5 Money Management Secrets for Successful Trading

Money management is like the “elephant in the room” that most traders don’t want to talk about. It can be boring, embarrassing, or even emotionally painful for some traders to talk about risk and capital management, because they know they aren’t doing it right.

Money management is like the “elephant in the room” that most traders don’t want to talk about. It can be boring, embarrassing, or even emotionally painful for some traders to talk about risk and capital management, because they know they aren’t doing it right.

However, as with anything in life, talking about the “elephant in the room” is usually the best thing you can do to improve your Forex trading. This means, being honest with yourself and focusing on the “hardest” or most boring things first and as often as necessary. If you ignore these things they will typically grow into huge problems that you can no longer control.

In today’s lesson, I’m going to help you understand some of the more important aspects of managing your risk and capital as you trade the markets. This lesson will answer many questions I get from traders asking about breakeven stops, trailing stop losses, and more. So let’s get started…

Keep risk consistent

The first “secret” I’m going to tell you about is to keep your risk consistent. As Marty Schwartz said in the the market wizards article that I quoted him in, “Also, don’t increase your position size until you have doubled or tripled your capital. Most people make the mistake of increasing their bets as soon as they start making money. That is a quick way to get wiped out.”

Why do I consider this a “secret”? Well, since most traders have a tendency to increase their risk size after a winning trade or after a series of winners, this is typically something you want to avoid. Basically, doing the opposite of whatever “most traders” do can be considered a “secret” of trading…and when it comes to money management there are quite a few of these “secrets”.

I’m a strong proponent of keeping risk consistent not only because it’s how other professional traders operate, but because of lessons learned from my own personal experience as well. Earlier in my career, I was the guy cranking up my risk after a winner…and finally after realizing that this was not the right thing to do, I stopped. Also, from my observations of traders that I help, I know that many traders increase risk after a winner, and this is a big reason they lose…

After you win a few trades you have a tendency to become over-confident…and I should stress that there’s nothing inherently wrong with you if you do this or have done it; it’s actually human nature to become less risk averse after winning a trade or multiple trades. However, it is something you’ll need to put an end to if you want to make money trading the markets. If you’ve read my article about the one thing you need to know about trading, you would know that even if you’re following your trading strategy to the T, your winners and losers are still randomly distributed. This means, after a winning trade there is no logic-based reason to think the next trade will also be a winner….thus no reason to increase your risk size. But, as humans, we like to gamble….and it can be really hard to ignore the feelings of euphoria and confidence after hitting a nice winner…but you HAVE TO if you want to manage your money effectively and make a living in the market.

Withdraw profits

As we discussed above, keeping your risk consistent or “fixed” is one of the keys to successful Forex money management. Professional traders do not jack up their risk exponentially after every winner…this is not a logical or real-world way to manage your risk. Professional traders who make their living in the markets withdraw money from their accounts each month and most will keep their accounts funded to around the same level each month. If you’re withdrawing profits every month then you would not keep increasing your risk amount over time.

What you need to do is build your account up to a level your comfortable with, and then you can start withdrawing profit each month to live off of…thus the amount you risk on each trade would not keep increasing because eventually your trading capital will reach an “equilibrium” level.

Moving a stop loss to ‘breakeven’ can kill your account

The big secret regarding breakeven stop losses is that you should not move your stop loss to breakeven unless there’s a real price-action based, logical reason to do so. Moving your stop loss to the same level that you just entered at doesn’t make sense if there’s no reason to do so. Moving to breakeven arbitrarily or because you have some pre-decided “rule” to do so is simply not an effective way to manage your trades. How many times have you moved to breakeven only to see the market come back and stop you out and then move on in your favor? You have to give your trades “room to breathe”, and if there’s no reason to tighten your stop or move to breakeven, then don’t.

What you might not realize, is that messing around with your stop loss or manually closing trades out before they’ve had a chance to move, is voluntarily reducing the ability of your trading edge to work in your favor. In short, if you don’t have a logic-based reason to move to breakeven, then you’re moving to breakeven based on emotion; mainly fear. You need to overcome your fear of losing money, because losing is part of being a successful trader, and until you learn how to let a trade breathe and move without your constant interference, you will not make money.

