Why You Should Use Wide Stop Losses

Stop loss placement is perhaps the most overlooked and misunderstood piece of the trading ‘puzzle’…

Stop loss placement is perhaps the most overlooked and misunderstood piece of the trading ‘puzzle’…

Aside from the particular trading strategy you use to navigate and trade the markets, ‘where you place your stop loss’ is arguably the most important aspect of every trade you take.

One of the core tenets of my trading approach that I hammer-home to my members is the importance of using wide stop losses. Many traders are naturally drawn to and tempted to place as tight (small) of a stop loss on their trades as possible. There are multiple reasons why traders do this, but they all are the result of not understanding key aspects of trading such as position sizing, risk reward ratios, proper stop loss placement and the use of wider stops.

This lesson will dispel some of the most common myths and misconceptions around placing stop losses and will help you understand just how critically important it is that you plan your stop loss placement correctly and do not act emotionally when placing your stops, e.g. avoiding placing them too tight and in a price area where they are likely to be hit.

First, a note on position sizing…

It surprises me how many people still email me each day believing that they must use tighter stop losses because they have a small account and too wide of a stop will cost them too much to trade. This notion comes from the (mis)belief that a tighter stop loss somehow reduces one’s risk on a trade or (equally as wrong) will increase their chances of making money since they can increase their position size.

90% of new traders I speak to still think that a smaller stop loss distance means a smaller risk, and that wider stop losses distance means they are risking more. However, these beliefs are simply not true and for any experienced trader who understands trade position sizing, it is obvious that it is the contract size (number of lots) traded that determines the risk per trade, not the stop loss distance by itself. The stop loss distance is nowhere near as important as the position size you are trading. It is the position size (lot size) that determines how much MONEY is risked per trade!

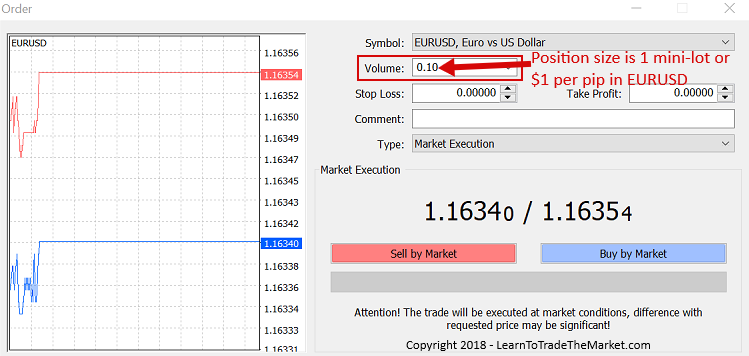

The money you are risking on any given trade is increased or decreased when you adjust the number of lots traded. For example, in the Metatrader platform I use, the position size is labelled as “volume” and the bigger the volume the more lots and hence more money you are risking per trade. If you want to dial-down your risk you reduce the number of lots you trade. Stop loss distance is only half of what determines how much you might lose (your risk) on any given trade. If you are adjusting your stop loss distance but not your position size, you are making a grave mistake!

To put this into perspective, a trader can have a 60 pip stop loss or a 120 pip stop loss and still risk the exact same amount of money, all they do is adjust the number of contracts they are trading.

Example:

Trade 1 – EURUSD trade. 120 pip stop loss and 1 mini lot traded, is $120 usd risked.

Trade 2 – EURUSD trade. 60 pip stop loss and 2 mini lots traded is $120 usd risked.

So you see, we have 2 different stop loss distances, and 2 different lot sizes, but the SAME Dollar risk.

It’s also important to note that wider stops do not decrease our risk reward, as risk reward is relative. If you have a wider stop you will need a wider target / reward. We can still yield great trades around 2 to 1 and 3 to 1 or higher with daily charts and wider stops. We can also use pyramiding to increase that risk reward yield.

Why Wider Stops?

So, now that we know that we can use wider stop losses on any size account, the question becomes why do I use wider stops and how can you implement the same in your own trading?

