Trading Price Action During Market Volatility

Volatility is a scary word to some, but to price action traders it is something to look forward to because price action leaves its most obvious “footprints” during volatile market conditions like we’ve seen recently.

Volatility is a scary word to some, but to price action traders it is something to look forward to because price action leaves its most obvious “footprints” during volatile market conditions like we’ve seen recently.

Due to the recent volatility in the markets, I wanted to take the time in today’s lesson to highlight some of the recent valid price action setups that have worked out for nice gains, some that didn’t work out, and explain why they were valid setups. Before we get started, keep in mind that all the examples in today’s article are from daily charts, I recommend all traders focus on daily charts as their core “anchor” chart, and beginning traders should exclusively focus on the dailies until they have gained a firm grasp of my price action trading strategies.

Please Share it – When your done reading today’s lessons please leave a comment below. Then click the twitter & facebook buttons to share it & pay it forward.

Recent Price Action Trading Examples:

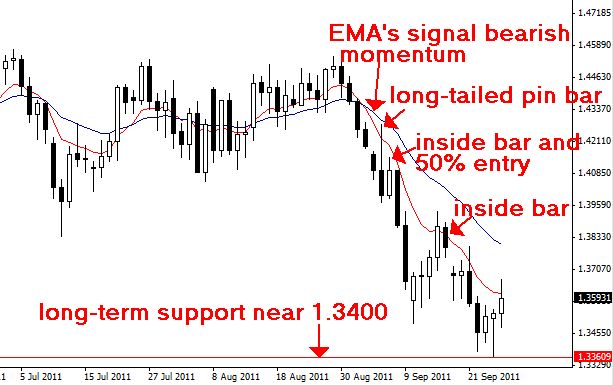

EURUSD – long-tailed pin bar with 50% entry and inside bar

On September 6th a long-tailed pin bar formed in the EURUSD. This pin bar trading strategy had a number of things going for it which I will highlight here:

• The daily 8 / 21 EMAs had recently crossed lower prior to the pin bar forming on September 6th after price rejected the top of the trading range it had been in for nearly 3 months.

• The pin bar itself was long-tailed, this means the tail showed a very “forceful” rejection of higher prices and it was also in-line with the fresh bearish momentum.

• The close of the pin bar was lower than the open and near the bottom of the pin bar, another indication of a “forceful” and meaningful rejection of higher prices.

• As we often see with long-tailed pin bars like this one, a 50% entry opportunity presented itself the following day as an inside bar formed. This allowed many of our forum members’ to get a very tight stop and large risk reward ratio. I personally made a reward of 3 times my risk on this setup.

• On September 16th another inside bar formed after a counter-trend rally into the 8 day EMA. This inside bar could have been used to re-join the downtrend again.

GBPUSD – pin bar and inside bars

On September 8th a pin bar formed in the GBPUSD, and on September 16th and 20th we had inside bars form. All of these setups were with the recent daily bearish momentum and worked out quite nicely for savvy price action traders. Let’s dissect them a bit more:

• The trend was already down when the pin bar formed on September 8th, as we can see in the chart below the 8 / 21 EMAs were already crossed lower, so this setup was with the near-term daily chart momentum.

• The pin bar itself was obvious and had an obvious upper wick or tail, which showed clear rejection of the 8 day EMA dynamic resistance level. The market sold off nicely after the pin bar formed and provided the potential for a large reward potential relative to risk.

• Next, we had two inside bar setups form near the core level of 1.5775 on September 16th and 20th.

• These inside bar strategies were with the dominant bearish momentum on the daily chart and provided excellent risk reward ratios to re-join the downtrend. As we can see they both paid off quite handsomely. Inside bars are best with obvious trending markets, like the two seen below.