Now, I’m not saying that you should never move to breakeven, because there certainly are times when you should. Below are some logical reasons to move your stop loss to breakeven:

• If an opposing signal causes caution and changes market conditions you can take that as a logic-based reason to move to breakeven.

• If the market approaches a key chart level and then starts to show signs of reversing, you should take that as a signal that the market might indeed reverse and then trail your stop to breakeven.

• If you’ve been in a trade over a few days and nothing is happening, you might exit the trade or move to breakeven…this is known as a “time stop”, or using the element of time to manage your trades. Generally speaking, the best trades do tend to work out in your favor soon after you enter.

• If a big news announcement like Non-Farm Payrolls is coming out and you’re up a nice profit, you might want to move to breakeven or monitor the trade. Volatile news announcements like this can often change market conditions.

Don’t be greedy: don’t aim for big targets all the time

Another “secret” of money management is that you have to actually take profits. This might not really seem like a “secret” to you, but I consider it a secret since most traders simply don’t take profits as often as they should…and many traders almost never take profits. Why do you have trouble with taking profits? It’s simple really; it’s hard to take a profit when a trade is in your favor because your natural tendency is to want to leave a trade open that’s in your favor. Whilst it is important to “let your winners run”…you have to pick and choose when you do this; you certainly should not try to let every winning trader run. The market ebbs and flows, and the majority of the time it’s not going to make a really strong directional move without retracing a lot of it. Thus, it makes much more sense as a short-term swing trader to take a solid 2 to 1 or 3 to 1 profit when the market is offering it to you…rather than waiting until the market retraces against your position and moves all the way back towards your entry point or beyond, at which point you will probably exit emotionally since you’re mad you let all that open profit go.

Especially for traders with smaller accounts, you have to be happy taking “bread and butter” rewards of 1 to 1 or 2 to 1 often….there’s nothing wrong with hitting those “singles” and “doubles” to build your trading account as well as your confidence. You have to avoid the temptation of trying to hit a “home run” on every trade.

Knowing when to let a profit run

Every now and then the market will be just ripe for a 10 bagger….a home-run trade. Whilst these trades are rare, they do indeed occur, however you have to avoid the mistake that many traders often make; aiming for a “home-run” on every trade. Most of the time, the market is only going to move a certain range each week and month. For example, the average weekly range on the EURUSD is around 250 pips.

Knowing when to try and let a trade run and when to take the more certain 1 to 1, 2 to 1 or 3 to 1 reward is really where your discretionary price action trading skill comes into play. I’ll be honest here because I do get a lot of emails asking about when to let trades run versus taking a set risk reward ratio, there’s no “concrete” rule I can give you except to say that training, screen time, and “gut” feel for reading the charts are things that you need in order to improve your skill at exiting trades.

I can however give you some simple filters that you can use to assess trades on a case by case basis to help determine whether or not they are good candidates to try and run into a bigger winner:

1. Strong breakout patterns – When the market has spent a while consolidating it will typically lead to a strong breakout up or down. These strong breakouts can often be good candidates for “home-run” trades. However, not every breakout is equal; some are weaker than others and sometimes the market makes a false break before the real breakout occurs. So, we need to exercise caution when trading breakouts, the safest ways to enter a breakout are the following two scenarios:

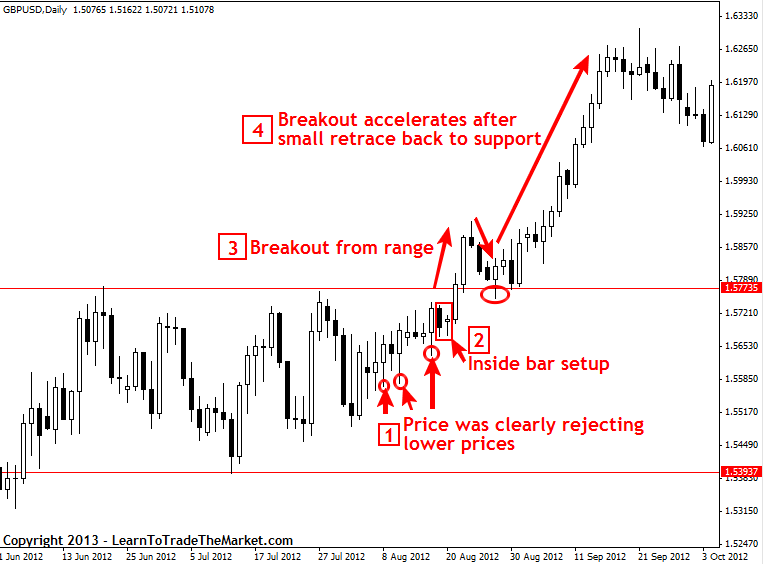

The chart image below shows us an example of entering the market on a price action setup in “anticipation” of a breakout. This is a more advanced way to enter a breakout but it can provide a tight stop and a very large risk reward potential on the trade. There are usually price action “clues” just before this type of breakout; note the bullish tails on the bars that preceded the inside bar setup in the chart below. This indicated that momentum was building just below resistance for a potential upside breakout, then we got the little inside bar setup just below the breakout level that provided a nice “anticipation” entry into the market.

The chart image below shows an “anticipation” entry on a price action signal just before the breakout:

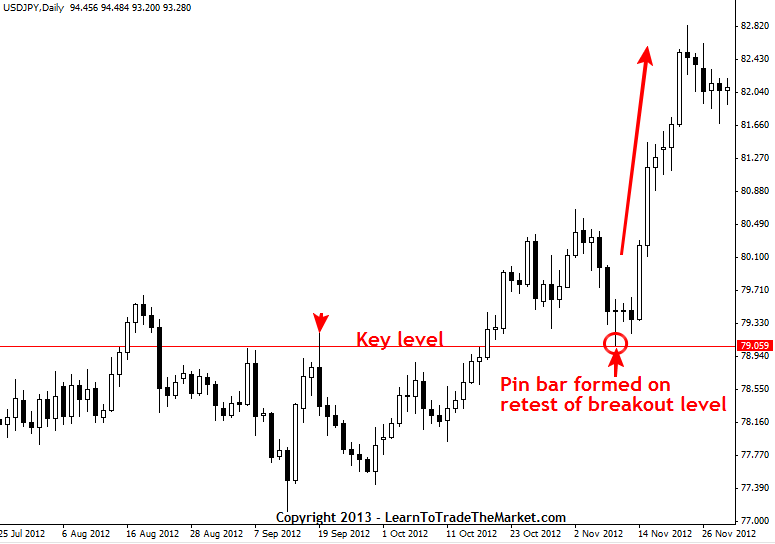

The next way to enter a breakout that could lead to the type of trade that you can let run into a bigger winner, is to wait for the market to “confirm” the breakout after a retrace back to resistance or support. Once price breaks above or below a key level it will typically come back and retest it before pushing off again in the direction of the breakout. These types of “confirmed” breakouts from key levels can also be very good opportunities to try and trail your stop to let the trade run.

The chart image below shows a price action signal that formed on a retrace back to the breakout level:

2. Obvious trend continuation signals

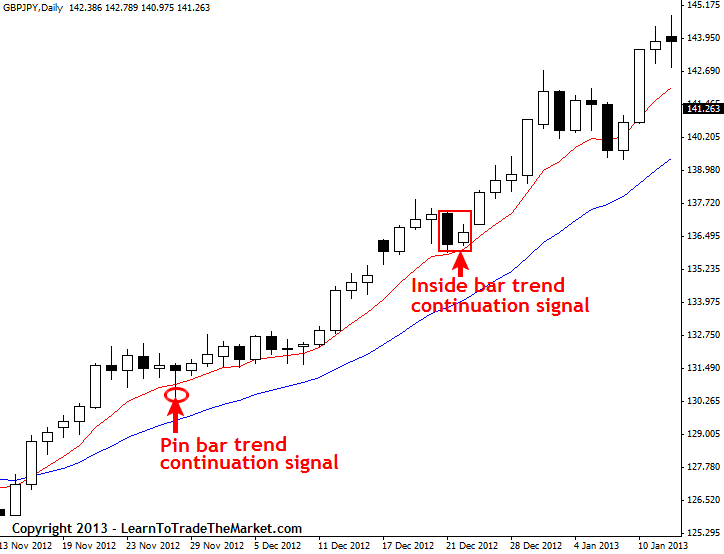

Strong trending markets can obviously be good candidates to try and let your trade run into a big winner. We sometimes see very large potential winners in strong trends like the GBPJPY chart below shows. Note, in this example below, the trend was clearly up and so any price action signal that formed in this strong trend would have been a good candidate for a larger gain, we can see the pin bar signal and inside bar setup in the chart below could have been very large winners for anyone who traded them.

