Develop A Daily Routine For Analyzing Charts & Trade Setups

Most of you know I publish a daily market commentary each day shortly after the daily Forex market close. What many of you probably do not know is that making these commentaries each day is part of my daily chart analysis and trading routine. I actually started writing down my thoughts about the markets each day well before I started this website, and it’s something I’ve done continuously every trading day for about the last decade. It’s literally a habitual part of my daily life…if I miss a day of commentary for some odd reason, like travel or a holiday, I literally feel ‘strange’, and like something is ‘missing’.

Most of you know I publish a daily market commentary each day shortly after the daily Forex market close. What many of you probably do not know is that making these commentaries each day is part of my daily chart analysis and trading routine. I actually started writing down my thoughts about the markets each day well before I started this website, and it’s something I’ve done continuously every trading day for about the last decade. It’s literally a habitual part of my daily life…if I miss a day of commentary for some odd reason, like travel or a holiday, I literally feel ‘strange’, and like something is ‘missing’.

My daily trading routine is the core foundation that all of my trades are built on, and it’s my opinion that all aspiring traders need such a foundation to build their trading career on if they want to have a serious chance at making consistent money in the markets. In today’s lesson, I am going to show you how I personally analyze the charts each day and give you a ‘peak’ into my daily trading routine. Hopefully, after reading today’s lesson you will have a better understanding of WHY you need a daily trading routine and HOW to develop one.

The POWER of routine, discipline and habit…

News just came out over the last week that Bill Gates, founder of Microsoft, is once again the richest man in the world. The one thing that you will never hear anyone saying about ultra-successful people like Gates and others, is that they are ‘lazy’ or have ‘bad habits’. It’s pretty well understood that a man like Bill Gates must be a very disciplined individual to have gone from college drop-out to richest man in the world and founder of the biggest software company on earth. Most people would agree he has probably developed some very effective daily habits that have brought him to the point he is at now in his professional life.

This leads me to my next point: How do YOU analyze your charts each day to find trades? Do you have a routine that you go through each day? Do you have any structure behind your trading method or do you basically just “trade on the fly”? Like success in any other field, trading success is the result of developing effective habits through discipline and proper procedure. What I mean is this; if you do not have the discipline to stick to your trading strategy and manage your risk properly, you will never attain the trading mindset and habits that you need to make consistent money in the markets.

At this point in my trading career, I am very set in my daily routine, yes it’s a little ‘boring’ at times, and repetitive, but I still do it because it’s a habit, and a very effective one at that. Each day, I go through my ‘ritual’ of checking the markets, making notes, placing trades if there any, wash and repeat. I got an email recently from someone who insisted that there was some “secret to trading” that I was not telling them, they actually didn’t believe me the first time I responded saying that there really is no “secret” besides discipline and proper money management. The real “secret” to trading success, if there is one, is that YOU need to develop yourself into a successful trader by learning to trade effectively and being disciplined long enough to follow a trading routine until it becomes a habit that you don’t even have to think about anymore.

Here’s how I do it…

The foundation of my daily trading routine

My daily trading routine is probably a lot less complicated than you might think…the most important thing to remember is that it has become a habit for me, just like it should be for you. The walk-through that follows is essentially how I create my daily market commentary for the members area each day, hopefully this will give you some insight into how to create a daily trading routine and trading plan…

Levels

The first main thing I do at the start of each new trading week as well as each day, is map out where the key chart levels are and watch how the market is reacting around them. I first zoom out to the weekly chart and get a quick view of where the key levels are, at that time I will draw them in on my charts.

In the weekly EURUSD chart below, I have drawn in the key weekly support and resistance levels as I do at the start of each new trading week. I am looking for levels that were key turning points in the market and then drawing a horizontal line across those levels, this is essentially how to draw support and resistance levels:

After I’ve drawn in the key weekly chart levels I will move down to the daily chart time frame. Here, I will probably see some of the same key levels I drew in on the weekly, but because I am not looking at as much data (time), some of the weekly levels won’t be relevant on the daily. There will be other levels to draw in on the daily chart; shorter-term levels.