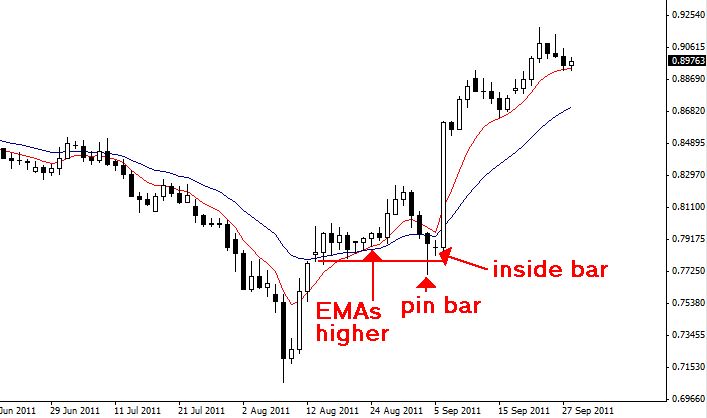

USDCHF – pin bar

On September 2nd, the USDCHF formed an obvious daily pin bar setup that has since given rise to dramatically higher prices. It’s worth noting that prior to the formation of this pin bar, the weekly chart had also formed a very large and obvious bullish pin bar reversal, so we had both time frames in agreement, this is not always necessary but it does add confluence to a setup. Let’s look more in-depth at this setup:

• The pin bar formed on September 2nd was with the near-term daily chart momentum. We can see it formed after a down-side retrace but was still in-line with the recently crossed higher 8 / 21 day EMAs. We always want to try and trade with the near-term daily momentum like this.

• The pin bar itself was obvious and well-defined; it had a long lower tail that showed clear rejection of price below the 8 / 21 day EMA support layer. We would have liked to see a bullish close on this setup but given that the tail was long and obvious, and the setup was with the near-term momentum, we don’t always NEED the close in our favor, it’s just an extra point of confluence.

• Note that after the pin bar formed, and inside bar formed within its range. This is a particularly potent price action “combo” setup that I’ve notice again and again in the markets. Often when an inside bar forms after a pin bar, price will break out forcefully in the direction implied by the pin bar reversal. In this case, we can see a huge rally took place and a dramatic shift in momentum after this pin bar came off.

AUDUSD – fakey with pin bars

On September 14th and 15th, two consecutive pin bars formed in the AUDUSD that also formed a pin bar fakey strategy as well. This setup was counter-trend but it was still valid due to its clear formation and location off 1.0175 -1.0200 support area, which if you look back was a long-term support. Let’s look closer at this setup:

• The first pin bar on the 14th completed the fakey formation, and the second pin bar would have given us an even stronger reason to consider a counter-trend position due to its solid definition and the fact that we had 2 pin bars in a row and a fakey.

• We can see that price popped marginally higher into the 8 day EMA before falling lower in-line with the dominant trend again.

• This setup likely would have resulted in a loss for anyone who traded it because it did not move into profit very much before falling lower. Not every valid price action strategy works out and this is a clear example of that. This is why we must always practice proper Forex money management and control our emotions as we trade.

Silver – minor fakey

On September 21st, a minor fakey setup formed in the spot silver market. The recent volatile down-move was “signaled” by this setup and some of the savvy price action traders in my members’ forum caught this move for a substantial gain. Let’s discuss it more:

• The minor fakey as outlined in my members’ area article, is only valid on the daily charts and consists of a false-break bar that only breaks the inside bar high or low, but not the mother bar high or low.

• We can see when this minor fakey formed, price had been grinding lower before hand and the 8 / 21 day EMA’s were already crossed lower, so the setup was in-line with the recent daily downward track of the market.

• Price then made a nearly unprecedented down move as the mother bar low of the minor fakey gave way, we can see a drop of over $12 an ounce occurred in the course of three trading days.

• Once you learn to spot simple high-probability price action setups, you can begin putting the odds in your favor to catch powerful moves like this one in silver.