The chart image below shows a good example of trading price action trend-continuation signals which can be good candidates for trailing your stop to let the trade grow into a bigger winner:

3. Price action signal at a key level in strong trending market

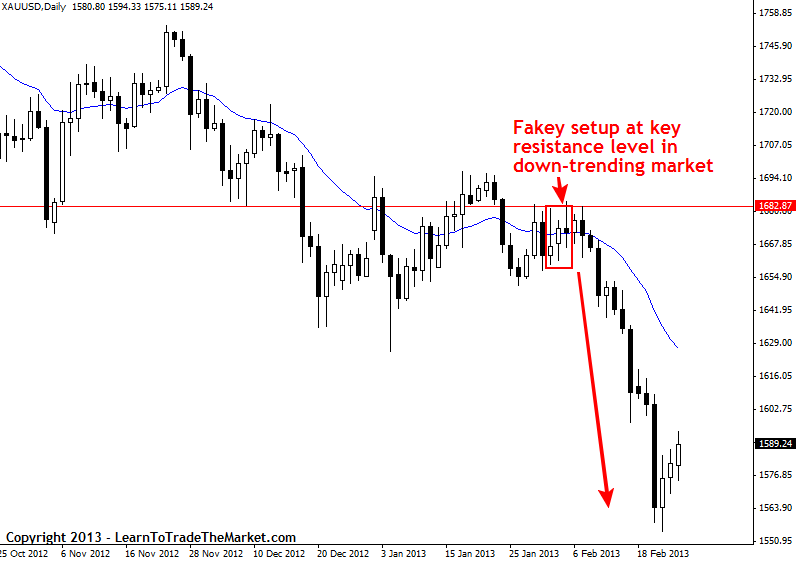

Another good scenario to look for potential “home-run” trades is after the market retraces to a key level within a trending market. In the chart below we can see a clear example of this when a fakey setup formed recently in the spot Gold market within the structure of the downtrend. We actually discussed this fakey in our February 5th commentary and we can see the market fell significantly lower after forming that signal from resistance. When a market is clearly trending and then it retraces back to a key level and forms an obvious price action signal in-line with the underlying trend, it can often be a good opportunity to look for a larger than average winner.

The chart image below shows a fakey signal that formed after the market had retraced back to a key resistance level within the down-trending market:

The above scenarios can be good for letting your profit run. You would want to begin the trailing process by moving your stop to breakeven once the market clearly shows you that the trend is taking off in your favor. I like to wait until I am up at least 1 times my risk before moving my stop to breakeven. After that, how you trail your stop and exit the trade is something you will have to use discretion to decide; there are many different trailing techniques but none of them are “perfect”. Over time and through training and practice, you will develop a better sense for determining whether or not to trail a stop and how to do it.

Final note

The strategy we trade with is obviously important, but in reality, that should not be the “be all and end all” of your trading plan. The way that you manage your risk and your overall capital is the true “secret” to trading. Most of you reading this already know you are not paying enough attention to how you think about capital preservation and risk management, you’re not taking it seriously because it’s the more boring part of the game. It’s time to wake up and face the reality; not paying attention to risk management and capital preservation will lead you to a path of financial pain and personal stress. Managing your risk properly while trading with a simple yet effective trading strategy is the basis of what I teach in my trading course and members’ area. Once you combine these two critical pieces of the trading puzzle, you will be ready to start making consistent money in the markets.

Thank you very much for this powerful article

Great Article Nial. You wont see this quality anywhere else on the internet, I know because Ive been looking for it for years. I just joined your member group recently and its been great fun interacting with all the traders on there.

Thank you Nial, great work!

And very useful information about filtering price action signals for high-profitable trades.

