Trading Forex With Confluence and Price Action Signals

If I had to boil down my Forex trading strategy into to one simple phrase, it would be this; trading simple price action signals from confluent levels in the market.

In this trading training lesson, I am going to explain how to find higher-probability trade entries by looking for price action trading signals from confluent levels or areas in the market. So, let’s begin by defining the two trading tools we will be discussing today:

In this trading training lesson, I am going to explain how to find higher-probability trade entries by looking for price action trading signals from confluent levels or areas in the market. So, let’s begin by defining the two trading tools we will be discussing today:

Price action: Price action is the movement of the price of a market over a specific period of time. By learning to read the price action of a market, we can determine a market’s directional bias as well as trade from reoccurring price patterns or price action setups that reflect changes or continuations in market sentiment.

Confluence: A point in the market where two or more levels intersect each other, thus forming a ‘hot point’ or confluent point in the market. In the dictionary, confluence means ‘a coming together of people or things; concourse’ (this the picture to the right showing two rivers coming together). So, basically, when we look for confluent areas in the market we are looking for areas where two or more levels or analysis tools are intersecting.

Some of the factors of confluence I look for on a chart:

• An uptrend or a down trend; essentially a “trend” is one factor of confluence in and of itself.

• Exponential moving averages; I use the 8 and 21 day EMAs on the daily charts to help with trend identification and dynamic support and resistance identification. Both the 8 and 21 EMAs are factors or levels that can add confluence to a price action setup.

• Static (horizontal) support and resistance levels. These are the “classic” horizontal support and resistance levels that typically connect highs to highs or lows to lows. Here’s a video on drawing support and resistance levels.

• Event areas. Event areas are levels in the market where a significant price action event occurred. This can be a strong directional movement after a price action signal forms, or it can simply be a rejection of a level followed by a strong directional movement…some significant “event” needs to have occurred at a certain point in the market, we can then consider this an event area or level. Read more on event areas here.

• 50% retrace levels. I personally watch the 50% to 61.8% retrace levels for another factor of confluence. I don’t get into all the other Fibonacci extension levels as I think they are too discretionary and haphazard to be of any use. It’s common knowledge that most major moves in the markets tend to retrace approximately 50% at some point after they form. But all the other Fibonacci levels are simply a case of “if you put enough levels on your charts some of them are bound to get hit…”, in other words they are more messy and confusing than relevant or practical.

The 5 factors of confluence above are just some of the levels that can intersect to form a confluent area in the market, there are also intra-day levels and other factors of confluence that we can watch for, which I discuss in my price action trading course.

Combining levels of confluence with price action signals

When I am analyzing the markets, I am primarily looking for an obvious price action pattern that has formed at a confluent point in the market. Of course, learning what constitutes on “obvious” or high-probability price action setup and a confluent point in the market is the result off education and screen time, but they really do not take long to learn. Once you spot a high-probability price action signal you can then begin to do some analysis of the market structure and the context that the signal has formed within. Check for the factors of confluence listed above and see if two or more of them line up with the price action signal, if so, you just might have a trade worth risking your money on.

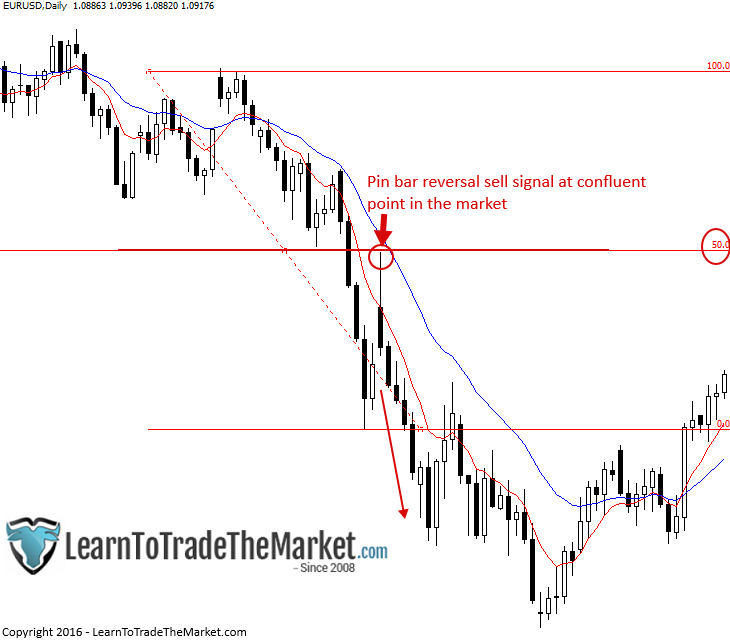

Here’s an example of an obvious pin bar setup on the daily chart EURUSD that had 4 factors of confluence supporting it:

