Price Action Forex Trading Strategy

Price Action – The “Footprint” of Money

Price action trading strategy basics:

“What is Price Action?” is a question frequently asked by aspiring traders. Getting an answer like “Price action is the movement of price over time” or similar, leaves many beginning traders still feeling like they don’t quite understand exactly what price action is or how to trade with it. In this tutorial we are going to give chart examples of exactly what price action is and explain how you can make use of it in your trading.

Ready? Let’s get started…

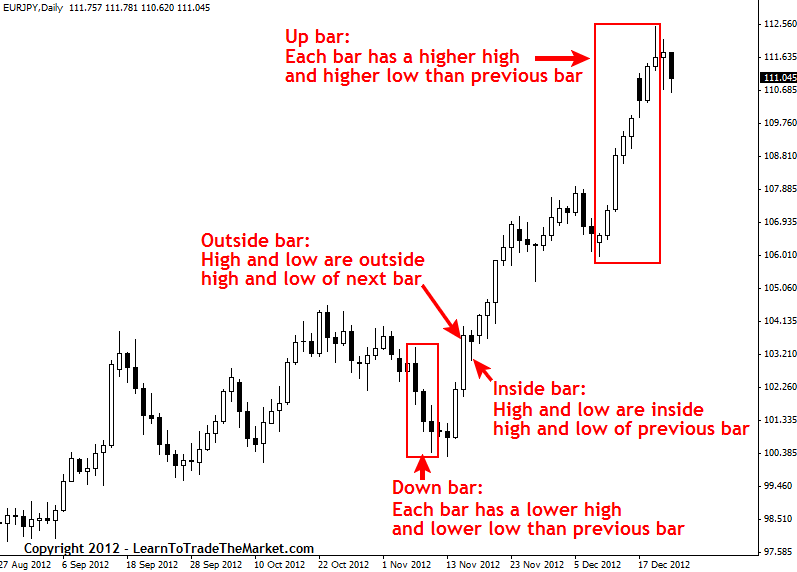

Let’s start with the very basics. In the chart below we are looking at some of the most basic terminology of trading with price action:

Note: The term “candle” describes trading with candlestick charts, you will see “candle” and “bar” used interchangeably sometimes, a “bar chart” is a form of charting that doesn’t use candles but rather simple bars that display the same information as a candle but in a less visually appealing way. If you want to know more about candlestick charts checkout this candlestick chart tutorial.

Up bar: An up bar or “bullish bar” is a bar with a higher high and higher low than the previous bar. The up bars marked above are in an uptrend. Generally, the close is higher than the open on an up bar, but sometimes you can have the close lower than the open and it can still be an up bar, as with the black bar we see in the “up bar” example above. This can happen in aggressive trends like we see above, because as you can see the high and low of that black bar are still above the high and low of the previous bar. Up bars show that buyers or “bulls” are still in control

Down bar: A down bar or “bearish bar” is a bar with a lower high and lower low than the previous bar. Notice in the example above how the close is lower than the open in the down bars highlighted, this is typical of most down bars although it is not necessary as we saw in the up bar discussion. Down bars show that sellers or “bears” are still in control.

Inside Bar: Also sometimes called a narrow range bar, an inside bar is a bar with a high that is lower than the previous bar’s high and a low that is higher than the previous bar’s low. Some traders do not consider an inside bar that has either an equal high or an equal low as an inside bar, others do. Inside bars usually represent market indecision. As on any bar, the closer the open and close are to each other shows just how undecided the market is as neither the buyers or sellers are in control.

Outside Bar: Also sometimes called a “mother bar”, wide range or engulfing bar, an outside bar is a bar with a high that is higher than the previous or next bar and with a low that is lower than the previous or next bar, thereby engulfing the previous bar or next bar. Since the close was substantially higher than the open in the outside bar example above, it shows buyers were in control.

When the open is in the bottom quarter/third of the bar and the close is in the top quarter/third of the bar, it is said to be bullish engulfing with the buyers in control. When the open is in the top quarter/third of the bar and the close is in the bottom quarter/third, it is said to be bearish engulfing with the sellers in control.