Regards

Dmitriy

Thank Nial. I have learned so much reading your articles. Managing sl and preserving capital is the first things I’m thinking about when placing a trade. I’m on 20% income for this year. My account has been growing ever Chinese I implemented these thing

Thanks

Hettie

My highlight is this one “combining managing risk properly and trading with a simple yet effective trading strategy like price action are really completing two critical pieces of the trading puzzle that will make us ready to start making consistent money in the markets.”

The financial management chapter is by far the best, its more like one big piece of the trading puzzle. Thank you Mentor. Salute

This is a very eye opening article, thank you my Mentor. Salute

Impressive Nial. your article was very true, the moment that i reading these the more closer i look what are those things we need before we get into the battle. Risk management was my priority and always take into consideration before the battle begins,We are so blessed to have you Nial… Thank you so much and I’m always happy when i wake up in the morning showing my lunch money on the table and keep my computer “greenback generating machine”.GOD Bless You!

Keep up with the great trading lessons. Great Job!

Hello, Nial.

Great article Nial, I’m really enjoying being part of this trading site.

Thank you very much.

NIAL..YOU ARE A SRRS ..SAVIOUR …FOR FOREX COMMUNITY…FX TRADERS MUST READ LEARN..AND PRACITICE YOUR TAUGHT FX STRATEGIES

YOU NIAL HAS PROVED TO BE A SAVIOUR FOR STRUGGLING FOREX-COMMUNITY..WELL DONE

Excellent lesson! Thank you!

This article is awesome, Thank you for this wonderful explanation.

Great article !!! Simply superb

Great article and give me enlightenment

thanks….

Great article again, many thanks.

Excellent write up, Nial.

God bless you.

nice article. keep on advising us we young traders.

Great article and the bit I’ve liked most is Keeping Risk Consistent.

great article NIAL KEEP IT UP

The knowledge nd wisdom inherited from GOD on this fx article will not decrease but ever increase tanks 4 d great article

What you might not realize, is that messing around with your stop loss or manually closing trades out before they’ve had a chance to move……………!! Written by Nial Fuller.

This is a nice and another perfect ADVICE. This habit of messing around with the trades once they are live is killing me. I confess again and from next week, I mean next week, I will never and ever look at the trades again after entering. It’s very hard to stop bad habits. Thanx buddy!!!!

Very nice article Nial :) reminded me how Money Management is important :)

Like you always wrote before, it is another deeply elaborate article. Good job Nial, thanks. But, I want to know the different among scalping vs trial stop?

hi nial, such a real examples, i remember again to manage risk, thanks lot

A very sensible first lesson.

thanks you Nial

Thanks for the article Niall. Money Management is the key to successful trading, and I can’t hear that enough. I’m also finding that I’m risking more with each trade as my winnings are increasing.

Thank you Nial !

Funny elephant picture Nial :)

Thank you Nial!!

I have never thought of lot sizing is the way to go. I always planted to increase my lot sizing after a win :p

I will stick to the consistent lot sizing!!

Thank you so much. This article has help me LOTS!

perfect article……since i lost much money, i take your every single words seriously….thank you…

I am so appreciative to your lessons. I am a beginner and learning to trade the forex, all commodities, the index and the others. I have not yet selsected my department but I am trying all at DEMO. I will choose which one to trade after two years. In course of time, I will put in not more than $100 to try both real money and the demo. My plans are to enter the market after 2015. I like your teachings and it is helping me doing well in my practices. Thank you once again

Hi Nial,

wonderful article Nial

thnx once again

Very useful article. Thank you Nial for sharing your knowledge and experience.

Hi Nial

This is your another great article helpful for everyone.

Thanks again

Another Great Article….especially for those who doesn’t care about money management and only run behind making profits….

Good Article. This is something that I am constantly working to get better at, and I feel like its something that you always have to work at to be good at. Consistency is success. I know that the more I am consistent, the better results I will see, and everyday I get better at this. When I take a loss it hurts, but only because I hate to lose. But I know that that loss has only gotten me one trade closer to my next winning trade, whether its a 1:1.75 or 1:10. Lately, It’s definitely been that I haven’t been taking profit at the right times, and wanting more “Home-Runs”. That’s going to change this week, as I study and re-study “Knowing when to let a profit run” as a guide that I will ingrain in myself. :)

Cheers,

And Happy Trading Everyone!