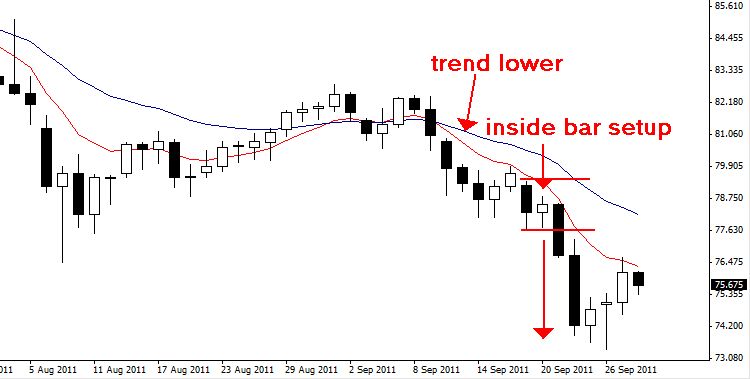

AUDJPY – inside bar setup

On September 20th, an inside bar setup formed in the AUDJPY in the course of a down-trending market. This setup came off to the downside last week, providing traders with an easy 1:2 risk reward potential. Let’s look at it closer:

• The daily 8 / 21 EMAs were crossed lower and the market was clearly losing momentum at the time this inside bar setup formed. Thus, the setup was in-line with the dominant near-term daily momentum.

• Price broke down past the inside bar and mother bar low and continued to fall substantially lower over the next two trading days.

• We can see this inside bar setup provided another excellent risk reward scenario in the midst of these recent volatile / trending markets. These are the times to make money in the markets and hopefully today’s lesson has given you some insight into the types of price action trading strategies to watch for.

You may ALSO be interested in the following lessons …

tnx sir

i hope u best wishes!!!!!!

very useful artical.thanks Nail

Hi Nial,

You have been Blessed .. In your success and your willingness to share.

Best regards,

Sam

Hi Nial,

thoroughout this article the only word coming was wow wow and wow

Excellent article Nial

I am sure anybody will benefit from this.

thanks

Informative and useful article. Thanks a lot Nial. About fakey set up, want to learn more. Specially on the AUD JPY image, after the pin bar price was fallen.

a great teacher. my question is, must we trade a pin bar formation that happen ONLY at the cross of the EMAs?

Muy bueno el analisis Nial, felicitaciones

Alvaro

Thank you so much for posting this summary. There is fantastic instruction and clear notes, and your lessons are always well annotated.

Thanks so much Mr Fuller. I really appreciate your desire and drive to make every body LEARN TO TRADE THE MARKET.

Regards

Thanks for your explanation of those past examples, Would you show me for the next pinbar so I can take the chance, because I still difficult to find that chance, expecially for the gold?

Hi Nial,

Hope you are well. Thank you so very much for another fantastic lesson, this lesson really is priceless.

Thank you for all your help

Thanks and Regards

Gurpal

Hi nail,

Thank you for another lesson..

Thanks Nial for your view .

Nial, your work in this area(price action trading) has been very helpful. This article however is among the best so far at showing the tremendous value that is in the three strategies you have been using. Many thanks for all the help you continue to give us the aspiring “successful traders”. Great work. Keep it coming.

These articles on recent trade examples are my favorites. Would be nice to have this item covered on a monthly basis!

thanks nial for these great lesson.

Hi Nial

This is GREAT STUFF!!!!

My trades have not been quite as successful, but I have learnt so much in the forum and now this article comes at a perfect time for me to,

1. Review my trading journal

2. Try and mind map your thinking ( What does Nial see that I do not)

3. Review all your education articles again

4. Be grateful

Thanks Nial

thanks nial,for the revision on pin bars,fakeys,and inside bar set ups.that have been happening recently..

Nice job. Keep it up.

Namste ! My GURU Mr.Nial

Tools you taught so far i.e. pin bars, inside bar, inside bar combo & fakeys are the excellent tools and a complete package of a trading system that one requires to be successful in one’s trading endevours.

Thanks again & Namste !

from Nainital, India

This strategy is simple yet powerful, Thx Nial for sharing it.. Great pin bar on eur/usd today just like you said on your daily commentary.. cheers

The good thing about Nial’s Price Action Signals are that they can be applied to all type of market conditions. Volatility… Bring it on.

Excellent examples on how you can capture big moves with these signals.

