I love this article, I dont know when you wrote it but it is an evergreen article with unforgetable insight. Thanks man.

Very important article! Now I approximately know when to hold when to clдose. Thanks Mr. Nial!

Best article ever on trade management. Reading your articles its like building a house brick after brick. My trading house is taking shape. Thank you sir.

Your teachings are simply the best and easy to follow. Thank you my Mentor. Salute

The best way to manage a wining trade In open position is never to be greedy. Contentment is the master key. Of course, once the market is always there today and tomorrow, then it is wise to close that profitable open position and be contented with it because more profit opportunities will always come our way, so far the forex market is still existing. Don’t be greedy but be wise!

Very helpfull thanks.

Outstanding article. Will definitely be one of the many checklists that i shall refer to many times in the future.

Nial, as with all of your lessons, this was outstanding advice. Thank you for sharing. Your work is certainly appreciated!

Nial..a great article which will help to keeps the distraction out of picture once a trade is live and profitable..thankyou

Excellent article as usual

I can just say that all this inputs from You are great.. a lot of to improve in my trading and I will not stop to read even more and more to learn from PRO..

Thanks a lot.

Thanks you very much from Barcelona !!

Another great one.. Thanks

Thanks for another amazing article Nial. Great work!

What time frame is best to use when checking for opposing/reaffirming price action signals. 4hr and Daily or do you ever use 1 hour?

Happy trading :)

This is really the right way to trade forex and you can call it Art of Charting, you are clearly reading the chart like abc

thanks alot.your articles has re-enfored my trading strategies using price action on daily charts.more strenght.

Getting in is only a part of the game. Out is the hard part. Very useful thoughts.

I have to say sometimes its really hard trying to decide when to cut a trade especially when its against the trend but having received a pin entry.

Great Article –

I’m 5 months in profit on demo and this week has been my first week on my live account and I am up around 8.5 Reward !! Thanks Nial

VERY VERY GOOD ARTICLE !

hi!! Thanks for this article ilustrated with figures!

this really makes the diference for that ones like me who are learning about forex market!!

Hi Nial,

I Agree with Fred above here, a very clear and easy to follow material. You have what is needed to understand here, without complicating it.

Thanks

Hello Mr. Fuller

Thanks for the “Meat and Potatoes”. Even though I am a vegetarian the savory smell I still do enjoy. Solid article.

great article and very honest. thank you.

Thanks for the posting. Truly Learning Price action strategy n money management are important keys to success in forex trading.

Nial,

I am a retired teacher and I know a great teacher when I see the way they teach. I must say I have purchased several Forex trading courses some good,some bad. The way you teach trading is crystal clear.I haven’t read or viewd all your material but what I have is so clear one can’t help but understand it. Don’t want to flatter you, but you are the best teacher I have run across on the net.You must be loaded with patience and a sincere desire to help others and it shows in your teaching material

Thanks very much for your kind wors Fred.

Nial

This was a great lesson. The analogy to Kenny Rogers’ song was brilliant. My trade management skills got a nice boost from this. Didn’t really consider opposing price action signals as alerts to a possible exit. This was a brief but powerful lesson on good trade management…thank you.

I have just discovered you’re website – this is a great article!

thanks for the brilliant article,you are the true forex guru

This is a very good article. I also like to use multiple lots as this allows me to put some money in the bank.

Brilliant article Nial and exactly what I need at my stage of trading. It especially helps when you have a written explanation and then the pictoral chart to help out. Thanks for taking the time to do this, must take a lot of time to put this stuff together.

Fully appreciated and keep em coming

This is awesome!!!!!!!!!!!! I really appreciate this course n othter articles I ve read from this site. Price action trading strategy isd best and Money management is the key to profit making in forex trading.

Lets contd to “make pips , Keep Pips and repeating it”

Happy trading

Regards,

James

Another great, practical lesson… Thanks Nial!

Thanks for the posting of today .,because is a very crucial area to know

Thanks Nial,

I was thinking about this very subject during my preparations for Monday. An excellent lesson on managing winning trades.

Perfect!

I have always had more trouble dealing with a winning trade than a losing trade.

This article hit the nail on head.

Thanks Nial

This is one of the most informative articles I’ve ever read, clear explanations, concise illustrations and good information, thanks fuller you’re the best.

God Bless You.

You bewdy!

Very logical and easy to understand.

Indeed an aspect that has a great tendecy to be governed by emocions, and it shouldn’t; it should be decided by confirmed price action/resistance/support.

How many of us took winning trades before our set gain target ??? :-)

Thanks Nial,

I’ve greatly enjoyed your course, and all your articles.

Cheers mate!

Gabriel.

Thanks for the good job you have been doing. infact this is one the best articles have read if not the best.

cheers

This is great.Right at this moment I’m facing a similar challenge with the USDCHF pair,but with this information I’m now well armed.

This should improve my trading drastically. Exiting is a very poor side of my trading. Thanks Nial. I really appreciate what you do to help us wannabie traders through LTTTM.

Excellent, excellent, trade lesson, Nial. You are always providing timely information for this changing market of ours. Well done.

Cliff

Very nice lesson for me, I will be follow from next trading day.

nice one nial! great lesson, i must say that i have been practising some of these points you have just mentioned and they really are effective speacially resistance levels, and i do recomend to any new trader to really practise them, becouse it really does inprove your winning rate and like most things practise makes perfect.

I really enjoyed this article, something that can be taken away and put into practice and not just forgotten about.

thanks niall

neale

Very nicely done. I truly love getting these in my email and going back over them from time to time.

This has always been playing on mind, how much profit to take. Thanks a million of giving my decisions a clarity. I now will be able to do in a much better way what I have been to doing… Thank you from the bottom of my heart…

Thanks Nial, as usual clear, practical and extremely useful.

Bridge

nice bit of saturday morning study !

thanks once again team.

It’s great to see more charts with these great articles. Thank you.

oh my Nial, this was what I needed. Than you so much.

king

Mr. Nial, thank you for your new artical teach me a lot. Now I am practicing candle stick formation as above. I love the long tail the revesal trend. Thank you again.

Thanks for this lesson. It´s very important for me. All in one :-)

Goodday Mr. Fuller,

I must confess, I did enjoy the forex lessons I had read so far. But I’m still trying to get use to most of the points you discussed in your lesson. This is because “I am new in the forex trade”. But I strongly believe that, very shortly, I shall join the pros.

Please, keep it up

This is the part of trading so often neglected as many so called professional trainers have not thought about it to the same depth as their entries. I suspect they think that the entry is the most important and the exit will look after itself. Most give examples after the event rather than guidelines as what to look for and why

Congratulations Nial

John

Very useful information!!!

I feel this is one of your best articles yet. Congrats! One question, I see you use charts at the closing of NY time. Do you enter your trades at the endo of the day or closer to the opening of London etc. Thanks

Now that was a great lesson!

Exits are as important as entries!

Another great article :)

Simply put JUST GREAT.

Thank you for explaining so lucidly and with clear illustrations.

Good Day