Master ONE Thing To Reach Trading Success

The background and inspiration for today’s article came about after I read a great book called The One Thing. In short, it’s about how the greatest people and companies that have achieved massive success always tend to be masters of one core process or thing; they perfect that thing and then keep repeating the process. They simply stick with the one thing they are good at and scale from there.

The background and inspiration for today’s article came about after I read a great book called The One Thing. In short, it’s about how the greatest people and companies that have achieved massive success always tend to be masters of one core process or thing; they perfect that thing and then keep repeating the process. They simply stick with the one thing they are good at and scale from there.

“The One Thing” is about reducing clutter and stress and achieving better results in less time. It teaches you how to build momentum toward your goal, whatever that may be. By mastering what matters to YOU, this book will help you increase your productivity and dial-down your stress. It’s a great book that is well worth a read or listen on audio book (perhaps on your next holiday) and it will help you significantly as a trader and person.

As traders, we should learn from this book and use the concepts it teaches by focusing on one thing at a time and mastering it. This means mastering and perfecting our trading strategy and everything that surrounds the execution and management of that strategy, effectively, the process of the trade and our trading plan.

I also encourage you to find the trading strategy that fits you the best or that you like the best (for me it would be pin bar trading), and stick to that exclusively, until you’ve MASTERED IT and feel like you OWN IT.

Master Your ‘One Thing’ …

Here’s what I would do if I were in your shoes…

- I would master my trading strategy by becoming a master of the process. Everything from the trade signal to the entry, stop loss, target, money management and my mental state. This is the one thing you are mastering, collectively it is the process. You are mastering the process of trading the entry signal of your choice, essentially.

- Your aim is to focus on this ‘one thing’ without distractions and without the obsession of changing, adding variables and searching for that ‘next best thing’. That is the key. You need to believe in what you are doing, stick with it, rinse and repeat. Eventually it becomes a positively reinforced trading habit and the by-product or side-effect of it is trading success.

- Many traders get this mixed up. They think they will first make money trading and then becoming a habitual trader who does the right things. It doesn’t work that way. You must, essentially, have faith in the process and follow it ‘blindly’ BEFORE you start making money. That’s really one of the keys. Trust the strategy, trust the signal you’re committed to mastering and trust the process.

- Example: Franchises like McDonald’s are so successful because they develop and implement focused processes and then the execute them flawlessly over and over. They commit to a proven model and stay focused on it; they NARROW their focus rather than broadening it. Most traders do the opposite! There’s a reason McDonald’s doesn’t offer boxes of friend chicken like KFC and why KFC doesn’t try selling a Big Mac; they stick to what they are good at, to what they OWN and have MASTERED.

- Another example: Remember what happened when arguably the best basketball player ever, Michael Jordan tried to paly professional baseball? Yea, me either. Fact is, he wasn’t that great at it. He was / is the best basketball player ever because he focused so narrowly on that one sport, he literally dominated it and no one to this day has equaled his achievements or abilities. Fact is, you really cannot be super good at many different things, like the saying goes, “Jack of all trades, master of none”. Well, if you want to be a “jack of all trades” that’s great, but you won’t make much money, I promise you that.

- The people who make money in trading or any other profession all have one thing in common: They are specialists. They specialize in one narrow field or focus, and they own it as much as they possibly can. That specialization results in higher pay / more money because MOST people have not focused on that one thing as much, so they do not know how to do it as well, they aren’t as good at it. Same thing in trading; most traders lose money because most people don’t’ have the discipline, patience, focus and passion to commit ONE THING, one process and become a Yoda-level bad-ass Master of It.

So, ask yourself right now, before reading on – are you committed to do what it takes to become a master trader or are you going to keep wasting your time, energy and money by screwing around with trading indicators all over your charts and a hundred different trading blog subscriptions all telling you something different?