Another definition used for this bar – especially if candlestick charts are used – is that the open and close have to engulf the previous bars open and close and not just the high and low of the bar. With this definition, the wide range bar or engulfing bar does not need to have a higher high or lower low to qualify. The first definition most probably came about with bar charts where it is harder to notice the open and close.

What is a price action trading signal?

As markets move they leave behind what I call a “footprint”, this footprint is price action and it sometimes leaves us clue as to which direction it is heading next. These “clues” are known as price action trading signals / price action patterns / price action setups or price action trading strategies.

What we are looking for is a price action signal to give us some “confirmation” for an entry into the market. We will see in a little bit how to combine price action with “confluence” in the market to find high-probability entries, but for now let’s just focus on an individual price action entry trigger.

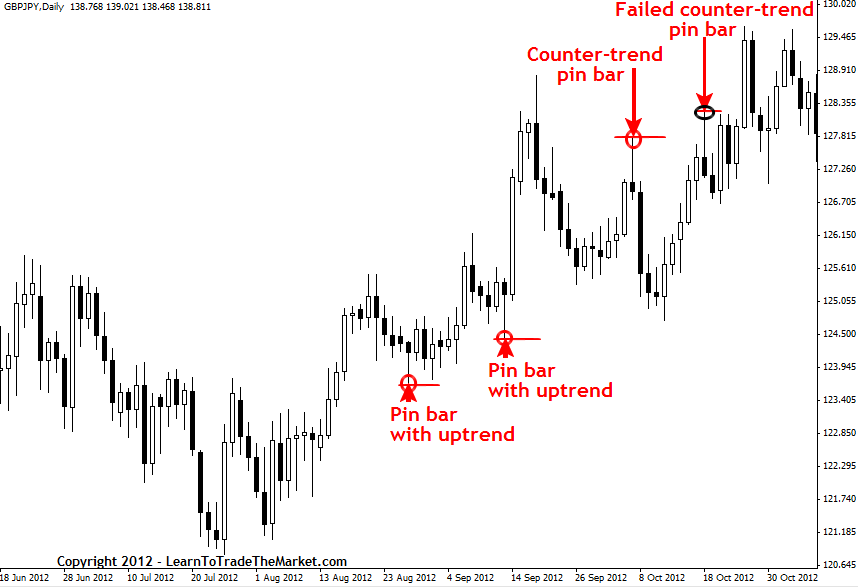

In the chart below we can see examples of one of my favorite price action trading strategies, the pin bar reversal setup. Note; we included a “failed” pin bar setup just to show that not every setup will work out; just as in real-life trading:

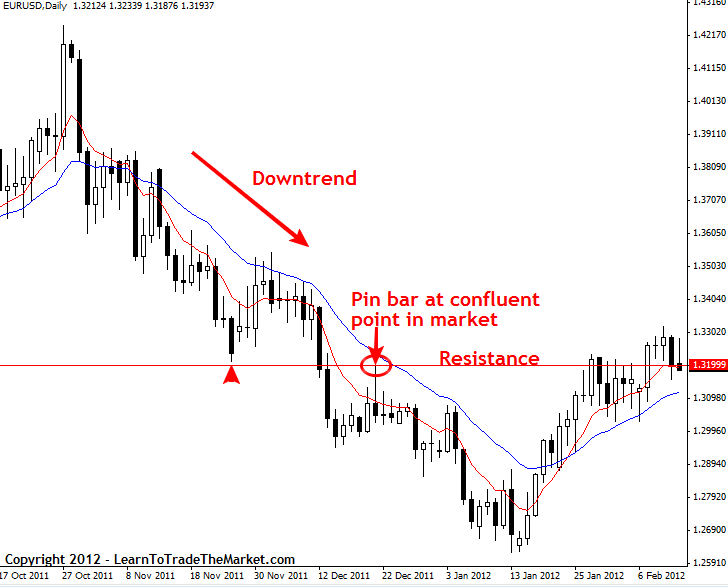

Trading price action with confluence

Confluence: A point in the market where two or more levels intersect each other, thus forming a ‘hot point’ or confluent point in the market. In the dictionary, confluence means ‘a coming together of people or things; concourse’. So, basically, when we look for confluent areas in the market we are looking for areas where two or more levels or analysis tools are intersecting.