1. This pin bar had confluence with the dominant downtrend, as it formed telling you to sell the market with the trend.

2. The pin bar showed clear and forceful rejection of the daily 8 / 21 EMA dynamic resistance layer.

3. The pin bar was also rejecting a horizontal level of resistance.

4. The pin bar showed clear and forceful rejection of the 50% retrace of the last down move.

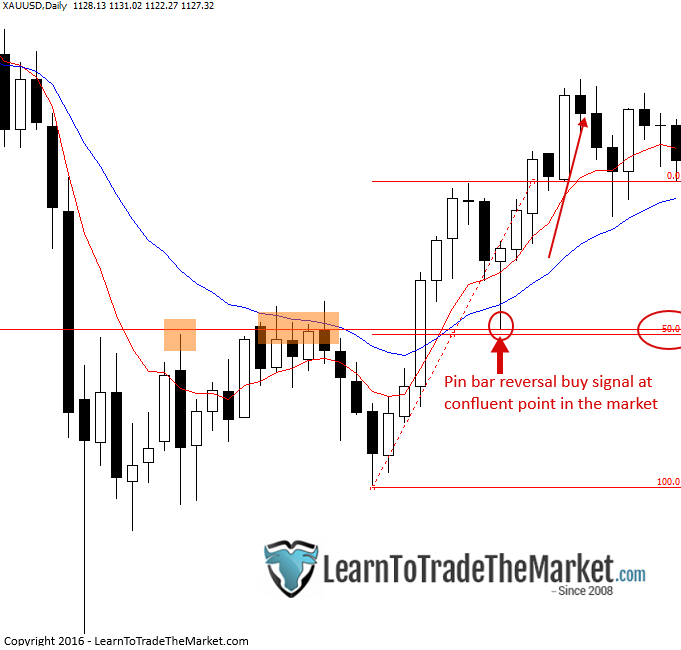

In the next example, we can see a pin bar setup on the daily spot Gold chart that had 4 of the factors of confluence mentioned above:

1. This pin bar had confluence with the recently formed uptrend, as it formed telling you to buy the market with the trend.

2. The pin bar showed clear and forceful rejection of the daily 8 / 21 EMA dynamic support layer.

3. The pin bar was also rejecting a horizontal level of support.

4. The pin bar showed clear and forceful rejection of the 50% retrace of the last up move.

In the next example, we can see an inside bar pattern on the daily GBPUSD chart that had 3 of the factors of confluence mentioned above:

1. This inside bar had confluence with the strong downtrend that was in place. Having the ‘weight’ and momentum of a trend behind the signal you are considering is a big piece of supporting evidence for a trade.

2. The inside bar formed after a small retrace up to the daily 8 / 21 EMA dynamic resistance layer.

3. The inside bar formed at a horizontal level of support.

When we get multiple factors of confluence coming together like this for a particular trade setup, it’s a very good sign and gives us a type of ‘confirmation’ that the trade is worth taking…

In the next example, we can see an fakey pin bar combo pattern on the 4 hour GBPJPY chart that had 3 of the factors of confluence mentioned above:

1. This fakey pattern had confluence with the strong downtrend that was in place. Having the ‘weight’ and momentum of a trend behind the signal you are considering is a big piece of supporting evidence for a trade. Also, the market was falling on the daily chart at the time this 4 hour signal formed, so that adds more weight or confluence to our setup.

2. The fakey formed at a horizontal level of support.

When we get multiple factors of confluence coming together like this for a particular trade setup, it’s a very good sign and gives us a type of ‘confirmation’ that the trade is worth taking…

Conclusion

From the examples above, you should have gained a basic knowledge of what trading price action from confluent levels in the market is all about. This lesson has given you a little glimpse into my core trading philosophy; looking for confluent levels in the market to trade obvious price action signals from. If you want to learn more about how I trade clean and effective price action strategies from confluent levels in the market, check out my price action trading course here.

Thanks Nial. Looking forward to seeing you one day

Hello Nial, it’s like I’m new to the world of forex reading your articles. I’m an experienced trader, but ever since I have come across your site I’m so amazed by your way of trading — trading strategy with high simplicity. Thanks so much. It has changed my way of trading drastically and positively.

Thanks it’s very useful to add to my trading knowledge

I like that teaching of massive pinbar

Thank you very much Nial Fuller for the article.

This is amazing. Keep the good work going, and God bless you.

Hello sir, really it was excellent way to understand trend indentification for new trader . i am thanksful to your efforts for new comers .

Haseeb

Lahore,Pakistan

Merge is force! Thanks

Magnificent article! thanks Mr. Nial!

Excellent tips Nial.

I recently took a trade on the daily and I went through this checklist.

1. The trend was up.

2. Inside bar at support.

3. The inside bar rejected off of a 10 emas I use.

4. Previous candles were very large and bullish. Trading with momentum.

Thank You Nial. For all that you do. Many are reading and learning.

Roy.

Thanks Nial! I always look forward to reading your articles…. your articles sure lift up my trading spirit.

Confluent point is like a border line decide to go cross the border or return.

Depends on situation a signal is given.

Great article. Very simple to understand. Will be adding this to my notebook. thanks

Hi Nial, thanks for the great article. very easy way you explained….really very helpful….thanks

This article is the crem de la crem. So many notes to take down. I have my homework for today.

Much thanks – Excellent explanation and guidance.

Thanks for the dynamic article. I am really struggling to make any sense of how to trade successfully, the markets are so totally out of control to my eyes. This article you have written gets right back to basics and is easily understood, many thanks for the clarity

Thanks Nial for the informative articles. They have really sharpened my trading skills. Keep it up

Excellent info on confluence. Thank you Coach.

Sir Nail,

Best info., I read/found on the Internet in 4 years of studying Forex.

THANK YOU.

Student of yours, for 4 years.

Hi Nial, thanks for the great article. This article has become a foundation for my trading rule, I am working on my trading plan around your idea.

Thnx for the wonderful article, Nial

Thank You So much Nail.

Thanks Nial. Great tips

Dear Nial,

thanks

Dear Nial.

its a very useful note for me.

Thanks.

Maniam

Great explanations as usual thanks Nial!