Give the market room to move…

How many times have you been right about a market’s direction, your trade signal was right, but you still lost money somehow? Very, very frustrating. So, here’s why this keeps happening to you; your stop loss is too tight!

Markets move, sometimes erratically, sometimes with high volatility without any notice. As a trader, it’s part of your duty to factor this into your decision making process when deciding where to place your stop losses. You cannot just place your stop loss at a set distance on every trade and “hope for the best”, that isn’t going to work and it’s not a strategy.

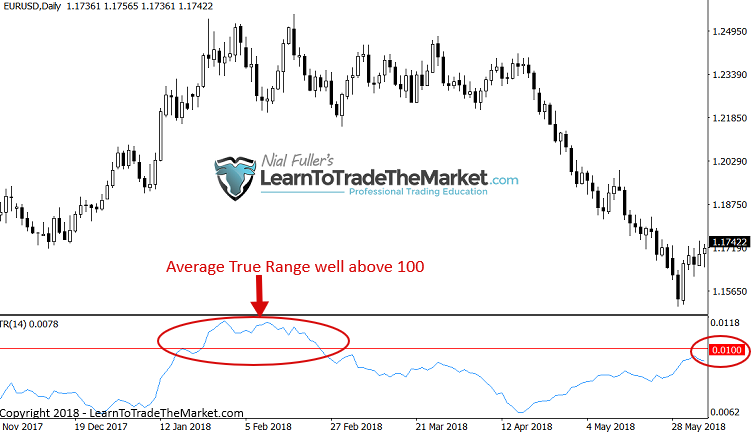

You need to allow space for the normal “vibrations” of the market each day. There is something called the Average True Range (ATR) of a market that will show you the average daily range over any given time period. This can help you see the market’s recent and probably current volatility, which is something you need to know when trying to figure out where to put your stop losses.

If the EURUSD moves 1% or more some days (over 100 pips) why would you place a 50 pip stop loss? It makes no sense does it? Yet, everyday, traders do exactly that. Of course, there are other factors to consider, such as time frame traded and the particular price action setup you’re trading as well as surrounding market structure, which I expand upon in great detail in my pro trading course.

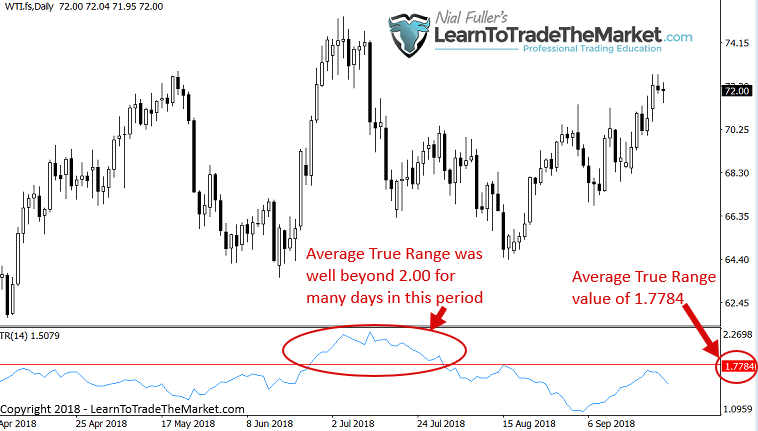

Below, we see two images, the first is the EURUSD daily chart showing an ATR of above 100 and near 100 for many days. The second is Crude Oil showing a large daily ATR as well (above $2 for many days). Traders who aren’t even aware of the ATR of the market they’re trading are at a huge disadvantage when it comes to placing their stop losses. At a bare minimum, you want your stop loss bigger than the 14 day moving ATR value:

Crude Oil ATR: Crude Oil is measured in dollars and cents but an ATR above $2 a day or even $1.75 is relatively large. Rest assured, if you aren’t placing your stops outside of this ATR, you’re going to get burned.

Wider stops give trades longer to play out

As we know, when trading price action based on the end-of-day approach that I use, big trades can take days or weeks to unfold. You’re just not going to catch a 200 to 300 point move on EURUSD with a 30 to 50 pip stop, most of the time you will have been stopped out well before the market goes the correct way.