In the daily EURUSD chart below, you can see the most relevant key support and resistance levels that I’ve drawn in. Note that I actually adjusted the weekly level that was at 1.3172 in the chart above, up to about 1.3193 on the daily chart, because it’s a little more obvious that the ‘actual’ level is up a little more once you drill down to the daily chart. Also note that I added in a level on the daily chart at 1.2955 that was not really obvious on the weekly chart. You will add more levels as you switch from the weekly to daily because some of them are simply not as obvious on the weekly.

Note how I have drawn in the key support and resistance levels in the chart above. I did not draw in every single little level I could find, rather, I focused on the levels that were CLEARLY important, and by that I mean the ones that caused price to make a significant change of direction. As you go lower in time frame you will naturally have more key levels to draw in, and finding and drawing them is NOT an exact science, there is discretion involved and you WILL get better at it through education and screen time.

Here are some of the key things I am looking for at these levels:

- How is the market reacting around the level…what is the price action doing at the level?

- Which levels broke and which ones held?

- Were there any false breaks or failures at levels?

- Most importantly, did any obvious price action trading setups form at the key level?

Determining market condition

The next I do after finding the key chart levels and analyzing what’s happening around them, is determine the condition of the market; is it a trending market, range-bound, or chopping sideways with no direction? This is very important because it basically decides how you will approach the market and how you will trade it.

The first thing I do is have a look at the weekly chart again and I will take note of the general direction the market has been moving in recent weeks. This can be called the “long-term trend”, and I am really just trying to get a general feel here for what the market has been doing over the last year and whether or not there is a clear trend.

In the weekly AUDUSD chart below, we can clearly see how useful and important it is to look at the weekly chart before drilling down to lower time frames. The AUDUSD weekly chart shows us that the market was recently trading within a very long 9-month trading range and no real long-term trend was in place. However, when the market finally broke down and out from this trading range it essentially ‘confirmed’ that a new downtrend was getting started, and this is a very important piece of information to know as we drill-down and look for price action trading strategies on the daily, 4 hour charts and 1 hour charts…

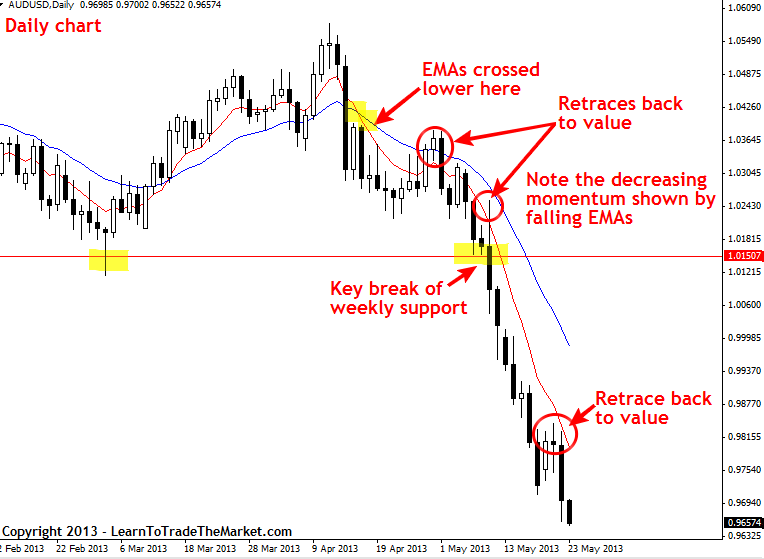

Now, let’s look at the AUDUSD again but this time we are looking at the daily chart time frame. In the chart below, we can clearly see that the 8 and 21 day EMAs show a potential trend change a lot earlier than you can detect it on a weekly chart. When we see the EMAs (red is 8, blue is 21) cross each other, it’s an indication the trend might be changing and is something to take note of. You generally need to see a pattern of lower highs and lower lows or higher highs and higher lows to “confirm” the trend change, but the EMAs are a good “early-warning” system that the trend might be changing. Read more about trend trading in my article on how to trade trends.

It’s important to note the retraces back to “value” in the chart below. In a downtrend, “value” means resistance, in an uptrend it means support. These do not have to be strict levels, they can be “zones” or even the “layer” between the 8 and 21 day EMAs, like we see in the chart below. When the market retraces back to these value areas, it means we need to pay extra close attention and look for price action signals to trade with the dominant daily chart trend. I look for signals on the 1 hour, 4 hour and daily charts.

