Identifying Forex Market Bias and Picking Your Trades Wisely

Identifying the bias of the Forex market at the beginning of each trading week is an important thing for every Forex trader to do. It is really important to simply sit down on Sunday at some point and take 30 minutes or so to figure out in your mind what you think the market has the greatest potential to do during the upcoming week. As you do this you should make some notes; record in your Forex trading journal what you see on the charts and use that information to explain your bias. Now, obviously there is no way you can know “for sure” if the market bias you have for the upcoming trading week will remain relevant. However, it’s a really good exercise that will get your mind more in-tune with the current market conditions and price action.

• Mapping out the levels and gauging market conditions

The first thing you should do when identifying market bias is to take a look at the last one to two weeks’ worth of price action on the daily chart to get an idea of what price has happened recently. What condition has the market been in most recently? Is it trending, if so, which direction is the trend? Is it moving sideways, if so, is it consolidating in an “orderly” range-bound fashion; between two obvious support and resistance levels? Or is it simply consolidating with no obvious pattern, also known as “chopping” around?

The next thing you want to do is draw in the relevant support and resistance levels on the daily chart. You will generally only need to go back about 3 months worth of price data when doing this, but you may go back as much as 6 months if it looks like there are some relevant levels from back that far. This takes some discretion and screen time to get good at, but after a little practice you will get confident in your ability to mark the relevant support and resistance levels.

After you mark the relevant support and resistance levels and identify the condition the market is in and your particular bias for the upcoming week, you will have a solid “framework” to use throughout the upcoming week. For example, if your bias is bullish for the upcoming week, you may look to only take price action strategies to the upside and watch the support levels you drew in for confluence. The opposite is true if your bearish was bias. If you end up deciding that the market is very indecisive right now then you may elect to take a neutral bias for the upcoming week, which leads me into my next point…

• Some week’s you should not trade at all

The market has a tendency to move in spurts, this means that some weeks you will see consolidation or chop for all five trading days, and then other weeks you will see strong directional price movement nearly every day. It’s best to try and gauge the potential of each week before you enter. Maybe wait until Tuesday to give the market 24 hours, so you can try and get a good idea of what the week’s conditions will be like. Based on the average daily trading ranges for the major Forex currency pairs, Tuesday, Wednesday, Thursday and Friday are usually the best days to trade, Monday typically has a lower volume and smaller trading ranges. Thus, waiting for Tuesday can often pay off in that you will get a clearer picture of what the rest of the week is likely to do, since you’re not in the market yet and are still totally objective and calm.

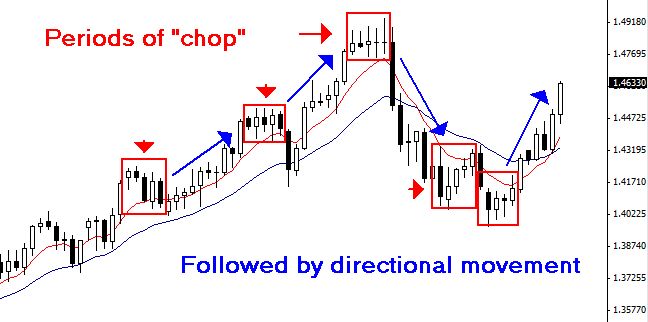

Here is an example chart of the daily EURUSD. We can see the red boxes show periods of about 4-5 days of choppy price movement followed by stronger directional movement. Generally speaking, the market will move and then consolidate for a period before moving again, even in trending markets like we see below. So, by simply doing some analysis before the trading week begins, you can make a good educated assumption about the probability of the market making a strong directional movement in the upcoming week. If the market is trending but consolidated last week, there’s a decent chance it will make a strong trend-move during the upcoming week. Conversely, if the market moved very strong in one direction last week, there is a lower probability for another strong movement this week and a higher probability of consolidation or rotation back to value. These are general statements and are by no means exactly how the market will operate each week, they are observations from years of trading and are good things to keep in mind.

Over the long run it pays to behave more like a “sniper” than like a “machine gunner”. You want to give your best effort in determining market condition / bias each week, always keep in mind that the market will be here tomorrow so there should never be any rush to trade.

Click the following the link to see some excellent price action education videos.

Nial ..Thanks for sharing your experience on predicting the market behaviour

concrete writing for trading, very inspiring…

thx a lot…

Very good article…I’ve been watching the Market for the last 2weeks…nothing worth trading!

Thanks for the advice…superfantastic!!

Great way for developing the perception of the market behavior .Thank you Nial

Very to-the-point lessons. Thanks for all the help. Very much appreciated.

Excellent article Nial and solid advice. Hopefully we’ll start to see more videos soon with instruction from the Master of Price Action trading.

Hi Nial,

Thank you for the opportunity of reading your review Identifying the fx market etc. On your example showing periods of choppy daily markets your boxes are I think are 5 bars in length (5 days) is this just an example or are the consolidation periods normally 5 days. If you do your home work correctly picking these consolidation periods and correctly identifying the market trend then a trader may have more than the 50/50 bias in his favour – is this the case.

Kind regards

Richard Shaw

Excellent lesson in price action analysis. I find the most important and sometimes the hardest part in trading is being patient and waiting for the right set-up.

Great stuff Nial. As always, you’re a “Genius” when it comes to market analysis! Please keep them coming!

Awesome article as usual! This is just a great basic framework. Today was my first day using MetaTrader 4 with a live account, and I happened to sit out of the market and do very similar things to what you’ve stated. Very concise and relevant. Thanks Nial :)