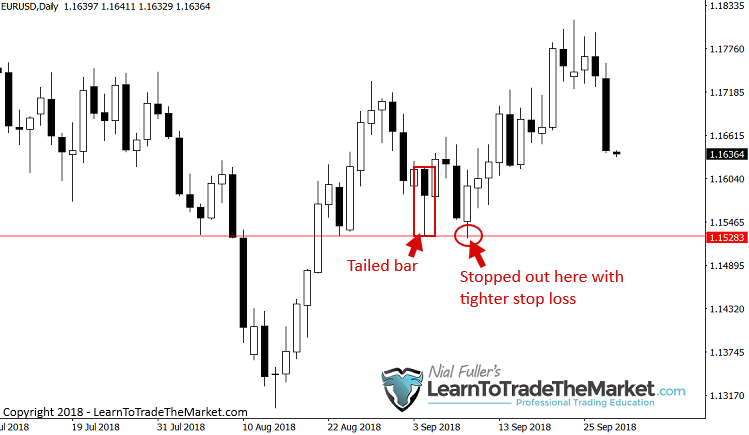

Case and point: The two images below show the same EURUSD tailed bar signal but with different stop loss placements.

The first image below shows a tighter stop loss and the second image below shows a wider stop loss, from looking at this example, it’s pretty clear why you need wider stops.

Note, the stop loss in the wider scenario seen below, was placed 20-30 pips below the support level at 1.1528 area, this is often a good technique to use:

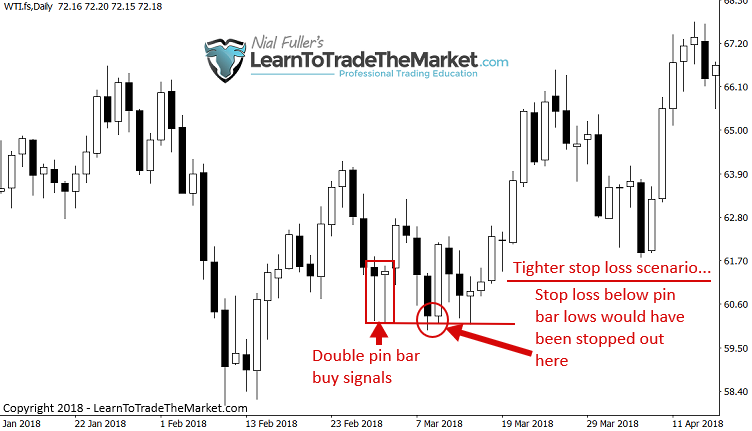

Next, let’s look at an example on the daily Crude Oil chart below. This time we have a very obvious double pin bar buy signal that formed on the daily chart time frame recently. Notice, if you placed your stop just under the pin bar low, as many traders like to do, you would have been stopped out for a loss just before the market pushed higher, without you on board.

Now, if you placed your stop loss 50 points or so below the lows of those pins, not only does that keep you in the trade but you would have been a fool to not make a nice profit after price began pushing higher again.

Note: No matter which entry you are using, a market entry or a 50% tweak entry, a wider stop loss will still dramatically change the outcome of the trade, even for the more conservative 50% tweak entries. The goal is to stay in the market until it clearly proves you wrong, not to get shaken out simply by the natural daily fluctuations of price. Give the market the room it needs to breathe!

I don’t day trade, so wider stops are essential

If you’ve followed me for any length of time, you know I don’t day trade. My view on day trading is that it’s just gambling on the natural market ‘noise’ that occurs each day, and I am a trader, not a gambler. Therefore, it’s essential I use wider stop loss that won’t result in my getting chopped up in the short-term intraday noise of the market.

It’s an interesting ‘coincidence’ (not really a coincidence), day traders naturally use very tight / small stops (some don’t use any!) and the stats show that day traders typically lose money and do worse than longer-term position traders. Is it just a coincidence that people who use tight stop losses tend to lose more money than those who use wider stops and hold traders for longer? I think not.