Price action signals

Finally, after I’ve drawn in and analyzed the key chart levels and determined the current market condition, I will look for price action entry signals. A price action pattern is my main entry trigger and I will not typically trade if there is not a price pattern ‘confirming’ a high-probability entry into the market.

The primary thing I am looking for are daily chart price action signals, as these are the strongest and best ones to trade in my opinion. I always go through the markets and look for price action signals once at the close of the trading day and then again a little later on in the day.

I am basically just looking for obvious PA signals that are well-formed and that ‘agree’ with the current market dynamics. That means an obvious PA signal that is near a key level or in the context of a trending market. I am also looking for price action rejection / reversal signals at key chart levels or at “value” as described previously.

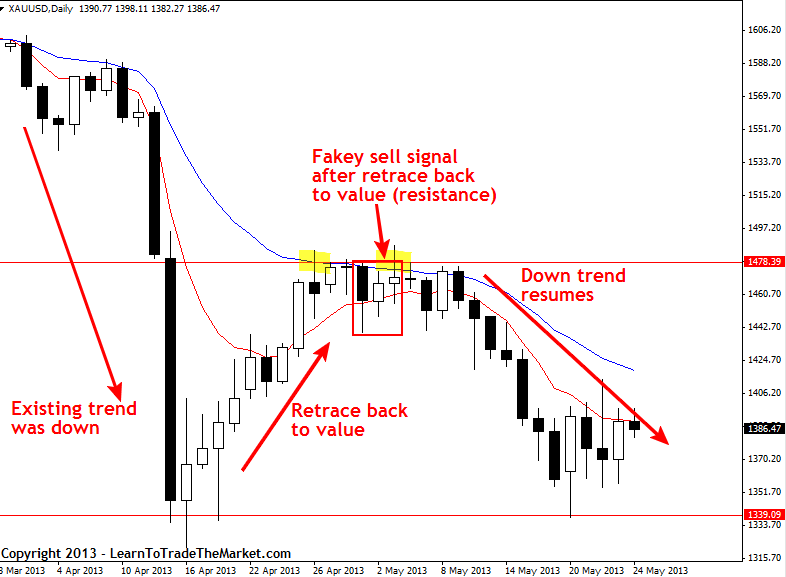

In the daily Spot Gold chart below, we are looking at an example of a fakey signal that formed after a retrace and subsequent false-break of value / resistance near $1,480.00. We discussed this setup recently in our May 7th Commentary and it shows a good example of how to trade in-line with a trend (downtrend in this case) after the market has made a retrace back to a key level of resistance as well as the 8 / 21 day EMA resistance layer.

Conclusion:

Hopefully, you have learned a few things from today’s lesson. The primary things you should have learned are that: 1) You NEED a habitual daily trading routine that is simple yet logical and effective, and 2) Creating a daily trading routine is not difficult, the guidelines I discussed above are really about all you need each day to analyze the charts.

I strongly recommend you start doing your own daily market analysis and keep your notes in a diary. This ‘trading diary’ would look very similar to the daily chart commentary I create for my members every day. You can get started by just following the three main steps I described in this article. Keeping a ‘daily trading diary’ has benefited me greatly over the years because it allows me to track the market each day and remain “in the zone” as the market ebbs and flows.

An invaluable learning tool to help you become an expert at analyzing your charts is my daily market commentary newsletter. You can check out my daily chart analysis newsletter in the members’ area and follow along each day as I discuss key levels, market conditions and price action setups that may have formed that day. For more information on my daily trading newsletter, trading courses and traders community, click here.

Wonderful work well done. I find it recreative and good to practise. Thank you sir.

Thanks so much Nial!

Will join ur course soon.

From Malaysia.

good

New to trading and this is just what I need right now – a routine. Thanks

Thanks Nial

great article.

I’m from sri lanka

Hi Nial,

I hope forex trader’s daily affirmation also comes under daily routine..

Am from africa and most people here talk about your style…..the best and GOD will continue blessing you on your work.

Great post. I have always been a fine of identifying these key levels and using a similar crossover to establish a trend forming.

Great article, Nial. It goes over the basic very well and is easy to understand.

