3 Common Errors When Trading The Inside Bar Strategy

The inside bar pattern can be a very powerful price action signal if you understand how to trade it properly. Unfortunately, many traders do not know how to trade it properly and as a result, they end up losing money over and over and become frustrated with inside bars.

The inside bar pattern can be a very powerful price action signal if you understand how to trade it properly. Unfortunately, many traders do not know how to trade it properly and as a result, they end up losing money over and over and become frustrated with inside bars.

Like any other price action signal, there are subtleties to trading the inside bar setup and learning these subtle differences between a ‘good’ and ‘bad’ inside bar signal is often the difference between winning or losing money with them. That’s not to say that every inside bar trade will be a winner once you know how to trade them properly, but you need to at least make sure you are putting yourself in a position to make money with the inside bar pattern.

The following three errors are the costliest mistakes that I see traders making with the inside bar pattern, read on to learn what they are and how you can avoid them…

1. Not trading inside bars on the daily chart

You probably have read some of my articles on daily chart trading, if you haven’t, you should. The daily chart is the most powerful and important time frame for a price action trader. That said, I do teach and trade some price action signals on the 4 hour and 1 hour charts if a signal forms on those time frames that agrees with my entry criteria.

However, one price action pattern that I ONLY trade on the daily chart time frame, is the inside bar pattern. Here are my main reasons for this:

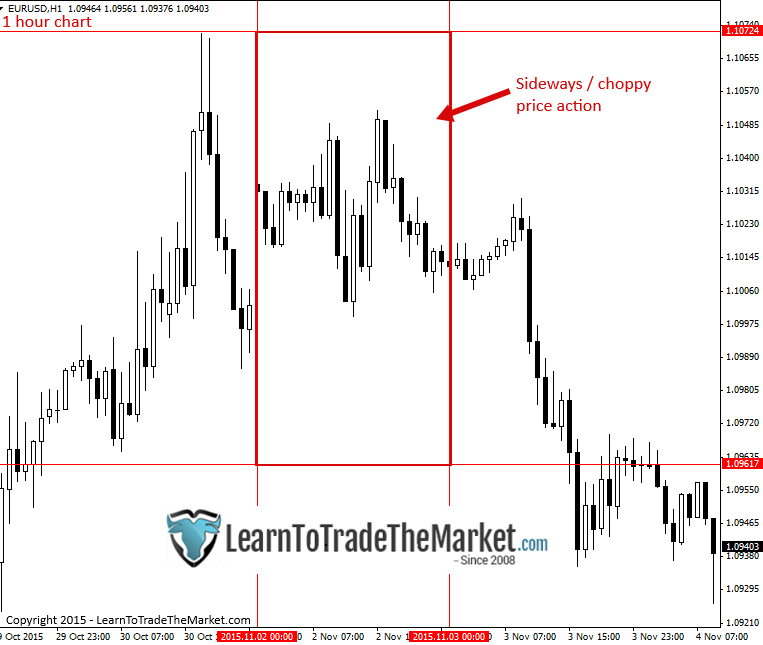

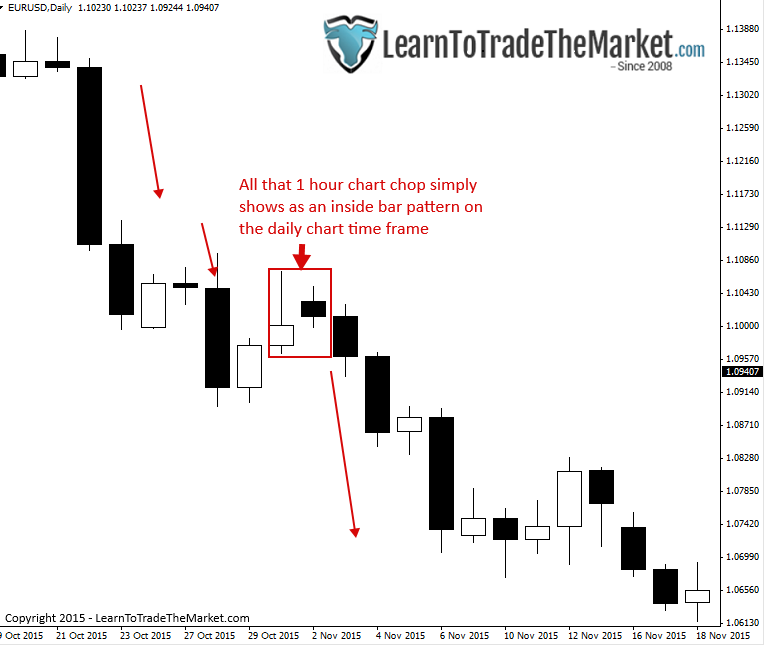

- An inside bar on the daily chart shows a period of consolidation on the lower time frames and that a potential breakout from this consolidation is coming. There is much more significance with a daily chart inside bar than one on a lower time frame because it ‘smooths’ over all that sideways chop and consolidation on the 4 hour and 1 hour (or lower) charts and represents it simply in the form of one inside bar pattern or inside day. This eliminates a lot of confusion, over-analysis and second-guessing, which generally leads to over-trading on those lower time frames. Remember, a choppy / sideways market is the hardest to trade, so the ability to remove sideways chop on the 4 hour, 1 hour or lower time frames, by simply seeing an inside bar on the daily chart, will save you a lot of money and anguish in the long-run.

- There are many, many inside bars on time frames under the daily, and many false-breaks of them occur. In short, they are just too hard to trade on time frames under the daily because there are so many insignificant ones, and they are not worth your time or money on these lower time frames.

If you look at the two images below you will see the power of the daily chart and why I only trade inside bars on the daily chart time frame. Notice that all the sideways movement on the 1 hour is represented simply as one inside bar pattern on the daily chart, which worked out quite nicely as a sell signal in this example. Also, notice all the 1-hour chart inside bars, most of which failed; you just can’t try to trade all those inside bars on the 1 hour…

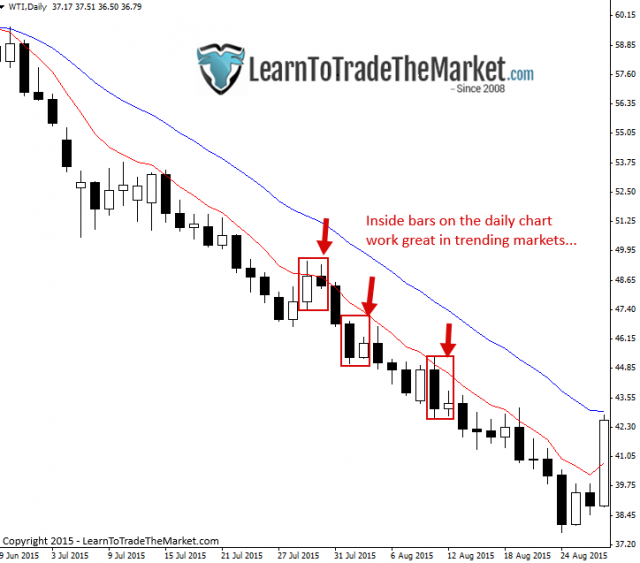

2. Not trading inside bars with the daily chart trend

I prefer inside bars with the daily chart trend and on the daily chart as discussed above. Trying to trade inside bars against a daily chart trend is very hard, especially if you’re a beginner or relatively new. It can be done, but it shouldn’t be tried until you are comfortable and successful trading inside bars WITH the daily chart trend, and it should only ever be done from key chart levels.

An inside bar is best traded as a trend-continuation pattern on the daily chart, they can be thought of as ‘breakout’ plays and can provide very good risk reward potential to jump aboard a trending market as it resumes its movement after a brief pause or consolidation.