Any time I read your article I always increase in knowledge,thank you FX Guru.

Hi Nail,

very promising and to great article

thanks

This is great. I was wondering these issues these days and was gonna to send emails to you regarding the money management. Many cases are: I entered just fine, but end up out at BE; or sometimes I let the profit run, and it turns out to be against me seeing all the profit gone with the wind.

Just a great article at the right time!!

Thanks for another refresher Nial! God knows that we all need to hear things we’d probably learn in the past over again!

Brilliant articles, I like it very much,

Thanks Nial

Hi Nial,

Very educative indeed.

I know it differs case by case but how much do the professional traders normally maintain as capital in their a/c-generally….

“I like to wait until I am up at least 1 times my risk before moving my stop to breakeven.” Thank you Nial, I needed this tip and already applied.

Thank you Nial,

Extremely fantastic, right and useful, like your other articles. You are really generous.

Please accept my thanks from the deepest part of my heart.

Good luck

Mehdi

thanks you very much for yr great article.

YOUR SYSTEM AND STRATEGY WORKS PERFECT AS IF YOU ARE THE ONE CONTROLLING THE MARKETS. IT MAKES PROFIT WHEN WE FOLLOW YOUR ADVICE ON MONEY MANAGEMENT. YOUR QUOTE OF LESS IS MORE IS EVER TRUE. THANK YOU PROFESSOR FOR YOUR EFFORTS IN MAKING US MAKE MONEY.

Thanks Nial.

Great refresh trading…

Enjoy and Cheers

Cant think of anything better than the article about risk management superb article mr Fuller

Thanks Nial, excellent article. I have joined recently and your strategies are excellent and give sound criteria to make consistent winning trades. The money management is without doubt the other side of the coin that must be mastered to turn the consistent winners into consistent money.

What an awesome and professional lesson. I like it very much. You’re great Nial ….

My Best,

WIBOWO

That picture of the elephant in the room is hilarious. My ‘girlfriend’ would love it :-)

Great article Nial, it makes a lot of sense, thanks a lot!!

Hi Nial I have just started to read your lessons and this was superb. Excellent look forward to read others as well.

Dear Nial, you are my mind reader :). Every time I read your new article it is about an issue that I had a previous day ! Thank you so much for your input, it is so valuable! Im so happy that I found your site. You are my real mentor!!!

Simply outstanding info as always Nial!

Just consistently excellent!!

Apart from the great information about the topic at hand, I always learn little nuggets of gold I didn’t know about.

eg the anticipation of a breakout! certainly was never aware of that, but realize you would have to be careful

After re reading you put out a while ago, “Know when to hold em, and when to fold em” you discussed the importance of re affirming pin bars, another little nugget to keep you in a trade rather than letting emotion get the better of you and prematurely exiting a trade.

Thank you for sharing your hard won wisdom.

I’m hopeful I will get a chance to meet you in person when you come to America :-)

Great article again, many thanks.

“Every article lays a new brick and together makes a solid wall of visdom in this business”.

Thanks

Tomson

This is the best article on the entire internet!

Thousands of trading strategies exist. Profitable are only the “holy grail”-systems. U ve again specified the holy grail with this article.

Another excellent article. I keep returning to your website to tap into your expertise and advice and to remind myself of ‘the rules’. You make it look simple, Niall, but we all know if it was that simple we wouldn’t be here – Clear, logical and concise information. Exceptional. Many thanks.

perfect timing

Excellent article which just answere to my actuals questions… Thank YOU

Hi Nial,

another great article with a great lesson!

Congratulations for your impressive work with your website – hope you will enjoy your work for many more years … and continue to supplying your readers with very valuable information ;-)

Best regards from Hamburg/Germany

Thomas

Reading between the lines of your article, I have learnt the hidden secret of trading practically.

Salute to your profound knowledge of trading.

Thank you so much for the tipps, I have just started trading and I need as much information as possible I would like tho make this a succecs. Thank you again

A great article, espescially the points on when there’s higher probabilities of a home run.

Hi Nial

Wonderful article. Thank you. Keep up the good work.

Super Explanation….Great….easily understandable………thanks

Nice one Nial, what a nice article, I think this will help me alot. I will apply everything I have learned from you and hopefully I will be a good trader like you in no time