Pure Genius

Wonderful Piece

Hello Nial,

I loved evething you have written in this article. I think sommeone like me new trader would be very much beneficial if they follow this steps.

Best regards,

Syed

Your incredible capacity to explain clear and concise all

forex concepts are really appreciated for everyone wants understand all inherent in markets.

Thanks indeed for your unvaluable job.

Great Nial

These articles are like a master course for us!

Thanks for sharing all your knowledge with us!

very inspiring, full of information nd well educative

Never tried to open 1W chart. Now its part of my analysis frame. Thanks Nial. Truly great relief.

An eye opening lession

Excellent article as always, Nial! I’m wondering if newbies like me should do this on a limited number of currency pairs ( 1 or 2) to get started and keep from being overwhelmed?

You are a bright beacon of hope for a struggling FX trader.

I thank you forever for your generous wisdom.

Thanks Neil. Your method acorss all your content is so simple and consistent. Moreover it covers such a wide area on trading. Awesome!

Jyoti

nail, you are a very good man for sharing is great knowledge with us ,God bless you thanks, Donald

Thanks Nial, like always fantastic article. God bless you for sharing your knowledge with us all in detail and depth. There is no word to say thank you because you are amazing person and doing a wonderful job of sharing your experience and knowledge with us to improve our forex trading. God bless you and all the best.

Thank you Nial,another superb aticle to improve our trading….

Habits!

That’s the key.

Thanks Nial.

Thanks Nial. At the end of every trading week, I would also look the weekly time frame to give me a overhead view of the potential direction in the coming new week to prepare my trading.

Thanks once again Nial. Your post are great educative learning material.

Hi Nial

Another moment of universal synchronicity.

I am currently reviewing my Business Handbook and Trading Plan. There are many gaps that I am connecting with new skills and knowledge.

My Trading Journey has been life transforming, learning and changing my life to be a better person.

“Develop A Daily Routine For Analyzing Charts & Trade Setups” is one of these moments when the penny drops, “AH AH moment”.

Although I have been doing a mental Analysis with some notes on a pad, I see from your article, to be professional, a more formal routine is required.

Please forgive me, as I will be stripping this article down, word by word to distil the very essence that I will put into my practise.

My sincere thank you.

Happy Trading

Hi Nial Excellent article – clear, concise, instructive – keep up the good work.

Totally agree with u! Nail!

I did that everyday (about the writing)! although I did’t trade much!

Indeed, without doing so, I don’t even sure i was right/wrong in the prediction, or I had made a mistake on the execution instead!

Thank you so much Nail you have helped me a lot I now make more profits than losses because of u

I really like this one because as a relatively new forex trader, this is exactly what I’m honing in on as I’m developing my trading style. It’s very reasuring that I’m on the right track and helps me tweak my ways for the better. I know if stick with it I could be very sucessful as a trader. Thanks, Nial!

Thank you Guru for another valuable lession. You have amazing Trading, Teaching & Writing skills.

No one can beat you in teaching the psychological aspects of trading.

thanx you nail

Its Totally Awesome Topic.

Thanks Again Nail

Thanks Nial for sharing this very highly valuable information.

thanks man!

A thousand thanks! with your good mentoring effort my trading skill is improving in good speed. Cheers!

Thanks Nial. Reading your articles and your daily commentary is part of routine. I like making my own analysis at end of NY close and then compare notes to check how I’m thinking about the charts.

Thanks Nial,this is the greatest forex article of all times!!

This article is just too wonderful.

thanks

You are the best !

Very Informative and GREAT Article once again…

Thanks Nial…..

Thank you nial,

this Lesson Very valuable for me

thanks again

Have a nice Day

Excellent technique for detailing the depths of the market. Thank you for disclosing wisdom.

Thanks Nial. It’s a rocking article. I think it is a very good idea to trade profitably. It helps newby like us.

I want such mory articles.

Many Many thanks.

HEY GURU ,

you hit the nail “trade on the fly” , yes this the mistake i repeatedly do . I wil follow the steps for daily commentary as u said . thanks for sharing, how the way to look the market like pro”s . with no tense and panic. thanks a lot nial ……..

Also I feel a bit strange when I don’t read your commentaries…..Great Nial!!