Burn this into your mind, print it out, love it…

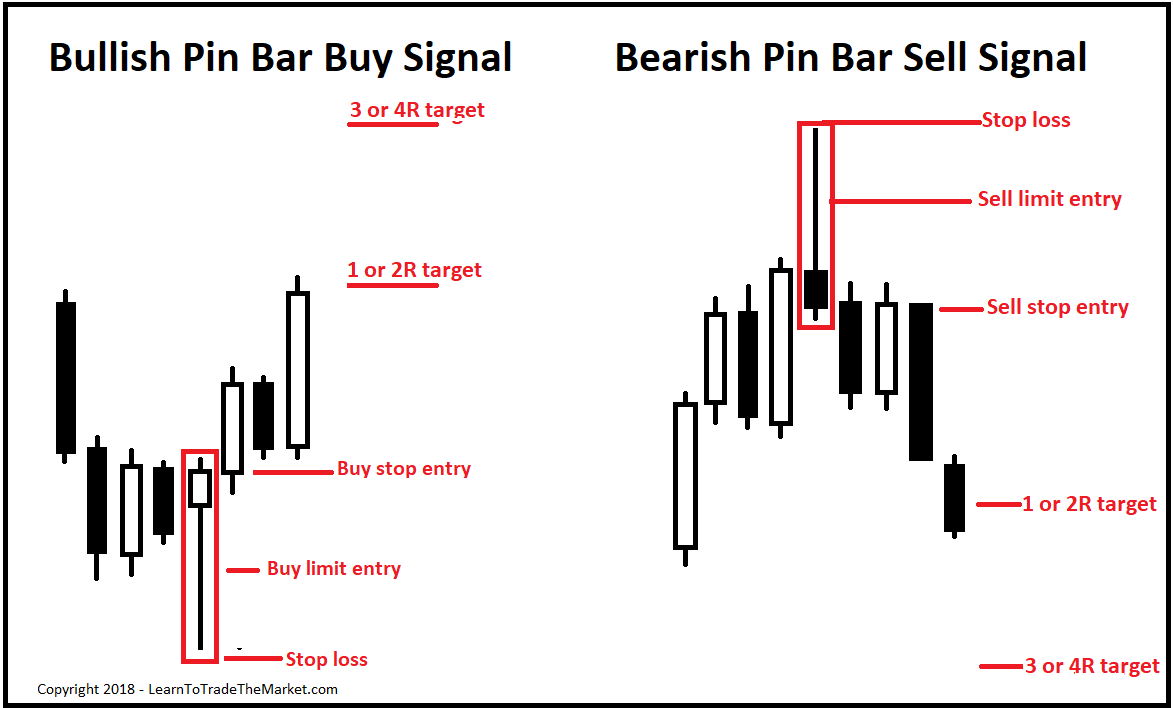

Here is the setup I would pick to master first: the pin bar price action pattern. Note: the targets are 1 or 2R or 3 or 4R depending on which entry you took; if you enter on a limit entry near the pin 50% level, the risk reward ratio potential is higher.

Here is what ideal pin bars look like (print this image out and add it to your trading plan or post it on your office wall if you want to, it will help.):

1. Now you know what you’re looking for when you hit the real charts. You’re looking for only super obvious pin bar signals, bullish or bearish, with long protruding tails. The tails should be sticking out from the nearby price action. Practicing taking only the most obvious ones, this way you give yourself the best chance at a winning trade because the more obvious the pin bar, the better chance it has of working out.

2. You may choose to read some trading mantras or go through some mental trading affirmations each day before you start scanning the charts. I know this may sound slightly funny, but trust me, it works. It’s all about getting yourself into the proper trading mindset before you start looking for trades. Trading psychology is paramount to trading success, believe me on that.

3. I suggest you have a written-out trading plan with screen shots of your setup. You can even print out the diagrams above and the real charts below, so you have examples of what you’re looking for. But, remember, each setup is unique, and they will always be slightly different. But, the basic idea is there: a pin bar has a long, protruding tail and it should typically have confluence either with a key level, the dominant trend, or both. Don’t over-complicate it!

4. Remember, we are looking mainly for 4 hour or daily chart pin bars here. 1-hour charts are OK, but I really don’t recommend them until you’ve mastered the higher time frames like 4 hours and daily. You will notice below these trades took some time to play out and hit the targets of 2R or 3 or 4R drawn in using the risk reward tool, BUT, the profits would have been massive. We are not looking to day trade, because that is not sustainable. We are looking to become skilled, savvy chart technicians who swing trade or position trade the markets to hop on big market moves and trade in a relaxed set and forget and end of day approach.