In the chart below, we are looking at an example of how to trade price action with confluence. A “confluent” level or point in the market is one that provides some weight to the trade setup. For example, in the chart below the pin bar is showing rejection of an obvious horizontal resistance level in the market as well as the dynamic resistance between the 8 and 21 day EMAs (red and blue lines). Yet another factor of confluence in the chart below is the downtrend itself. If you have a price action setup that’s in-line with the trend, as the pin bar in the chart below, that’s also considered a point of confluence. Thus, in the chart below we have 3 factors of confluence validating and strengthening the case for a short entry from the pin bar setup:

1) Downtrend

2) Rejection of horizontal resistance

3) Rejection of dynamic resistance

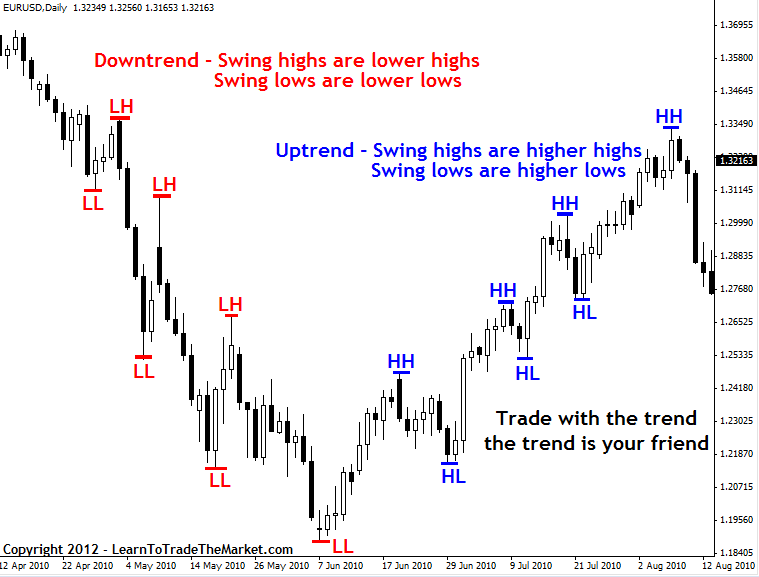

How to use price action to determine a market’s trend:

The following chart has the swing highs and lows marked in both an uptrend and a downtrend. Price on a given time frame is in an uptrend if it is making a higher highs (HH) and higher lows (HL) and in a downtrend if it is making lower highs (LH) and lower lows (LL). If price is doing anything else, it is in a consolidation pattern – range, triangle, pennant, rectangle etc.

The trend is considered in place until price is no longer making higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. After a trend is broken, there is usually a period of consolidation that is easier to see on a lower time frame. With practice, you will be able to visualize this going on without looking at the lower time frame.

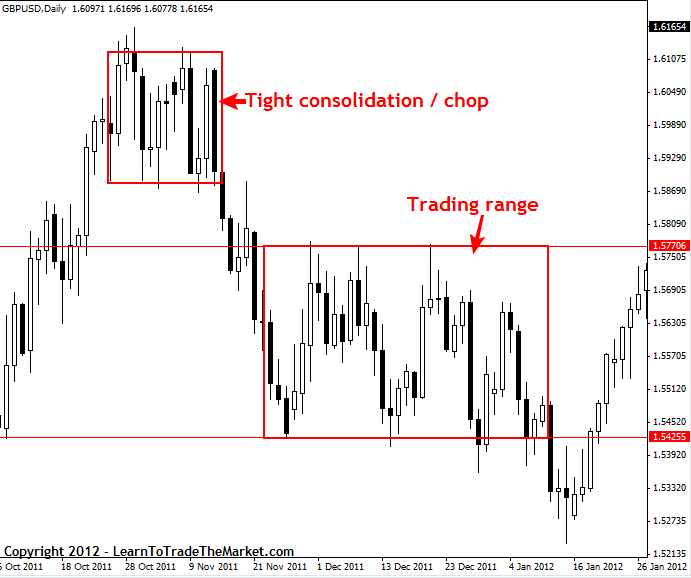

When price is in a tight consolidation pattern, it will often be referred to as “chop” or “sideways” price movement. When price is in a larger consolidation pattern it is said to be in a “trading range” with no trend pattern to the swing highs and lows. In the chart below, we can see an example of a tighter consolidation area or “choppy” price action and then a larger consolidation area that was a more defined “trading range”:

Using price action to trade with a trending and consolidating market

“Trading with the trend” is a rather general phrase that often causes confusion for beginning traders who have not yet found an effective strategy for trend-trading. The way that I trade with the trend is to simply look for one of my high-probability price action trading strategies to form with the daily chart trend, ideally from a “confluent level” within that trend. Trading in a consolidating market is best done when a market is range-bound; in a larger consolidation phase rather than in a tight “choppy” consolidation phase. Tight consolidation can be traded but it needs to be done on lower time frame charts and is best left until you are very skilled at trading the daily chart first.

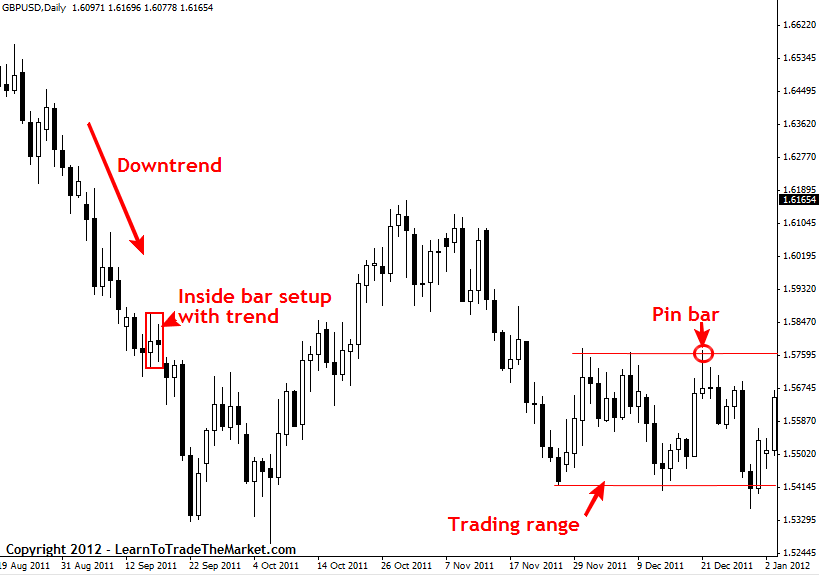

The following chart is an excellent example of trading price action “with the trend” as well as trading price action in a range bound market:

In closing…

You now should have good understanding of the basics of price action trading. One thing that I didn’t touch on in this article is what time frame you should begin learning to trade on. All the charts in this lesson were made on the daily chart time frame, and it’s very important that you first learn how to trade on the daily charts before going lower in time frame. The reason is simple, the daily chart gives the clearest and most accurate view of a market’s price action, and the lower in time frame you go the more random market “noise” there is. Just like you need a strong foundation to build a house, you need a strong foundation to become a successful trader, and learning to trade on the daily charts before going lower in time frame will help you build that foundation. If you want to expand your knowledge of the price action trading strategies discussed in today’s lesson, checkout my price action trading course for more.

Checkout my Free Introduction to Forex Trading course:

You nailed it on exact wounded spot.

You’re truly educator

what validates a higher high or lower low….. ?

i am udeme williams ,

i like your teaching, i am a beginner, continue with this mind blowing

lecture.as we keep following your instructions,it appears that we will become

successful traders. thanks

Thanks Mr. Nial! Article is very informative

Hi nial,by using daily TF will expose small trader like me into a bigger risk. Even there is a setup triggered but due to daily TF candle we can’t afford to pull the trigger. Can you please recommend any lower TF which the signals still good for entry as the risk will be smaller.