Hi Nials this would have to be the most informative info in set up’s , for newbies , I have ever come across. Excellent article

Cheers W

Hi NIAL,

your are doing a wonderful job here and its has change the way I look at the market this time around In the past when ever I enter trade its will become support or resistant until i gat stop out due to coloures indicators but trading nakad open my eyes about forex hope to join your membership soon hope you still have more instock to share there?

Appreciate your timely and candid post.

And a great reminder for not drifting out of this habit

Thank you

What a terrific article and piece of personal information.

The logic is undeniable and the overview full of clarity.

Thx again Niall.

In my few weeks of reading your articles, I have gained what i will call a break through knowledge in forex trading. Remain blessed as me and my friends who previously had a wrong view on forex trading are now appreciating how easy forex trading can really be with the right trainer. keep up the good work.

Your article is constructive as usual.May God bless you and your whole family.

i know nial you are the master of market and you know every thing about it and your every article have contain many amazing and new thing new as well as old traders

thankx to guide everyone

Thanks Nial …

i really thank you to be a supporting leader and trader for all the newbie and to your follower’s….this article will really change my daily habit and also my mindset thanks a lot……good article……..

outstanding as always…

It is exactly what I am doing. There is no secret in trading the markets, just putting your odds at your favour.

Thank you Nial,

Great Article

Hi Nial,

When you draw S/R lines on weekly chart, how far you go back on the chart to draw the lines ? Is it 1yr – 2yr – 3yr

Thx

Raj

Although I’m not a subscriber to your site I do frequent it often and read most of your articles. This one, is by far, one of the best and informative ones yet. Thanks for the education.

An other very interesting article like of your´s, Nial. I draw key levels monthly, weekly snd daily but I have to take the routin of write commnets daily.

Thanks a lot.

Hello Coach,

Thank you for sharing your analysis insights and guidance !

Couldn’t have been more timely for studying volatile markets like now.

Best Wishes,

Sam

very effective and useful guideline. Thanks a lot Nial.

Thank u Sir, for wonderful information.

There are many points to take note of, from this article friends. Let us follow his guidelines.

Thank you, great!

Hello again Mate,

Your extraordinary ability and willingness to teach

go beyond the limits of mere generousity.

And that would include the thanks of newbies and pros alike.

I shall refer your source to anyone I know with a serious inclination for forex.

All the best mate,

Mike

You are the man Nial. Thank you for all your help and your web site. wish everyone the very best in there future trading.

Thanks for your educative article !

Your article ultimately tells us to enter the trade

after full analysis with perfect PA set up and not during

the course of the trading day like a blind man who knows nothing where the market will go !

Learning a lot !

Keep it up !

Waiting for many more articles please.

thanks nial, great lesson, this is the essence of trading!!!

Hi ‘Prof’,

I am the most blessed by your teachings. It has always been very useful, interesting and empirical.

Thank you so and a lot.

very helpful indeed.

Thanks Nial

great article.

cheers

simple, clear,easy = BEST

is that really simple like that ?

great article !!!

well,

i will start to focus on all your comments about trading

i love it

thank you

Ales

Great article and website. Lucky to know you !

Hi Nial,

I think telling after the chart made high or low is easy when doing in practical trading is very hard to expect the trade how will it turn….

good knowledge you give

thanks

palli

Thank you for organizing all this material in such well readable articles. They keep me focused and motivate me always to improve and keep on learning from mistakes i make while trading.

So rich and freely given makes it even richer!

Once again, thanks.

SUPERB article nial. Like MONEY-MGMT theories,writing daily commentary is also ignored by lot of traders…from my experience, i would say writing daily commentary is one of the holy grail secret of success in forex

Thank you Nial!

You have made such a huge difference in my forex trading journey.

I have read most of your material and i am truly greatfull that people like you with the heart to share your story exist in this world.

My very best wishes to you always.

You are rocking Nial.Thanks for sharing your Knowledge

Thanks Nial–one thing I do is print of you charts on individual pages at the beginning of the week. I might even add some level manually with pen.

The chart takes up the top 1/3rd of the page and leaves me room to make notes beneath each day of the week.

VOILA–mkt diary :)

Thank you Nial! Great article.

I think newbie traders can learn a lot on your site.