Examples of real-life pin bars setups to model your trading plan after:

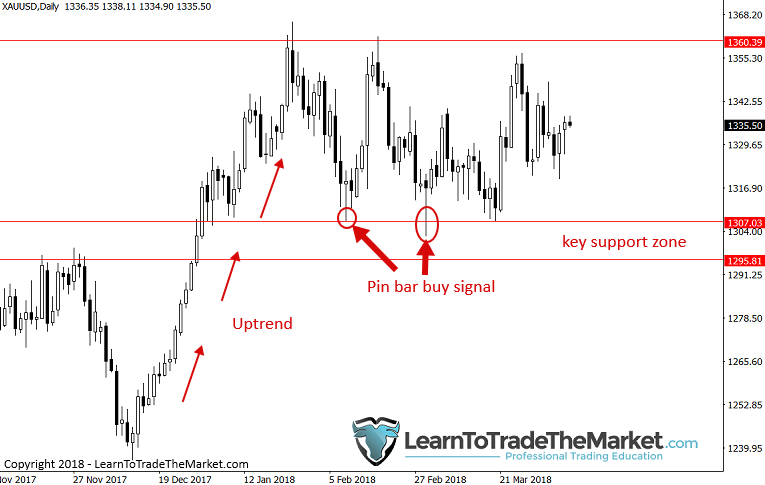

Below, we see two bullish pin bar buy signals that were about as ‘perfect’ as you will see. They had confluence with the previous underlying uptrend and also formed at a key level of support.

Notice the potential risk reward of 4R on the second pin bar if you entered using my “trade entry trick” which is a tweaked entry where you enter near the halfway point of the pin bar after a retrace down the pin’s tail. You will also notice it took some time, about a month for that 4R to get hit, but if you’re making 4 times your money on one trade, can’t you wait a month? I can. Discipline and patience are HOW you make money in this game, NOT trading high frequency.

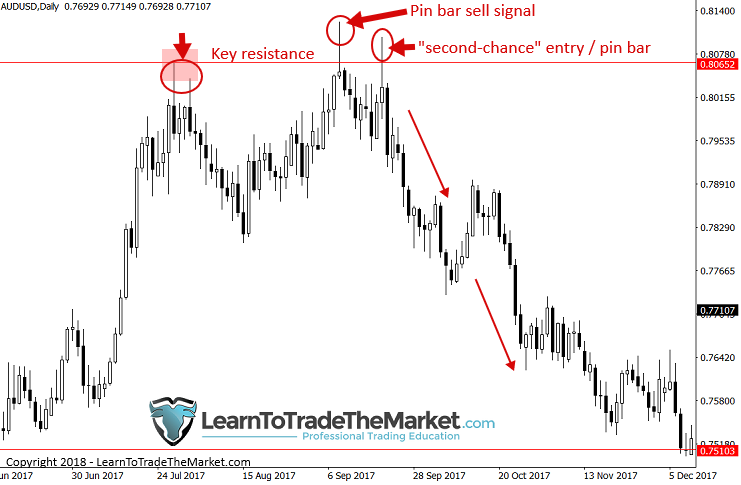

Here is an example of a counter-trend pin bar sell signal. This one was also darn near ‘perfect’. It formed at a key resistance level and had a large protruding tail, which is what we need to see if taking a trade against the trend. There was even a nice second-chance entry a week and a half later for anyone who missed the first pin bar. Note: whilst I typically don’t recommend beginners try counter-trend trading, it can be done on the daily chart if a signal forms at a key level – if done right it can lead to huge moves and even entire trend changes…

Here is the potential risk reward had you entered a ‘standard’ entry at the pin bar low and a stop loss above the pin bar high; note that 4r or more was possible entering this way. Had you entered on a 50% retrace tweaked entry as discussed previously, you could have gotten 8R or more!

Important insights for you to remember:

- Building focus – too many signals, strategies, markets, news. – focusing on one signal creates focus you need to become a Master of It. To get good at anything you must focus on that and only that. Whether it’s writing an article like this one, reading a book, learning to paint, play a sport or ANYTHING – you will never get good at it by having scattered and broken focus. Similarly, focusing on one thing helps you get good at it faster, obvious, right? But most traders overlook this fact in their quest for fast-money. Laser like focus on ONE setup will help you to make money faster than if you try learning 20 different trade signals and strategies all at once, it sounds obvious, but it seems to be human nature to try and do and learn too much at once, resulting in exhaustion and giving up. Rather than really committing to one thing and OWNING IT.

- Bruce Lee was the master of his domain. Be the master of yours. Was Bruce Lee good at everything? No, but he was THE BEST at the martial arts he practiced because he was intensely focused on it. If you want to make money trading, you need to narrow your focus and become obsessed with the topic of that focus.