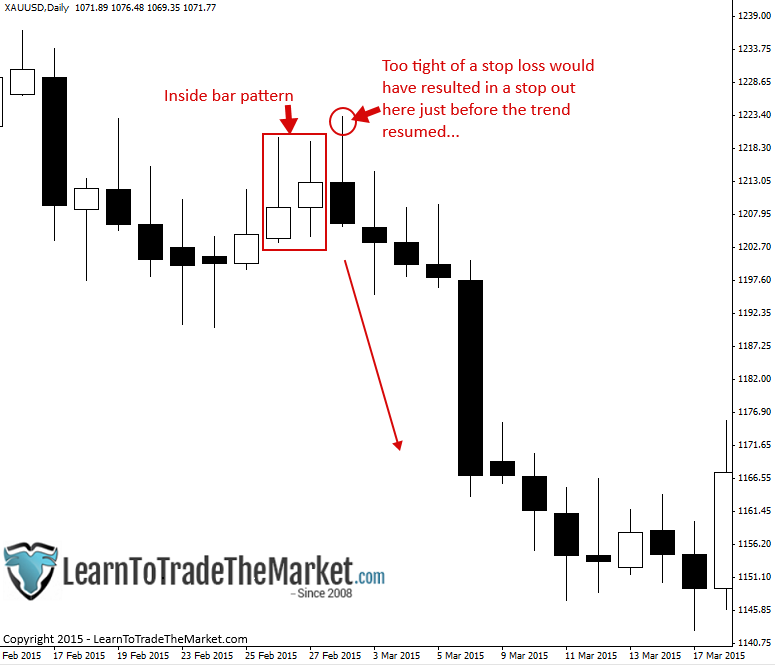

3. Using too tight of a stop loss

Placing your stop loss just above or below the mother bar high or low of an inside bar can sometimes be a mistake. When placing stop losses, you cannot place them based on greed, meaning, you can’t place them too close to your entry just because you want to trade a bigger position size. You have to place them logically, where they have the best chance of not being hit by the normal daily fluctuations in price.

I suggest you check the average true range of the pair or market you are trading and make sure your stop loss is at least outside of that as well as beyond any near-term or nearby key support or resistance levels. This might mean reducing your position size to meet a wider stop loss distance (in order to maintain your 1R risk amount), but if that is what it takes to profit on the trade, that’s all you should care about.

As I discussed in this recent article on ‘how to trade with a small account’, you can’t be so focused on making money that you forgo proper trading habits (like proper stop loss placement). Proper trading habits are what leads to long-term success in the market, whereas mostly focusing on ‘profits and rewards’ will cause you to lose your focus on proper trading and ultimately will result in you losing money.

To learn more about how to trade the inside bar and other price action patterns properly, check out my price action trading course.

Superb article ; thanks a lot — Concise and precise. Thanks

Excellent article. Important. Thanks for information

Had difficulties trading inside bars during trending times,particularly when a signal opposite the trends appears.

I trade inside candles both in ranging and trending markets. Its very possible to avoid price swings if you read prices in the lower timeframes of time price and volume from the daily curve. Which many fail to do. Many traders trade different strategies when its better to just be the master of one. The simplest ones are the best.

Nial,

This is great.

Thanks so much for your inside

Thanks for your energy to make me successful Nial. I’m almost there, after a long time. You can lead a horse to water …..

Very very thanks GURU master,bless you????

Thanks guru????

Great article, God bless you Nail.

nail i luv this article. your are a great teacher in this field. i really miss any of your article

How timely when I am adding inside bar to my trade plan. Thank you! Great article.

Thanks nial

There is great clarity in the article and chart thank you

Great piece! Will make trading inside bars much easier! Terrific advice re ATR as well. Many thanks, as always, Nial.

Thank you, Nial! :)

Nice article and good timely reminder to trading inside bars. Tks

Nice work! i will definitely pull out of my chart all of the useless indicators !

Thank gain.

Good article ! thanks Nial!

Thanks Nial , you are the best coach when it comes to price action method.

Supermaster Nail.

I have watch your article and trading forex for 6 week.since I manage to start $50 into $34992 of real dollars.cannot believe.your way best in world.your are clever and good handsome man.with many thank you.b.Johnsons

There’s no doubt you are one of the best coach and forex trader I’ve seen. I takes experience to know the true value of your lessons. Thanks a lot. I hope newbies will pay attention and obey. It will save them a lot of money and make more for them.

In my opinion, is not so simple to understand: is the inside bar trend continuation or not. To understand this, I open

smaller timeframe chart. And if consolidation looks like a wedge (raising or descending), then Yes – it is a signal the resumption of the trend. If I see consolidation in the form of a triangle or rectangle, it is impossible to say for sure where the price will move: up or down.

Great article!

I like the fact that you also re commend that we find a good place to place our stop loss and not simply place it just below or above the mother bar…..out of greed.

Thanks coach!!

you are very correct, this is the method have been observing for a while now, well done bro