Longer-term trades require larger stop losses. If we know the EURUSD moves a few percentage points a week (say 200-300 pips) and we are looking at a price action setup that could yield us a 200 to 300 pip profit target, then it stands to reason you’re going to need wider stop loss to stay in that trade.

Keep in mind, the power of higher time frame charts is immense. Yes, you have to wait longer for trades to play out on higher time frames, but the trade off is that you get more accurate signals and it’s much easier to call a market the higher in time frame you go. Thus, trading becomes less like gambling and more of a skill set the higher up in time frame you go. For many reasons, the daily chart time frame is my favourite, it’s a happy medium.

Lifestyle and less stress

Perhaps the greatest benefit to YOU is that using wider time frames reduces stress and improves your lifestyle. You can set and forget trades with wider stop losses. Wider stops are what my end of day trading approach encourages and it means you don’t have to sit there agonising over each tick of the market.

This style of trading also allows you more time to learn and focus on finding good trades and identify trends and price action patterns, reading the footprint on the chart; the stuff that matters!

If you want to walk away from your trades and relax whilst the market does the ‘heavy lifting’, then all you have to do is: Use wider stop losses and adjust your position size to maintain your desired dollar risk per trade. That’s it!

Conclusion

Let me ask you something…

Do you know why most traders fail over the long-run? Well, yes, because they lose too much money. But, WHY do they lose too much money?

The two main reasons why so many traders lose money and blow out their accounts are: Trading too much (over trading) and using stop losses that are too tight (not letting the trade have room).

A funny thing happens when you start placing tight stops, you get stopped out more often! Seems obvious, right? Yet, each day, thousands, probably millions of otherwise very intelligent traders do something really unintelligent; they place a tiny little stop loss on a perfectly good trade setup. They do this because they don’t understand position sizing or they do this because they’re being greedy, either way, they are doomed to fail and be just another statistic.

Don’t be like them.

Be patient. Be willing to place a wider stop even if that means letting a trade go for a few weeks. Ask yourself, what’s better: Placing 20 trades with tight stops and losing on most of them or placing 2 trades with wide stops, winning big on one and taking a predefined 1R loss on the other? I promise you, it’s the latter, not the former.

Read this lesson again closely. It may be the most important trading lesson you ever learn. Combine the concepts taught here today with trading techniques and price action strategies I teach in my trading courses and the daily guidance from my members trade setups newsletter and you have yourself a pretty potent long-term trading strategy that, if followed, stands a very good chance at bringing you closer to consistent success in the markets.

What did you think of this lesson? Please leave your comments & feedback below!

If You Have Any Questions, Please Email Me Here.

Thank you sir for your tutorial which you have been providing l have been losing my money time and again because of the tight stoploss today I see where the problem was

Hi, you say you don’t use indicators but I see here the ATR?

It’s not used as a trading entry indicator, the ATR shows average daily range, and it’s used to help determine stop loss distance

Wow ! What a great ideas you shared in this latter. I really learned a lot from it something I never knew about . The the effect of position sizing and stop loss on the trade .I never knew if the is something existing in trading called ATR and the benefits of trading with a bigger time frame. Keep educating mr. I am planning to take your professional forex trading course in a few months to come.

If we use “50% tweak entry” should we use half of 14 day ATR for our SL placement? Does that make sense? Cause if we use 50% entry + full ATR range for SL, SL might be just a little too far out.

Place the stop loss in the most logical position, where if the market moves to a certain level the signal will be well and truly invalidated and you are exiting the trade. Just keep in mind the average daily movement of the market you trade to be sure your stop is not too tight.

fantastic ,i love your idea

You said to place SL at 50% or 75% of mother bar on large IB strategy or even normal one? That’s not really wide stop loss, is it because if the mother bar breaks out it should play in our favour straight away and not retrace in a trend continuation scénario?

very nice..thanks.

I am new in forex trading and out of ignorance have blown some accounts. But ever since i staryed reading your articles i started developing a different mindset and approach to trading. As at now am devoting my time to learn the skill so that i dont make the mistakes have made so far. Thanks men! For your insights

Very interesting.