- Don’t doubt yourself or let anxiety ruin you – people often think themselves right out of success and they often make things much harder than they are. Often, the hardest part of success, be it in trading or business in general or even in getting fit, is just GETTING STARTED. Don’t sit there staring at the walls, thinking how hard XY or Z MIGHT BE, just start doing it and you might find you enjoy it more than you thought (and that it’s not as hard as you thought!)

- How do you become a master? Breaking things down into smaller piece s/ goals, don’t overwhelm yourself by trying to achieve the lofty goal first. You will get distracted and lose focus if you do that.

- An exercise in discipline. Focusing on one setup creates discipline. You need to execute with confidence when your setup forms and systemize this to some extent. This is done by creating a trading plan with screen shots of a ‘perfect’ example of your chosen setup and the way you will trade it: stop loss placement, exit strategy, risk reward, position size, money management, psychology – those are the main topics to cover in any trading plan.

- Specialists make the most money. Become a ‘pin bar specialist’ or a ‘fakey specialist’ or whatever setup you like the most, pick one, master it, rinse, repeat.

Here are some articles that will assist you in learning more and helping you understand today’s lesson more:

Master One Trade Setup at a Time

Daily Chart End Of Day Trading Routine

Conclusion

If you want to turn your trading around or just start on the right path, you really need to narrow your focus. Most of the time, traders just get inundated with the loads of trading information swirling around the internet. I am telling you, from 16+ years of trading experience, most of it is just rubbish and will hurt you if you let it.

You can really pick one of two paths: Get serious right now and start mastering one price action entry signal at a time, until you are literally a Bruce Lee – level owner of that signal, or keep doing whatever you’re currently doing. But if what you’ve been doing isn’t working, I strongly suggest you try what I have outlined in today’s lesson because this is basically how I trade and it is what I know works for me and has worked for many of my students.

I suggest you pick the price action pattern you like the most, that you have the best grasp on and study it and commit to mastering it until you are dreaming about it in your sleep. If you need more help you can study my trading course for more in-depth examples and explanations. But, whatever you do, if you’re serious about trading, I strongly suggest you start following what I have laid out here today to put some structure and consistency in your trading routine.

What did you think of this lesson? Please share it with us in the comments below!

Wonderful… now i know what am looking for in the market.. thank you very much Nial.

Glad to hear it :)

You are indeed a pro

Thanks and God bless you.

neil million dollar article.from my experience what you are saying is true

Hi Niall, Grateful. Excellent articles. You impart not just skillset to harness on but also the mindset to have a laser-sharp focus on the one thing that becomes your trump card. Very true of the saying ” less is more”.

This is a word of wisdom for me during this pandemic C-19, learning a skill that has an edge and not rely solely on the 9-5. Will sign up to your trading course. Thanks again. God blessed.

Julian_ Dublin Ireland

The best description of pin bar strategy

I have ever read. It is wonderful. Thanks.

Great article! Some obvious things I ignore at times. Thank you so much, Nial!

Great lesson Nial

Possibly one of the best, thin slice focus and as he says in the intro its a mind set and me like many others are looking for quick wins …where a single strategy will come through for you …I am still working at it as I move around too much …cheers

Mr. Nial! what can I tell? article super, thank you

thank you my brother nial…….contact me every time

Great. be blessed more

Thankfully Nial. . . . . .

The big reveal . Good bye to indicator . Tqvm mahaguru Nail Fuller .

Nial your God-sent!

Superb

I am always frustrated when I see charts and graphs because I find it difficult reading them so I became a bit jittery knowing I have come ones again face to face with graphs and charts learning Forex Trade but with this article I am confident I don’t have any problem at all. I now know what I will be looking out for. I know I will get there soon. Nial, thanks for your educative write ups. God bless you abundantly.

As well as a great article. But most of us don’t follow this simple system and lose …….continue….

great stuff 100%

Very good article

commentdata

Great write up. thanks.

Thanks nial u give us very expensive knowledge as a beginner like me, may god bless u

Nothing ever said clould be closer to the truth! Great article!

Thanks for the article Nial, it was very timely. I’d found myself trying to figure out fakeys and inside bars having not yet mastered the pin bar. The pin bar it is from now on!

Great piece of writing and most of new trader face this problem, they cant do focus on one setup.

just what i need to reaccess my path. thanks for the great insight….

Thanks Nial! Your articles always inspiring and educating. Already learnt a lot since i took your course. Thanks a million times.

good article.

i too am focusing on a pin bar set ups, they don’t occur often but when they do, they seem to make a good profit, now is time for me to focus on patience when i am in a trade as well.