Hi Nial thanks for your best write ups. I am a current member and vastly have improved my trading skills.

When your course is understood , it becomes so clear , and it really makes trading and reading the charts so simple compared to the elliot wave trading tecnique…Marvellous!

Thanks Nial that was excellant. I spotted most of those trades but did not take them live as I am a newbie. Just on Demo. But still good experiance for me. Thanks for all your help it is making me alot mre confidant in my trading seeing what you see. Colin

Very very good Nial, more write ups like these would be brilliant. Nothing like getting inside your head as a syccesfull trader.

Thank you.

Great stuff and the Discipline lesson of last week has helped me greatly. And it makes me feel good about my trading.

Great stuff, clear and to the point as always!!! thanx, greg

Hi Nial, I really grateful for your efforts, I have joined your course and immediately started making profits.

Mahdi

Excellent article Nial. This sort of stuff is priceless for us novices. Clear and precise. The text and writings are brilliant, but you can´t beat these images and how they play out. Many thanks

Thanks Nial! U are the man!. I appreciate your trading setups and price action strategy,the have helped me so much, there is no other better way to trade fx outside your simple price action keep it up

Hi, very effective technique in identifying the trend, and thus the trading strategy. Thanks so much for your generous sharing. Great work!!

Very nice teaching Nial! You made me more confidence to trade. Thank you very very much!!

This lesson is great .It is an eye openner.More greece to your elbow.

Thanks.

This lesson is great. It is an eyes opener.More gteece to your eibow.

Thanks.

Incredible article, Nial. As always your explanations are never less than enlightening. However, I still find it difficult to take bearish pin bar that formed at the recent swing low like you pointed out on the EURUSD example. And the opposite is also the case, bullish pin bar that formed at the recent high not after retracement. Many, many thanks to you. Please keep enlighten us.

Ahh…daily charts…I can breath again…cheers Nial.

Hi Nial,

Your explanation of the charts and the price action is so clear and precise; it’s a pleasure to read.

I’m doing my best to learn your techniques, m ore of the same please.

Thanks Nial Great timing with this recent pa material as it real drives it home.

Thanks Nial, great article, I,ve learned much in the past 12 mths from you & your team.

Thank you Nial. Very worthful analysis. Especially for beginners like me. Your work helps me to understand that the patience, discipline, risk and trading management are very crucial elements for succesfull trading. I know, the way to be a successful trader would not be straight but your advices seems to be a powerful light during this journey One question, the pin bars on 16th and 20th for GBPUSD and pin bars on 14th and 15th for AUDUSD looks quite same. What is the difference that the firsts you evaluated as perfect inside bar setup for down-trend and the seconds as perfect pins for reversal?

Nial, thank you for the well-explained articles. Great!

Thank Nial for great lesson, but I have one question.

In the AUDUSD, after two pin bars and counter-trend fakey, formed another fakey consistent with the trend. Whether the next fakey is correct?

Hi Nial, great article, things like this really help me to understand price action, I am no trading live and have grown my account by 800% so far! Thanks again.

hi nial,

it was nice and lovely revision of price action strategies. the biggest hurdle which i commonly face is deciding support/resistance levels. your S/R line [in many examples] is joining bodies of the candles at places and sometimes to the tails of the candles. would it be better to take closing prices for drawing S/R lines ? i usually fail to pick-up the inside bars at these levels. and most importantly, i get trapped in sideways market with inside bar strategy.

may be you could throw some light on it for the benefit of all of us. thanks a million once agin for lovely revision. bye now, pk moghe,

Email me for more help on s/r PK, talk soon

Fantastic article Nial. Thank you for all your work.

Timely article Nial and great chart examples. Thanks again for putting your thoughts and insights down in an article for us.

thanks Nial… your articles provide great guidance and assists with the way I deal with the market… thanks for sharing todays lesson and will add this to my trading tool box

Hi Nial,

Thank you so much for posting this summary. There is fantastic instruction and clear notes, and your lessons are always well annotated.

I have learned so much from you.

Alis