Change your position size, it’s all relative to how many contracts you trade.

Thanks for the lesson Nial. Very informative and easy to ninderstand.

Hi Valued Traders

I am in Forex from nearly 10 years and I studied it in very depth..but I find nothing like Price Action, I welcome to all these people who want to earn something and recover their loss..It will be like saying 1, 2,3 etc

You are genius

Simply put,I am impressed with Nial’s professional yet clearly understandable presentation in such a generous manner.Giving out so much valuable knowledge and information for free has only convincedz me that he is one of the hornest educators out there.

Thanks Sir, your artical is very good

Hi Nial

Very informative article,iam a beginner but with the info you are providing iam already feeling positive

Thanks Nial,your article is really good ,simple but easy to understand even for a beginner like me, this price action strategy is new for me, so i will keep looking to this site for learning while i am try to applying price action strategy to my trading.

I want to learn about forex trading from your community

Thanks for the wonderful articles. I stumbled upon them, and inspite of having experience of a few years trading full time, have learnt something anew.

Good work, keep it up & God bless.

I especially appreciate all the visuals. Very easy to understand and apply. Thank you.

Incredible explanation Nial Thank you very much. It has been incredibly helpful your tips and tricks on being a successful trader need to start with oneself, and has changed my trading completely

I have a question regarding regular trading on the opening market. What is the perfect time frame to use?

As you pointed out different time-frames give you different trends and trends within trends. Therefore the smaller the Time frame the more volatility or Trends you will see. What is a good tool to find the appropriate time frame for the investment you are in? is there an equation, a set of guidelines or different points you notice that change everything?

Again thank you very much for everything

Regards

Charles

May I just say what a relief to find someone that actually knows

what they are talking about online. You definitely know how to bring a

problem to light and make it important. A lot more people should

check this out and understand this side of your story. It’s surprising you are not more popular because you certainly have the gift.

Thanks Nail for a great article,

it is real well kept secret. There are a very little information about how to analyse multiple time frames trends using HH->HL LH->LL, about how to enter a trade correctly using multiple time frames.

I wanted to ask if there is more information about multiple time frame trend analysis in your course? If yes, could you tell us more about it?

nice work !

I’m an aspiring trader and I have been paper trading for a few weeks. It has been extremely difficult to get honest, clear explanations of this terminology without shameless plugs to buy something, and still not even receive accurate information. This article is very informative and has given me a whole new level of understanding of price action analysis and it will help me a lot with developing my strategy. Thanks for your help.

Hi please Want be a member in this. And I need help of video of price action tutorial please

Thanks a lot Nial for the wonderful and great article

ENJOYING READING YOUR TEACHING ARTICLES.

EASY TO UNDERSTAND.

THANKS FOR SHARING

LARRY

thanks nial for your explanation, its so useful for new trader like me :)

Very well done Nial..so much for free.. I have your trading course.. But i all ways find my self coming back to all this free stuff.. so much in it.. Thank You

Hi Nial, so far I came accross no other website explaining pin bar, inside bar and related strategies in great detail.

I am a newbie but apprieciate your untired effort.

Thank you for invaluable sharing of knowledge.

Take care……….

Hi Nial,

A very impressive explanation, many thanks to you.

Regards,

Carlos P.

Hi, I am a full time FX trader of 6 yrs now. I have a pure price read strategy that I developed myself and use with good success but I always keep an eye to what good educators have to say to increase my knowledge. To that end, I literally stumbled on your website Niall when doing a google search about something entirely different……….As you’ve welcomed me to leave a comment, I want to say that in all the years I’ve been trading and learning, I’ve never seen such a useful, honest, well communicated amount of information. It took me years to properly learn how to be a form reader and confidently read raw price action as you call it…And I had to teach myself because that is truly the only way to develop the skillset. And you are one of the first people I’ve come across to hammer the point appropriately and suggest there are no shortcuts to it. It’s a basic skill of reading the market yet how many traders years into this game are without this skill. I’ve enjoyed everything you’ve had to say here. Well done. Great work.

Cheers