Thank you, Thank you, Thank you Nail ! The article was great! I now have the courage of becoming a Master Trader !

great job you have done , i am a profitable trader since i read all your articles

Youre a hero! Great article. Im working on owning the 4hr Fakey and I must say since I ditched everything else, and I mean everything, Im mastering it! Thanks to you Nial – without your course and ongoing articles, it never would have happened. I would remain another frustrated trader just blowin in the wind;)

This is superb Nial, thank you. Yesterday I finished back testing my second strategy (100 trades EACH!) and was just about to start a third… now, I’ll just refine the one that I was most comfortable with, which also happens to be the simplest.

Great article, made me think and reaccess my my focus. Thanks

People think themselves out of success and make they often make things harder than they are,golden words that I took from this lesson today.great article thanks

Classic write up Nial as usual. You are habitual to write just too good. Will join your course not for signals but surely for these worthy articles…

????????

I found the book “The One Thing” in PDF here. Everyone would love to read it. http://association-for-leadership-practitioners.com//TNbWZ/wp-content/uploads/The-One-Thing.pdf

Great examples with many real inspiring ideas. Thanks master Nail.

Thanks…thanks and thanks, Nial. You are truly a blessing! This makes sense.

Thank you for the good lesson. What are your views on swing trading?

Life changing lesson. Thanks a lot.

Bruce Lee master in two things, Martial Arts and Celebrity Actor

Out of all the trading mentors I have had Nial is the “One” mentor that finally got me moving in the right direction.

Thank you Nial :)

I am totally in agreement; what doing is what doing well. Thanks a lot for this lesson.

great article.It really opened my eyes.

Another passing thought, remember, ” jack of all trades, master of none” so choose wisely

Fabulous article Nial.

We all get carried away …. desperation, greed, trying to make quick money but without applying our mind…we keep wandering and end up losing more time.

Every new trader has to somehow get this imbibed…. LASER FOCUS is the key.

Thanks Nial, once again.

Thanks Nial. Great lesson.

Mr Steel…Just a thought. Ive been looking carefully at my own trading, too, and for a few weeks I was getting pretty critical of myself: Ive not been generating the profits I had been. Was I over-trading, or being undisciplined? Stepping away and looking objectively at my trade journal, I realized that the results of the past few months were being impacted not by my trade discipline, which was fine, but the PRICE ACTION itself. Look at pairs like the euro/usd, for example. Price Action has moved essentially sideways since January, with decreasing volatility. Contrasted with the moves in euro/usd throughout 2017, and your results will be much flatter right now. Several pairs that I commonly trade have been very range-bound for the past 10 to 12 weeks or so. Nial Fuller has a great article on adjusting your risk/reward and fitting it to changes in volatility. Like you, my results in these past two months have been off of the results that were happening during high-trending times we saw in 2017. The volatility and trending will return. They always do. In the meantime, lets folks like you and me and the others who are dedicated to the methods and means advanced by Nial Fuller and Mark Douglas stick with our trading plans, adjusting our risk/reward for lower volatility price action, and well be fine. In my years of studying currencies, Ive discovered NOBODY who trades better, teached better, writes better, thinks better than Nial Fuller. When I coupled his coaching with the great Mark Douglas, it changed things for me, big time. Stay disciplined. Youll be fine!

Hi Nail. You never stop to amaze me, you are just simply the best. Master one setup at a time, this is the best thing i ever did in 2018

Such a powerful article bro. I think this is what all traders need the most. This article really make my concious mind waking up.. Thanks bro..

Great lesson.

Thanks Nial, things not going well so needed the pep talk.

Yes yes and yes …. Maestro N Fuller. Outstanding lesson that is very typical of you. Thank you sir

Yes yes and yes …. Maestro N Fuller. Outstanding lesson that is very typical of you. Thank you – Siyabonga – Merci beaucoup.

Nial it is essential to have a mentor like you for someone like me to gain an edge as a retail trading person. With such insight presented in step by step understandable format it provides the recipe needed to face the challenge of the markets. The greater challenge is my preconceptions and how I can use the steps you provide to get to the stage of confidence in ‘setting and forgetting.’ It matters to me. Nigel

This is wonderful Nial. The “One Thing”. Am trying to master and stick to my strategy, The PIN BAR..

Keep up the good work you are doing. Through your pieces am slowly improving my trading .

Thanks

Fabulous and powerful article Nial all I need to do now is put in the DISCIPLINE and focus. Great lasered in concepts thank you/