I never used sl i always make good profits without sl

I wish I saw this article 5 years ago I would be very far with my trading :( , but anyways its never too late to turn things around. Thanks for sharing. Long term charts are the bomb (Monthly+Weekly Charts). I use Daily and 8HR or 4 hours to refine my entries with good position size and wider stops, i see improvements and less stress. Keep up the good work.

Nice and one of the very important articles. Thanks.

How many times have you been right about a market’s direction, your trade signal was right, but you still lost money somehow? Very, very frustrating… it hurts so bad!!!

Thank you Nial.right,the success mantra.

Oh,I’ll never stop calling you the oracle.

Wider stop loss makes sense, will definitely go this route

Dear Nial,

It was a very important lesson. I experienced it many times, and I doubted that if I increase stop loss or not. Yor valuable article made me sure to do this.

Sincerely yours,

Kamran

Proud to say that these lessons and strategies are working out pretty good to me and for that we thank you nail.

Nice one as a bigner will definitely follow

thank you

My knowledge about Forex trading keeps improving ever since I started reading your articles. Good job Nial.

well explain

This is very illuminating, you have just done a major correction in my trading carrier.Thank you.

Thanks,Nial this important lesson got me at the right time i needed

Thanks Nial for providing these charts now I understand how to place stop loss in a proper way

I will say a big WOW to this. Thanks so much Nial for this timely article.Serious, i know all about what you wrote here since you’ve written couple of similar article. A reminder is just very necessary. To be honest, most of my recent trade’s stopped out all because of tight stoplosses. I’m adding this to my trading tool box. Thanks once again Nial. :)

Thanks Nail. Great read as usual. One big big question I have is how can a small account trader make 10R in a month using higher times frames? You maybe rightly criticise day trading but I have seen day traders do make 10% (10R as risk per trade is 1%) even after high transaction charges & other fees. Of course, I am talking about same day traders who trade with trend and have gone beyond the urge of catching tops & bottoms. So can you answer my big big question in first line of this very long post.

You don’t need to make 10R in a month. Some people do make money day trading, but 99% won’t

Hi Nial,

Thank you for this lesson. I’ll change what I have been doing and I trust I will be stopped out less often. That will make a nice change.

Thanks again Nial.,

What a lesson. I just learnt alot from you. Thanks.

It’s a very instructive lesson, really! I do beleive in wide sl, I started to apply it on every trade I take. The question I got in mind while reading is this: I have a smll account, I use wide sl according to the money managment I’m using: not more than 3%, but what if I have 2 or 3 or even more good trade setups at the same time, this would mean risking 6% or 9% or even more of my balance, right ? any advice here ? Thank you

I have been trading for a very long time with tight stop loss and guess what, it was from one loss to the other. A lot of times, trades will go in my favour but I would have been stopped out along time. I believed the brokers were taking sides so I changed brokers until I came across a lesson like this on YouTube and now I don’t get stopped out and most strategies I consider as not working are working well. Nial, I believe this is the most important lesson in the market.

Love it….absolutely love it!

this is really an eye opener, Im very grateful, thanks so much mr nail

you always speak like you know what is happening to me. I never took wrong trade, yet am losing day in and out. am glad finding you. it doesn’t matter whether I join your trading course but will pay you want day for your articles, I bet you. you put in so much time and effort to do this for us. god bless you more Nail

OLYMPIAN APPROCHES FOR THE FOREX TREADER EITHER NOVICE OR SCEASONED ONE . THANK A LOT !

Excellent. Had heard of ATR but never made the connection. When you make connections, stuff often starts to happen!

so much sir, but i think understanding the atr and how to use it properly is my problem. and i think atr is very vital here

Excellent advice. I use a ‘lot size calculator’ script on MT4 which gives you the exact lot size after you input your risk % and stop size. If I’m happy with the risk and the trade I’m much less likely to keep checking on it and over- managing it with impulsive emotional decisions.

This is eye opener

“Read this lesson again closely. It may be the most important trading lesson you ever learn.” – What a marvelous lesson for seasoned & experienced traders also like me who are losing money afters spending years in the market. This one lesson can really change your P&L statement. These are the gems shared honestly by Nial which you won’t find anywhere else. I salute to his generosity and knowledge. Bang on target article which opened my eyes after years to know what I was missing in my trading. Thanks a lot Nial!!

“If you’ve followed me for any length of time, you know I don’t day trade. My view on day trading is that it’s just gambling on the natural market ‘noise’ that occurs each day, and I am a trader, not a gambler.”

“The two main reasons why so many traders lose money and blow out their accounts are: Trading too much (over trading) and using stop losses that are too tight (not letting the trade have room).” – Only experienced trader can understand the pain of the statements and what a relief by genius Nial!!

Its an important and motivational lesson. Thanks a lot.

Simply Brighty, super taught article. Well done Nial, and thanks for sharing with us!

I also do that but maybe my problem I don’t leave the trade enough time to ply out. If I see a pullback I usually close my profit, I think it’s fear of losing profit. But I should be patient enough.

as usual … very informative and insightful.. well said Nial!!

Another vintage Nial. What a great eye opener. Thank you Nial.

Hi Nial —- EXCELLENT —- Thank you — well said and well written —

Makes so much sense — Now the challenge is to put it into practice —

Keep it up — the subscription I have paid is worth every Dollar —

Regards

Ron

Well, what a gem of a lesson.

Nial, you have dropped yet another trading nugget.

I can’t thank you enough.

what would be the ideal starting capital on a daily trading strategy? I now see the rationale much as I do price action and bit of elliot wave analysis

Very interesting lesson .

But what’s about stop losses when u enter on a 50% retracement ?

Thanks Nail, for this great eye opener and a great revelation. You are unmasking the secret behind successful trading.

I always read your newsletters and this is one of the best if not the best that l have publised. I actually bookmarked it lol. What you said is very true and l used to put very tight stop losses till recently when l changed my trading strategy and placing of stop losses. l guess l had not realised that l have widen my stop loses until now when l was reading your newsletter. I have shared this article with friends too, l hope that is okay with you.

Very powerful information.

Thank you!

wider stop loss is the best. Nothing more, is greed and ingnorance that cause most of us traders to loss our money and time in the market. thks boss

Thanx so much my mentor. It has just happened to me in a sell. I made a small stop loss and was taken out in forming a longer pin bar in line with my trade.

Hello Nial, I have been a student of yours for many, many years. If there is 1 thing you have taught me that has allowed me to make and remain a trader is Position Sizing & Stop loss placement. One thing I will add to your fantastic article is Spread increases. I was carefully placing stop losses and with the daily fluctuations of the market sometimes would go against me ( No Big Deal). But at certain periods of the day the spreads increase dramatically and even with a Wide stop was getting stopped out. So I watch what maximum spreads especially during the NY Close for the Crosses I trade I have added that increase to the ATR+ (Which is the Stop-Loss I use) and have eliminated me being stopped out. Thank you again for your knowledge and wisdom in trading.

Great great great … Thank you Maestro

This lesson is really great, I have learnt a lot from it.

Thanks Nial.

Ride on.

Thanks Nial for another great lesson!!…it truly is the most important lesson article I think,keep up the good work :)

Perfect n inspired . Tq

What do you think about hedging instead of stop loss? What is your experience with hedging?

Well said Nial, and like you said the most profound trading lesson I have read in a very long time☆

Thank you very much sir, from a man who wiped 3 accounts and who almost gave up on trading at once.

After I bumped into your articles and learn your philosophy around price action trading and higher time frames, my trading career took a huge turn for the better and and I’m counting gains every mouths in my account for the last 6 months

Thanks from a grateful trader!

Hi although i do not trade forex and i trade futures, i find your tips very useful. I dont like forex because its a battle of 3( buyers, sellers and brokers) brokers who win no matter what. With futures its just buyers vs sellers so no manipulation except from the big money guts and girls. But you Nial are a very smart trader and i like yur style